In the afternoon, the test of the 152.41 level coincided with the MACD indicator just starting to move downward from the zero mark, confirming a valid entry point for selling the dollar. This resulted in a 50-pip drop, though the target level of 151.68 was not reached.

Without significant fundamental data from Japan, demand for the US dollar continues to gain momentum. Yesterday's inflation data from the US was interpreted in favor of dollar purchases and yen sales, even though the Federal Reserve is likely to proceed with an interest rate cut next week. At the same time, the likelihood of the Bank of Japan raising borrowing costs soon has also diminished, making the US dollar more attractive under current conditions. Many economists believe that rising inflation may push the Fed to take more aggressive measures to stabilize the economy, which, in turn, supports the US dollar. On the other hand, the Japanese yen remains vulnerable. Due to the BOJ's low rates and ongoing stimulus policies, investors seek more attractive assets, leading to yen sales. This dynamic places additional pressure on the USD/JPY pair, creating new opportunities for speculative trading.

As for the intraday strategy, I plan to focus on implementing Scenario #1 and Scenario #2.

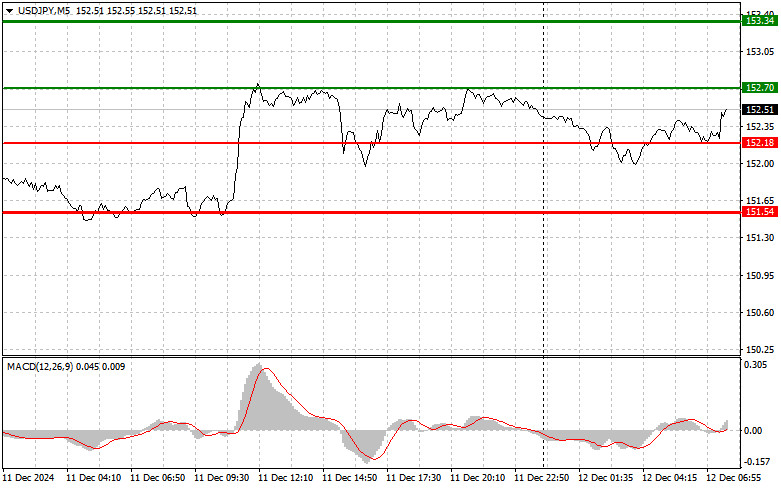

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point near 152.70 (green line on the chart), targeting a rise to the 153.34 level (thicker green line on the chart). At 153.34, I plan to exit purchases and open sell positions for a retracement of 30–35 pips. Considering the upward trend, trading in line with it is reasonable.

Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 152.18 level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger an upward market reversal. A rise to the opposite levels of 152.70 and 153.34 can be expected.

Scenario #1: I plan to sell USD/JPY today only after breaking below the 152.18 level (red line on the chart), likely leading to a sharp decline in the pair. The key target for sellers will be 151.54, where I plan to exit sales and immediately open buy positions for a retracement of 20–25 pips. Pressure on the pair may return today after a failed attempt to update the daily high.

Important! Before entering a sell trade, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 152.70 level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward. A decline to the opposite levels of 152.18 and 151.54 can be expected.

QUICK LINKS