(Reuters) – Společnost Home Depot v úterý oznámila, že navzdory americkým clům, které však mohou způsobit nedostupnost některých produktů v řetězci prodejen s potřebami pro kutily, udrží ceny beze změny. Společnost zároveň oznámila, že tržby za první čtvrtletí překonaly odhady.

Billy Bastek, výkonný viceprezident pro merchandising společnosti Home Depot (NYSE:HD), řekl analytikům po zveřejnění výsledků, že společnost hodlá „udržet ceny v celém svém portfoliu“.

To však znamená, že některé produkty by mohly zmizet z regálů.

„Máme některé položky, které by mohly být potenciálně ovlivněny clem, které, upřímně řečeno, nebudeme v budoucnu uplatňovat, pokud to nebude dávat smysl v rámci struktury sortimentu,“ uvedl Bastek. Konkrétní položky, které by mohly být ovlivněny, však nejmenoval.

The EUR/USD currency pair began to rise from the very start of the day on Wednesday. We were even surprised by such a substantial rise in the euro, as the market has been very reluctant to buy the currency in recent weeks and, over the last 2.5 months, has completely ignored a series of factors contributing to the dollar's decline. As a result, we observed either an inexplicable rise in the dollar or weak euro growth. However, on Wednesday, the market situation changed sharply, and traders suddenly became fond of the euro. This is not surprising for us, as we have consistently stated for the last few months: the market has formed a flat, and there are no reasons for the dollar to rise in the medium term. The key question was when the flat would end.

At this point, we cannot yet say that the flat on the daily timeframe has concluded, as the price remains within the sideways channel of 1.1400-1.1830. However, we also warned that a price reversal around the lower boundary of the channel would likely trigger a rise, at least towards the upper line. We have also repeatedly pointed out the illogicality of the pair's movements due to the same flat. Therefore, on Wednesday, we witnessed an entirely predictable decline of the dollar, for which even the ADP report was unnecessary.

The pair began to rise during the night when there were no news events. In the morning, a couple of business activity indexes were released in the Eurozone, which could not provoke such a strong move. When the ADP report was released, it became clear that the market was justified in renewing its sell-off of the dollar. According to the ADP report, the number of employees in the private sector (analogous to Non-Farm Payrolls) decreased by 32,000. It doesn't even matter what the forecasts were. A decrease of -32,000 is not just low; it's a catastrophe. Recall that to prevent the unemployment rate from increasing, 150,000 to 200,000 new jobs are required each month. The normal Non-Farm figure is precisely within that range. The ADP report, while not Non-Farm Payrolls, does allow conclusions to be drawn about the state of the U.S. labor market.

Thus, on December 10, the Fed will likely lower the key rate for the third consecutive time, and no significant labor market reports will be published before that date. Only on the day of the Fed meeting will an inflation report be released, but what significance will it have if the labor market continues to fall into the abyss? Overall, long-term conclusions will only need to be drawn after the Non-Farm Payrolls data for October and November, as well as the unemployment rate for the same period. The Fed may well take a pause in early 2026 due to high inflation. But for now, we do not know the November inflation data, the November Non-Farm figures, or the November unemployment rate.

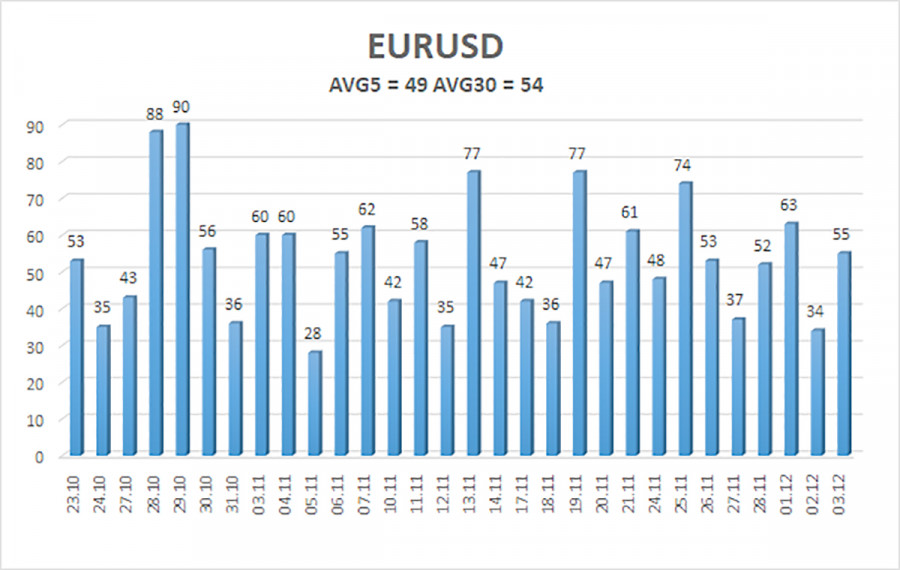

The average volatility of the EUR/USD pair over the last five trading days as of December 4 is 49 pips and is characterized as "medium-low." We expect the pair to trade between 1.1614 and 1.1712 on Thursday. The upper channel of the linear regression is directed downwards, signaling a bearish trend, but in fact, a flat continues on the daily timeframe. The CCI indicator entered the oversold area twice in October, which might provoke a new upward trend in 2025.

The EUR/USD pair remains below the moving average, but the upward trend continues on all higher timeframes, while the flat has persisted on the daily timeframe for several months. The global fundamental background still holds enormous significance for the market. Recently, the dollar has often risen, but only within the bounds of a sideways channel. There is no fundamental basis for long-term growth. When the price is below the moving average, small short positions can be considered with targets at 1.1566 and 1.1536 on purely technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

RYCHLÉ ODKAZY