The first test of the 157.82 price level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I decided not to buy the dollar. Shortly afterward, the second test of 157.82 coincided with the MACD being in the overbought zone, allowing Scenario #2 for selling to play out. As a result, the pair dropped by more than 50 pips.

Despite the dollar's decline against other risk assets, the Japanese yen remains an exception. The rise in USD/JPY continues due to the Bank of Japan's passive stance and the lack of new guidance on further interest rate hikes. However, given the thin market ahead of the New Year holidays, speculative traders might take advantage of this situation, leading to sharp and uncontrollable pullbacks in the pair. I suggest capitalizing on these opportunities. Buying at current levels is risky, so it's better to wait for a proper pullback and act at more favorable prices. For my intraday strategy, I will rely more on implementing Scenarios #1 and #2.

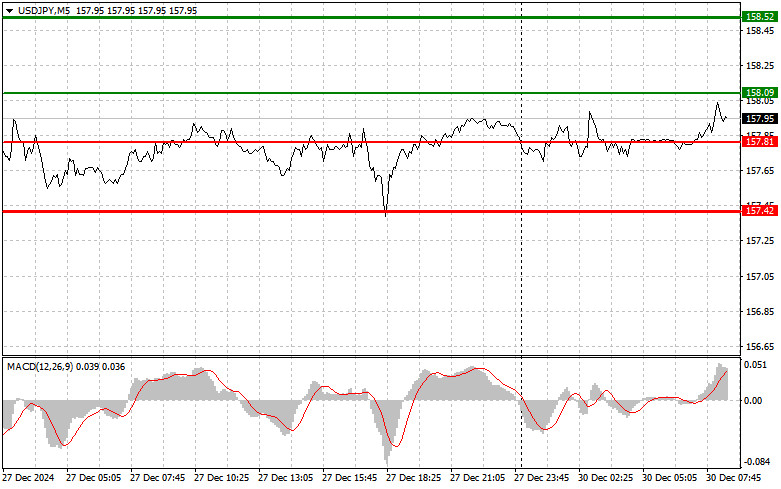

Scenario #1: Today, I plan to buy USD/JPY if the price reaches 158.09 (green line on the chart), with a target of 158.52 (thicker green line). At 158.52, I plan to exit purchases and open sales in the opposite direction, expecting a movement of 30-35 pips from this level. It's best to focus on the pair's further growth and buy on pullbacks. Important: Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 157.81 price level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger an upward market reversal. Growth toward the opposing levels of 158.09 and 158.52 is expected.

Scenario #1: I plan to sell USD/JPY today only after breaking below the 157.81 level (red line on the chart), likely leading to a quick decline in the pair. The key target for sellers will be 157.42, where I plan to exit sales and immediately open purchases in the opposite direction, expecting a movement of 20-25 pips from this level. Sustained pressure on the pair today is unlikely. Important: Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 158.09 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the opposing levels of 157.81 and 157.42 can be expected.

QUICK LINKS