Today, on Tuesday, the AUD/USD pair attracted buyers on the dip, halting a slight pullback from the previous day, which came close to a three-week high. At the moment, prices have increased by more than 0.10% for the day and appear ready to continue the recent recovery from the November low.

The Australian dollar continues to strengthen amid decreasing chances of further monetary policy easing by the Reserve Bank of Australia. On the other side of the pair, the U.S. dollar remains under pressure amid rising expectations of a December interest rate cut by the Federal Reserve. Additionally, there is a positive risk sentiment in the market, which reduces the U.S. dollar's status as a safe-haven currency and supports the risk-sensitive Australian dollar.

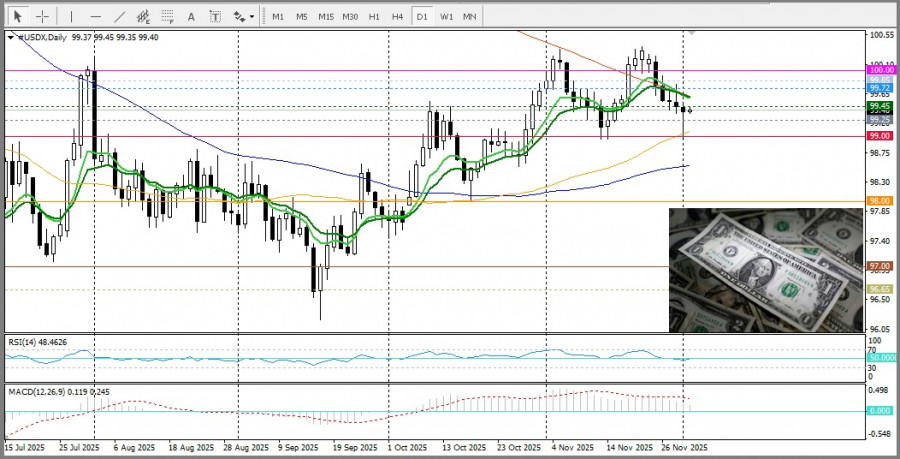

From a technical standpoint, the AUD/USD pair is trading above the 100-day Simple Moving Average (SMA) while continuing to rise, indicating its positive bias. It is worth noting, however, that the oscillators on the daily chart — specifically the Relative Strength Index — have begun gaining positive momentum. This confirms the likelihood of prices returning to the round level of 0.6600.

A steady break above this level will pave the way for further gains, lifting AUD/USD toward the next significant resistance level around 0.6660–0.6665. The momentum may continue above 0.6700 and test the current yearly high.

On the other hand, the 0.6535 level — or the 100-day Simple Moving Average — has become immediate support, which may help limit a decline toward the psychological level of 0.6500. A convincing break below this level will expose the key support of the 200-day Simple Moving Average, currently located at 0.6465. Failure to defend these levels would shift the outlook in favor of the bears.

QUICK LINKS