Trumpova administrativa v pondělí označila nové účinné léky na hubnutí, včetně Wegovy a Zepbound, za cíl svých snah o snížení cen léků na předpis.

Výkonný příkaz prezidenta Donalda Trumpa požaduje, aby výrobci léků v nadcházejících měsících snížili ceny svých produktů tak, aby se více přiblížily cenám v jiných vyspělých zemích, jinak jim hrozí nové regulace a donucovací opatření, od omezení vývozu až po cla.

Při podpisu nařízení Trump popsal rozhovor s obchodním přítelem, který si stěžoval, jak jsou léčba nadváhy v USA dražší.

„Jsem v Londýně a právě jsem zaplatil za ten zatracený lék na hubnutí, který beru,“ citoval Trump slova svého přítele. “Zaplatil jsem 88 dolarů, zatímco v New Yorku jsem zaplatil 1300 dolarů. Co se to sakra děje? … Je to stejná krabička vyrobená ve stejné továrně stejnou společností.“ Název léku neuvedl.

Injekční léky na hubnutí Wegovy od společnosti Novo Nordisk (NYSE:NVO) a Zepbound od společnosti Eli Lilly (NYSE:LLY) mají v USA doporučenou cenu přes 1 000 dolarů měsíčně. U některých pacientů je velká část těchto nákladů hrazena zdravotním pojištěním. Pro ty, kteří pojištění nemají, začaly společnosti Novo i Lilly nedávno prodávat své léky přímo americkým spotřebitelům za hotovou cenu 499 dolarů měsíčně.

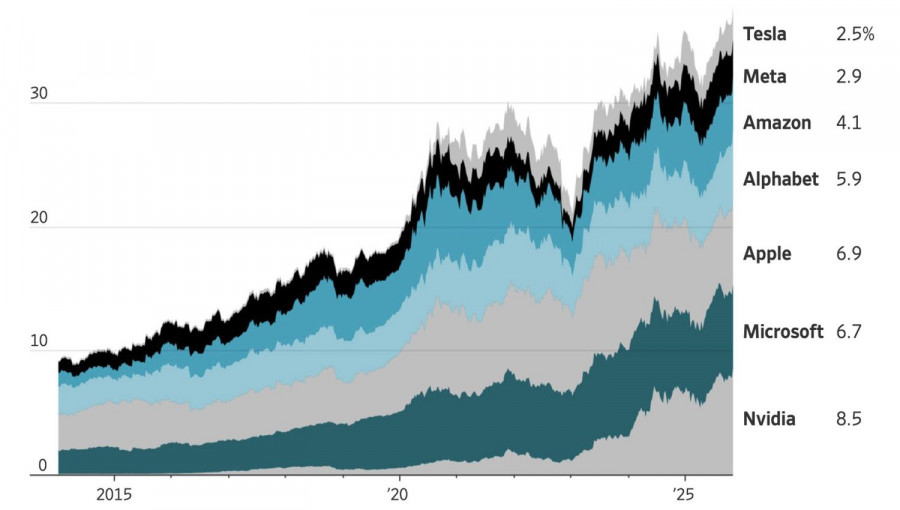

Invest or lose. Companies are ramping up expenditures at a record pace in the race to create AGI, artificial intelligence systems that are smarter than humans. Over the past year, combined spending by Alphabet, Meta Platforms, and Microsoft on AI has increased by $78 billion. It is understandable why technology giants are pushing ahead. After all, falling behind in the race means defeat. However, doubts among investors about whether spending will ever pay off have led them to lock in profits, resulting in a pullback in the S&P 500.

Dynamics of technology giants' spending on AI

Skeptics point to the limited number of paid subscriptions and the lengthy time required to train employees and integrate AI systems into company operations. Their criticism of extravagant spending has led to mixed performances in the stocks of tech giants. For example, Meta's shares plummeted by more than 11%, marking the most significant sell-off in three years. Microsoft and Amazon also faced declines in market capitalization, while Alphabet's market value grew.

NVIDIA was caught in the sell-off following Donald Trump's statement that the issue of Blackwell chip supplies to China was not discussed during the meeting with Xi Jinping.

Magnificent Seven market capitalization dynamics

As details of the US-China trade agreement become clearer, investor euphoria is fading. Natixis describes it as a truce with hidden risks. Beijing eased export controls on rare earth minerals. However, restrictions imposed in April remain in place. China maintains a powerful lever for future disputes, while US gains are minimal, highlighting America's dependence on the largest economy in Asia.

Donald Trump calls his meeting with Xi Jinping fantastic, rating it 12 on a scale from 1 to 10. However, the agreement is set for one year with the possibility of extension, and the eccentricity of the White House owner does not rule out new escalations. Markets prefer caution, which hinders bulls in the S&P 500.

This is similar to the drop in the likelihood of a federal funds rate cut in December from over 90% before October's FOMC meeting to 67% afterward. The Fed managed to surprise investors. Jerome Powell stated that the continuation of the monetary expansion cycle is far from a settled issue, and Kansas City Fed President Jeffrey Schmid voted to keep rates unchanged.

If the Fed does not meet investors' demands for aggressive monetary stimulus, the risks of a pullback in the broad index will increase. This factor is already priced in the stock market, and a correction will be a response to factual sales. On the other hand, the crowd's "buying the dips" strategy has not been canceled.

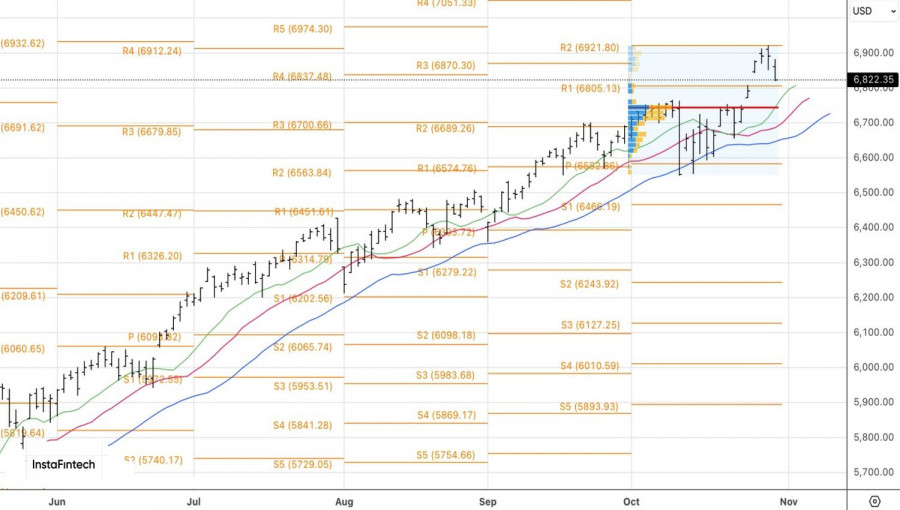

Technically, according to the daily chart, the S&P 500 has taken a step back. Nevertheless, the upward trend remains intact. Therefore, rebounds from support levels at 6,805 and 6,745-6,755 should be utilized for opening long positions.

QUICK LINKS