The market has crossed a line. It can no longer ignore the developments in the Middle East. US President Donald Trump has given Tehran 10 to 15 days to strike a nuclear deal. He is considering military strikes on Iranian territory, and if those do not work, the US plans to implement regime change. Oil prices are surging, with the possibility of hitting $100 per barrel if the Strait of Hormuz is blocked. Markets like Kalshi and Polymarket are assigning a 34% and 38% chance of that outcome by the end of 2026, respectively.

Oil crises have long been a serious blow to the global economy, dragging down corporate earnings. It is no surprise that S&P 500 traders have finally started paying attention to geopolitical risks. Until now, the broad equity index has been laser-focused on one factor: rotation. On an equal-weighted basis, it is up 6% year-to-date, showing investors' intentions to offload tech stocks, particularly software companies.

Dynamics of S&P 500 and software stocks

Markets have been actively searching for losers from AI adoption. But what if we need to look at the situation from a different angle? Huge investments from tech giants in AI are not only supporting the tech sector but also benefitting other industries.

AI is contributing positively, as noted by FOMC officials. For instance, San Francisco Federal Reserve President Mary Daly mentioned that the central bank should not stifle AI-driven economic growth with excessively high rates. On the other hand, the impact of new technologies on inflation remains unclear. High consumer prices are a key factor preventing a loosening of monetary policy.

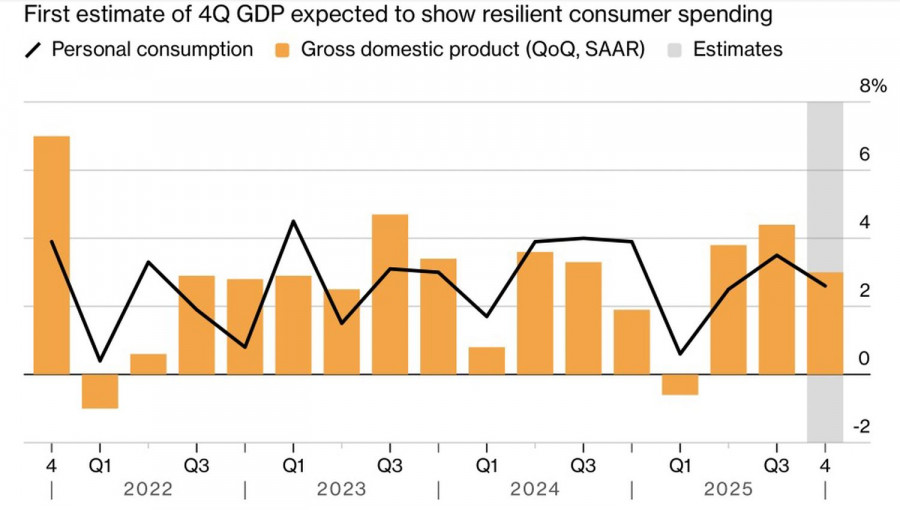

The rotation has sparked renewed interest in companies that, according to Morgan Stanley, have been in a recession for a long time but are now starting to see increased demand. This is due to their sensitivity to the US economy. The strength of the economy allows investors to diversify their portfolios toward former underperformers. Positive GDP data for the fourth quarter could fuel further buying of these stocks.

US economic performance

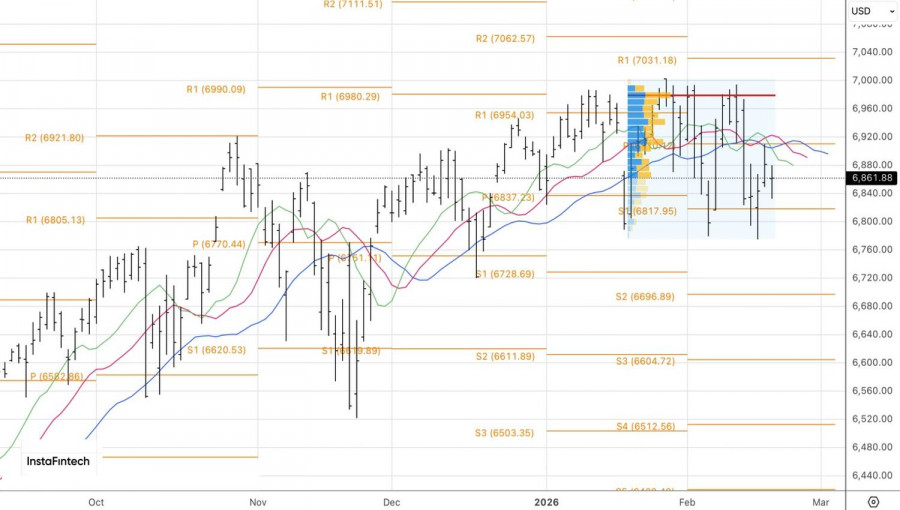

Thus, markets are starting to react to rising geopolitical risks in the Middle East, but the rotation theme is far from over. At the same time, tech giants are regaining their footing.

Technically, the daily chart of the S&P 500 shows a potential Triple Bottom pattern, signaling that the corrective move might be losing steam. The index has entered a consolidation range between 6,790 and 7,000. A breakout above or below this range will determine whether we see a deeper correction or a continued upward trend. Trading breakouts now seems like the most relevant strategy.

QUICK LINKS