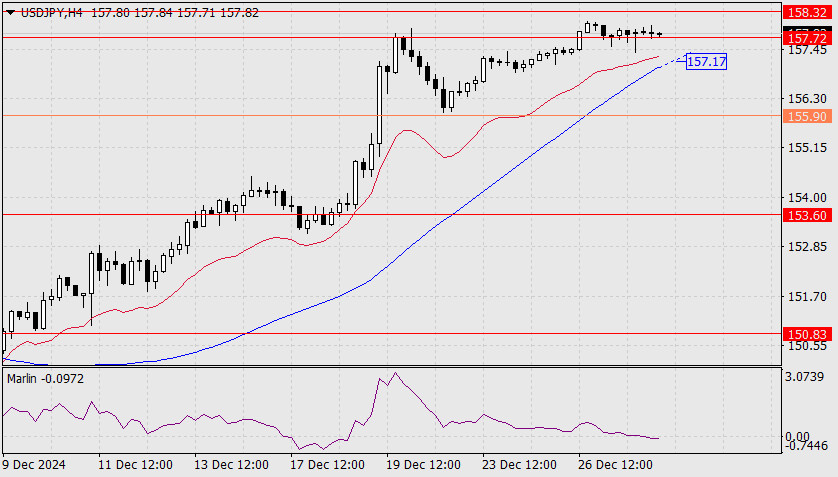

The USD/JPY pair has settled within the 157.72-158.32 range. The Marlin oscillator is turning downward. These technical indicators, especially given the decline in stock indices, suggest a possible reversal toward intermediate support at 155.90. However, for a more significant decline to the 153.60 level to occur, the price must consolidate below 155.90, and the Marlin oscillator needs to move into negative territory.

A rise toward 160.20 is also a possibility, particularly if the price continues to consolidate within the current range. This scenario is estimated to have a probability of around 20%. If the price intends to reverse and enter a medium-term downtrend (indicating yen strengthening), it would be logical for it to consolidate at lower levels above 155.90.

On the H4 chart, the price's movement toward 155.90 is likely to face resistance from two indicator lines at 157.17, as well as from the 157.72 level and Friday's low. However, the Marlin oscillator is providing support, having entered the bearish zone and visually accelerating its decline. The market is currently in a wait-and-see mode, which is understandable given the approaching New Year.

QUICK LINKS