Skupina amerických zemědělců a neziskových organizací podnikla právní kroky proti Trumpově administrativě. Žaloba podaná ve čtvrtek tvrdí, že administrativa nezákonně zadržuje granty ministerstva zemědělství, které jsou financovány na základě zákona o snížení inflace.

On Friday, the EUR/USD pair continued to rise but pulled back in the second half of the day. The decline (i.e., dollar strengthening) was short-lived, and by the end of Friday, the US dollar had once again posted significant losses. The current market situation suggests there is nothing stopping the dollar from continuing its decline on a daily basis. The informational backdrop is simply too strong for traders to pause midway. At the same time, over the weekend, there were no new aggressive signals from Trump, which could lead to reduced trading activity.

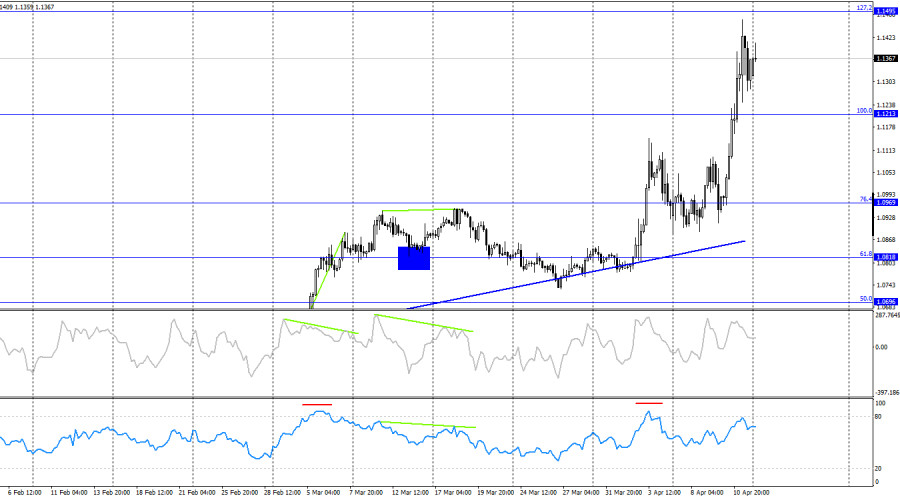

The last completed downward wave failed to break the previous low, while the new upward wave broke the prior high. This currently indicates the continuation of a bullish trend. Donald Trump continues to introduce new import tariffs, and markets remain gripped by panic and chaos. Bulls re-entered the market last week, and there are clear and logical reasons for that.

The news backdrop on Friday was much weaker than in the previous days. Trump, of course, raised tariffs on Chinese goods to an unthinkable 145%, and China responded by increasing its own tariffs to 125%. However, it seems these figures may mark the upper limit. Any further increase would appear absurd or comical and lack practical sense. Personally, I believe both sides will eventually sit down at the negotiating table. The only question is when. If Trump refrains from raising tariffs on China this week, the dollar might find some temporary relief.

Remember, Trump can only impose new tariffs against China right now, as he has granted a 90-day pause to all other countries. So, this week, the dollar might see some improvement. Still, the US–China trade war is such a significant event that it's impossible to be fully confident that the market has already priced everything in.

On the 4-hour chart, the pair continues to rise toward the 127.2% Fibonacci corrective level at 1.1495. The trade war, in the full sense of the word, has only just begun. Therefore, I cannot forecast a rise or fall in the pair solely based on the current data. Movements will depend entirely on the news backdrop, which may continue to flow in a steady stream this week. The bullish trend remains intact. A bounce from the 1.1495 level would suggest a potential reversal in favor of the US currency and a moderate decline.

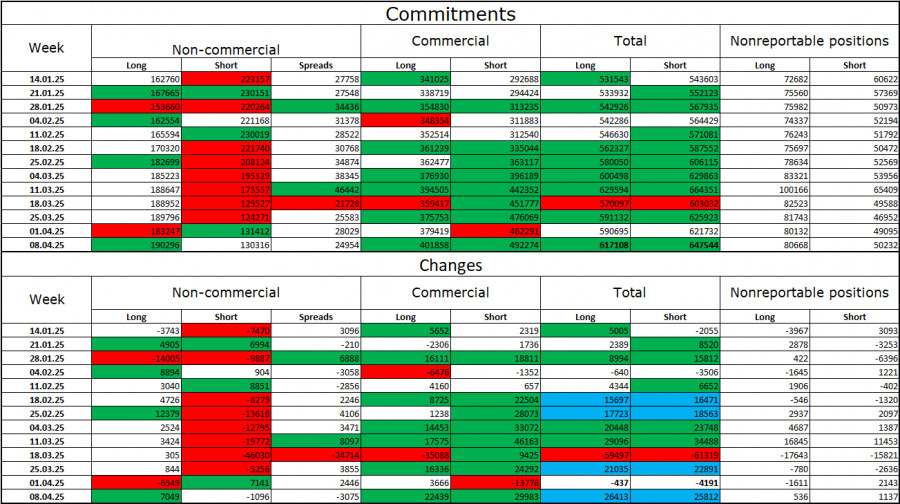

Commitments of Traders (COT) Report:

During the most recent reporting week, professional traders opened 7,049 long positions and closed 1,096 short positions. The sentiment of the Non-commercial group has recently turned bullish again – thanks to Donald Trump. Total long positions held by speculators now amount to 190,000 and total short positions are at 130,000.

For 20 weeks straight, large players were shedding euro positions, but for the past 9 weeks, they've been reducing short positions and building long ones. The divergence in monetary policy approaches between the ECB and the Fed still supports the US dollar, but Trump's policies are now a more influential factor for traders. His actions may push the Fed toward a more dovish stance and potentially trigger a recession in the US economy.

News Calendar for the US and Eurozone:

On April 14, the economic calendar contains no significant entries. Therefore, the influence of the news background on market sentiment may be minimal on Monday — unless new tariff announcements emerge over the weekend. Such headlines remain the main market driver right now.

EUR/USD Forecast and Trading Advice:

Buy or sell opportunities for the pair today should be considered only if clear signals appear around key levels on the hourly chart. However, I'd like to stress again that movements will mostly depend on the news background, not the technical setup.

Fibonacci levels are plotted from 1.0957–1.0733 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

QUICK LINKS