There were no tests of the designated levels in the first half of the day.

The U.S. Q4 GDP report and weekly Initial Jobless Claims will only indirectly impact the market. A stronger-than-expected GDP print could support USD/JPY, especially after significant losses during Asian trading. Weaker U.S. data may increase pressure on USD/JPY, potentially pushing it toward last week's lows.

Given the intraday setup, I will focus on executing Scenario #1 and Scenario #2, continuing the downward trend.

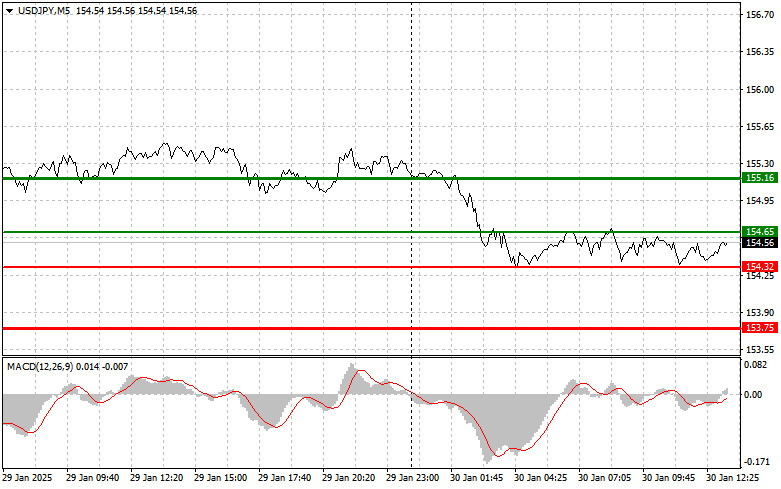

Scenario #1: I plan to buy USD/JPY today if the price reaches 154.65 (green line on the chart), targeting 155.16 (thicker green line). At 155.16, I plan to exit long positions and enter a short trade, expecting a 30-35 point downward correction. Bullish momentum for USD/JPY will be supported only if U.S. data is strong.

Important: Before entering a buy trade, ensure that the MACD indicator is above the zero level and just starting to rise.

Scenario #2: I also plan to buy USD/JPY today if the price tests 154.32 twice in a row, while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a bullish reversal. Expected upside targets: 154.65 and 155.16.

Sell Signal

Scenario #1: I plan to sell USD/JPY after the price breaks below 154.32 (red line on the chart), which could lead to a sharp decline. The main target for sellers will be 153.75, where I plan to exit shorts and immediately buy for a 20-25 point rebound. Selling pressure on the pair is likely if U.S. data is weak.

Important: Before entering a sell trade, ensure that the MACD indicator is below the zero level and just starting to decline.

Scenario #2: I also plan to sell USD/JPY today if the price tests 154.65 twice in a row, while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and trigger a bearish market reversal. Expected downside targets: 154.32 and 153.75.

Beginner Forex traders must approach market entries cautiously. Before major economic data releases, it is often better to stay out of the market to avoid sharp price fluctuations. If trading during high-impact news events, always use stop-loss orders to minimize potential losses. Trading without stop-loss protection can quickly wipe out an account, especially for traders without proper risk management or those trading large positions.

Keys to Successful Trading:

QUICK LINKS