The test of the 1.3512 price level occurred when the MACD indicator had just started moving down from the zero mark, confirming the correct entry point for selling the pound. As a result, the pair declined toward the target level of 1.3489.

This morning, the British currency showed a significant jump following the release of data indicating that actual inflation in the UK exceeded expert forecasts. The Consumer Price Index came in higher than expected, triggering active buying of the pound sterling. Investors viewed this as a likely sign that the Bank of England would be forced to take a more cautious approach to lowering interest rates in the near term – especially considering that the latest GDP data encouraged many economists.

This prospect increased the attractiveness of the pound for investors seeking higher yields. Generally, higher interest rates encourage capital inflows from abroad, boosting demand for the currency. However, despite the need to contain inflation, the BoE faces a difficult task: supporting economic growth, which, despite a slight rebound in the second quarter, remains under threat. Going forward, the pound's dynamics will likely depend on new inflation data and the BoE's decisions. The market will closely analyze signals about the central bank's strategy to balance the fight against inflation with the need to sustain growth.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

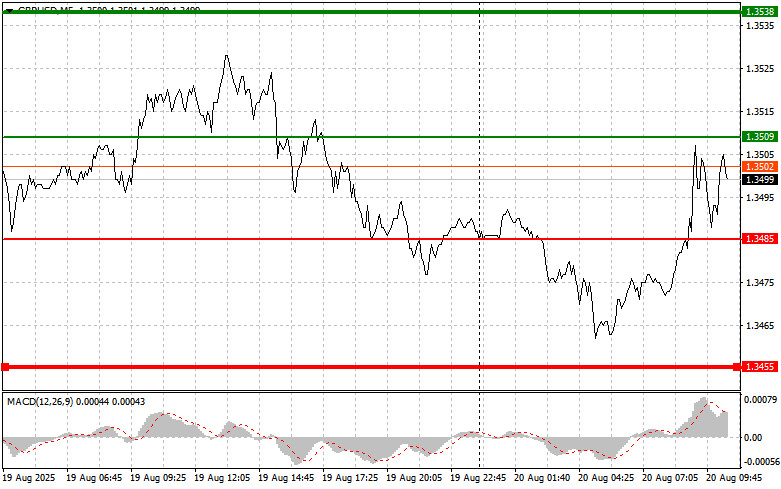

Scenario #1: Today, I plan to buy the pound at an entry point around 1.3509 (green line on the chart) with a target at 1.3538 (thicker green line on the chart). Around 1.3538, I intend to exit long positions and open shorts in the opposite direction, expecting a 30–35-point move from that level. Further pound growth can also be considered today. Important! Before buying, ensure the MACD indicator is above zero and is only just starting to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3485 level at a time when the MACD is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth toward the opposite levels of 1.3509 and 1.3538 can be expected.

Scenario #1: I plan to sell the pound today after the 1.3485 level (red line on the chart) is updated, which will lead to a quick decline in the pair. The key target for sellers will be 1.3455, where I intend to exit short positions and immediately open long positions in the opposite direction, expecting a 20–25-point rebound from that level. Sellers may return to the market at any moment today. Important! Before selling, ensure the MACD indicator is below zero and is only just starting to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3509 level at a time when the MACD is in the overbought area. This will limit the pair's upside potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3485 and 1.3435 can be expected.

QUICK LINKS