The price test at 1.1766 coincided with the MACD indicator having risen significantly from the zero mark, which limited the upward potential of the pair. For this reason, I did not buy euros.

The US currency declined sharply after data showed that the United States' unemployment rate reached 4.6%. Information regarding non-farm payrolls also indicated a continuing negative trend in the national labor market. Investors interpreted this news as a precursor to further rate cuts. This factor, in turn, reduced the dollar's attractiveness relative to other currencies. The future behavior of the dollar will be determined by new macroeconomic data and statements from Federal Reserve representatives, both expected in the afternoon.

In the first half of the day, market participants anticipate the release of data on the German IFO Business Climate Index, including assessments of current conditions and economic prospects. Almost immediately after, the Eurozone Consumer Price Index for November will be announced. The markets will closely examine the IFO data to forecast the state of Germany's largest economy amid ongoing instability. The publication of the Eurozone Consumer Price Index will serve as an important benchmark for determining the European Central Bank's further actions. If inflation rises, the ECB will likely be forced to resume discussions on restrictive policies next year. In the case of easing inflationary pressures, the ECB may be less concerned.

Regarding the intraday strategy, I will rely more on the execution of Scenarios No. 1 and No. 2.

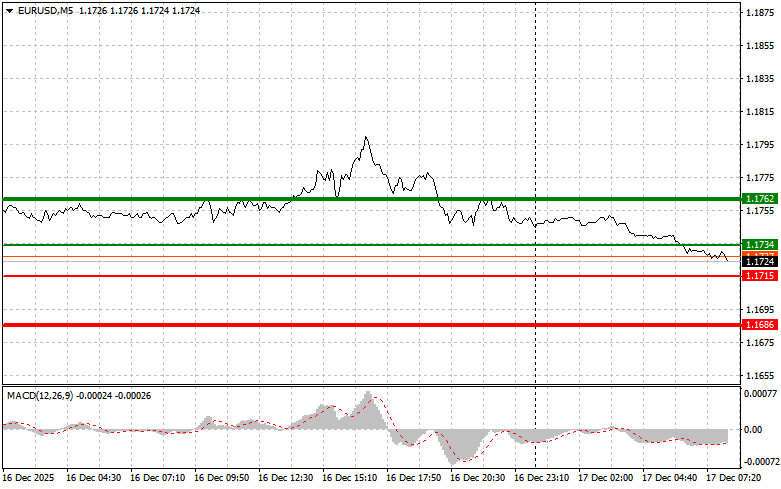

Scenario No. 1: Today, euros can be bought when the price reaches around 1.1734 (green line on the chart), with a target growth towards 1.1762. At point 1.1762, I plan to exit the market and sell euros in the opposite direction, anticipating a move of 30-35 pips from the entry point. It is important to only anticipate euro growth after positive data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario No. 2: I also plan to buy euros today if there are two consecutive price tests at 1.1715 while the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a market reversal upwards. A rise up to the opposite levels of 1.1734 and 1.1762 can be expected.

Scenario No. 1: I plan to sell euros once the 1.1715 level is reached (red line on the chart). The target will be 1.1686, where I plan to exit the market and buy immediately in the opposite direction (anticipating a 20-25-pip move back from the level). Pressure on the pair will return with weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also intend to sell euros today if there are two consecutive price tests at 1.1734 while the MACD indicator is in the overbought zone. This will limit the upward potential of the pair and lead to a market reversal downwards. A decline toward the opposite levels of 1.1715 and 1.1686 can be expected.

Thin green line – entry price at which to buy the trading instrument;

Thick green line – estimated price where take profit can be set, or profit can be realized, as further growth above this level is unlikely;

Thin red line – entry price at which to sell the trading instrument;

Thick red line – estimated price where take profit can be set, or profit can be realized, as further decline below this level is unlikely;

MACD indicator. When entering the market, it is important to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making entry decisions. It is best to stay out of the market before significant fundamental reports to avoid sharp currency fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

And remember, successful trading requires a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

QUICK LINKS