The price test at 1.1673 occurred at the moment when the MACD indicator had just started moving down from the zero line, which confirmed a correct entry point for selling the euro. As a result, the pair declined toward the target level of 1.1647.

Better-than-expected unemployment claims data, combined with a positive trade balance, triggered another strengthening of the U.S. dollar.

Later today, in the first half of the day, data on changes in retail sales in the Eurozone for November, as well as information on changes in industrial production and Germany's trade balance, will be published. These reports will be an important indicator of the European economy at the end of the year and could potentially influence the euro exchange rate.

Retail sales, being a key component of consumer demand, reflect the overall economic condition and the population's willingness to spend. At the same time, Germany's industrial production, as the flagship of the European economy, will be closely monitored. A decline in production could indicate a slowdown in economic growth and disruptions in supply chains.

Additionally, Germany's external trade—being the largest exporter in Europe—will demonstrate how effectively the country is adapting to new economic circumstances and global challenges. The trade balance, which shows the difference between exports and imports, allows an assessment of the competitiveness of German industry and its ability to generate foreign currency inflows. A positive trade balance generally supports the strengthening of the national currency, while a negative balance may have a negative effect.

For intraday trading, I will primarily rely on Scenario 1 and Scenario 2.

Buy Scenarios

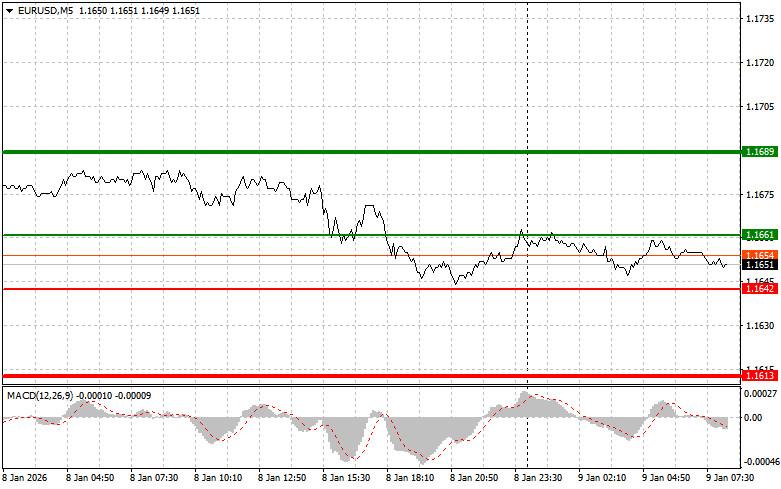

Scenario 1: Today, euros can be bought around 1.1661 (green line on the chart) with a target of 1.1689. I plan to exit the market at 1.1689 and also sell euros in the opposite direction, expecting a 30–35 point move from the entry point. Buying euros is justified after good data.

Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario 2: I also plan to buy euros today if the price tests 1.1642 twice in a row while the MACD indicator is in the oversold area. This will limit the downward potential of the pair and trigger a market reversal upward. Growth can be expected toward the opposite levels of 1.1661 and 1.1689.

Sell Scenarios

Scenario 1: I plan to sell euros after reaching the level of 1.1642 (red line on the chart). The target will be 1.1613, where I will exit the market and buy immediately in the opposite direction, expecting a 20–25 point move from this level. Pressure on the pair is expected today after weak statistics.

Important: Before selling, ensure that the MACD indicator is below the zero line and just starting to move downward from it.

Scenario 2: I also plan to sell euros today if the price tests 1.1661 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward. A decline can be expected toward the opposite levels of 1.1642 and 1.1613.

What Is Shown on the Chart

Important Notes for Beginners:

Forex beginners should exercise extreme caution when deciding to enter the market. It is best to stay out of the market before the release of important fundamental reports to avoid sudden price fluctuations. If trading during news releases, always use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you trade large volumes without money management.

Remember, successful trading requires a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on the current market situation is a fundamentally losing strategy for intraday traders.

QUICK LINKS