Společnost Thyssenkrupp zachovala svůj výhled na fiskální rok a očekává stabilnější tržní prostředí ve druhé polovině roku 2025, uvedla ve čtvrtek poté, co nižší ceny a poptávka a odstávky související s údržbou způsobily propad čtvrtletního zisku.

Výrobce dílů pro ponorky a automobily uvedl, že upravený provozní zisk (EBIT) ve druhém čtvrtletí klesl o 90 % na 19 milionů eur (21 milionů USD), přičemž jeho ocelářská divize se přehoupla do ztráty 23 milionů eur oproti 68 milionům eur zisku v loňském roce.

„Přetrvávající obtížné tržní prostředí se odráží v našich provozních číslech za druhé čtvrtletí,“ uvedl generální ředitel Miguel Lopez. „Ve druhé polovině roku očekáváme stabilnější tržní prostředí a pozitivní dopady opatření, která jsme zahájili.“

Německý konglomerát uvedl, že stále očekává upravený provozní zisk (EBIT) ve výši 600 milionů až 1 miliardy eur a volný peněžní tok před fúzemi a akvizicemi ve výši 0 až 300 milionů eur.

Upravený provozní zisk (EBIT) divize ponorek skupiny, která se v současné době připravuje na rozdělení ještě v tomto roce, vzrostl ve druhém čtvrtletí o 24 % na 31 milionů eur.

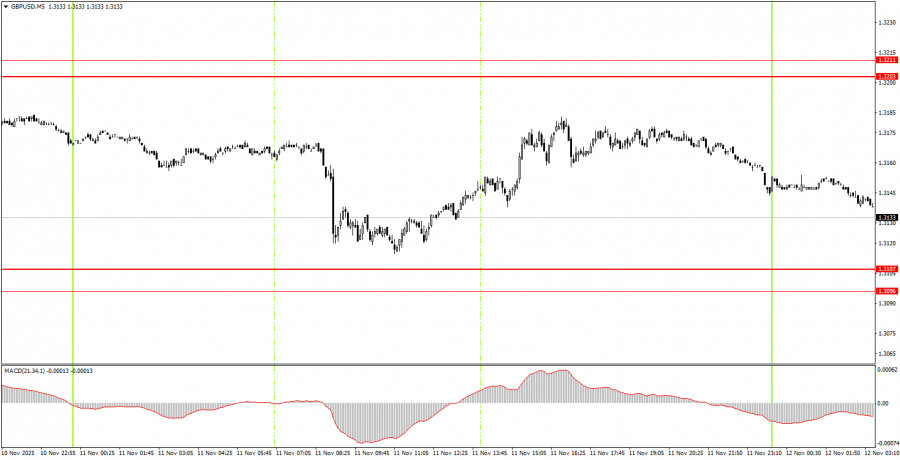

The GBP/USD pair traded up and down throughout Tuesday. In the morning, the only data published in the UK provided traders with some basis for opening trading positions. In principle, one report was enough to send the British pound falling again. The unemployment rate rose, but it increased more than expected, to 5%. Additionally, the number of unemployed rose more sharply than anticipated. Therefore, the British pound's morning decline was entirely logical. However, shortly after that, the pair began to rise, and closer to the end of the day, it fell again. On the hourly timeframe, the price remains below the descending trend line, suggesting the overall decline in the British pound may not be over. We still believe there are no substantial global factors driving the pound's decline, so we expect only medium-term growth. However, from a technical perspective, confirming that the price moves above the downward trend line is necessary to be confident in the move.

On the 5-minute timeframe, no trading signals were formed on Tuesday. The price did not work through any of the levels or areas throughout the day. Thus, there were no grounds for novice traders to open trading positions yesterday.

On the hourly timeframe, the GBP/USD pair continues to form a new downward trend, as indicated by the trend line. As we mentioned earlier, there are no global grounds for a prolonged rise of the dollar, so in the medium term, we expect movement only to the upside. However, the flat (or correction) factor continues to pull the pair down in the long term, which is an absolutely illogical development of events from a macroeconomic and fundamental standpoint.

On Wednesday, novice traders will have to search for new trading signals in the areas of 1.3203-1.3211 and 1.3096-1.3107. The macroeconomic background will be absent today, so movements during the day may again be weak.

On the 5-minute timeframe, trading is currently possible at 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. On Wednesday, no major events or reports are scheduled in the UK and the US. Low volatility and possibly a flat are expected.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

QUICK LINKS