Turecký konglomerát Zorlu Holding se snaží zmírnit obavy investorů z dluhu ve výši 4,9 miliardy dolarů a v rámci komplexní restrukturalizační strategie připravuje prodej majetku a snižování počtu pracovních míst. Společnost již prodloužila splatnost části svých úvěrů.

Prodej aktiv, mezi něž patří i pozemky, je podle zdrojů, které jsou z první ruky obeznámeny s telefonátem investorů s vedením Zorlu z minulého týdne, jednou z hlavních priorit. Tento hovor zprostředkovala společnost J.P. Morgan Securities. Společnost Zorlu Holding má rozmanité portfolio podniků, které zahrnuje nemovitosti, textil, energetiku a výrobu.

Začátkem letošního roku došlo ve vedení firmy ke změně, když v březnu odstoupil generální ředitel Cem Koksal. Tato změna přispěla k problémům společnosti.

The EUR/USD currency pair traded relatively calmly on Monday while maintaining an upward trend. This is quite encouraging, as we may be witnessing the beginning of a new phase in the global upward trend that we've been waiting for over the past few months. Since approximately July 1, the EUR/USD pair has been stuck in a sideways channel between the levels of 1.1400 and 1.1830. Sooner or later, any flat period comes to an end. When it does, a new trend begins or an old one resumes. The trend remains upward, so we continue to expect growth.

On Monday, there were no significant fundamental events in either the U.S. or the Eurozone. Yet this is not needed at the moment. The dollar has failed to demonstrate sustained growth over the past five months, showing a total decline of 1650 pips while correcting by only 23.6% according to Fibonacci. In simpler terms, the dollar fell nearly 1700 pips and then spent five months stagnating, as a 23% correction hardly qualifies as a true correction.

The fundamental reasons behind the dollar's new decline remain unchanged: Donald Trump's policies, the trade war, the Federal Reserve's easing of monetary policy, and the ongoing pressure on the Fed from Trump. Moreover, the unresolved "shutdown" issue, the end of the European Central Bank's easing cycle, and the uncertain prospects for the American economy mean there are plenty of reasons to sell the dollar. Importantly, all these factors remain relevant.

We want to emphasize that the trade war is not a Fed meeting that the market can price in in a day and then forget. The trade war can have a prolonged and destructive impact on the dollar. We already see central banks beginning to reduce dollar reserves, which can be interpreted as a global counter-dollar trend. The world is shifting away from reliance on the American dollar, mainly due to Donald Trump. Of course, the leader of America will demand that the dollar remain the number one currency. Those who dare to disobey will face tariffs and sanctions—as usual, nothing new or surprising. Traders have likely become accustomed to Trump's policies.

It is also worth noting that the dollar has risen against the euro and the pound for about 16 years, since 2008. Trends eventually come to an end, so we may now be at the beginning of a new 10- or 20-year trend. The euro has already risen by 22% or 21 cents against the dollar since 2022. However, considering the next 10 years, this is relatively modest.

Warnings of a new rise in the European currency have also been abundant. The CCI indicator for both the euro and the pound has been persistently showing "bullish" divergences and entering oversold territories in recent months. In an upward trend, bullish divergences signal a resumption of the trend.

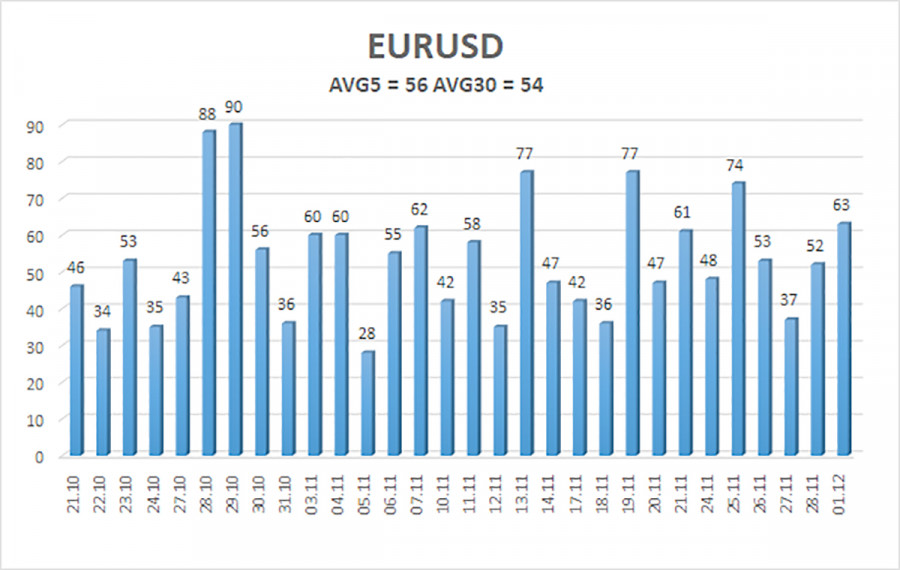

The average volatility of the EUR/USD currency pair over the last five trading days, as of December 2, is 56 pips and is categorized as "medium." We expect the pair to trade between 1.1570 and 1.1682 on Tuesday. The upper channel of the linear regression trend is directed downwards, indicating a bearish trend, but a flat continues on the daily timeframe. The CCI indicator entered the oversold area twice in October (!!!), which could trigger a new upward trend for 2025.

The EUR/USD pair remains below the moving average, but the upward trend persists on all higher timeframes, and a flat has been ongoing on the daily timeframe for several months. The global fundamental background remains critically important for the market. Recently, the dollar has risen, but only within a sideways channel. There is no fundamental basis for long-term growth. With the price positioned below the moving average, small short positions with targets of 1.1536 and 1.1505 can be considered on purely technical grounds. Above the moving average, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

QUICK LINKS