The GBP/USD currency pair also traded with significant gains on Wednesday. Overall, we have been waiting only for substantial growth in the British currency in recent weeks and months. We believe the GBP/USD pair has corrected too far and expect the global upward trend to resume in 2025. Thus, we welcome any growth of the pair and consider any declines to be illogical and excessive.

On Wednesday, the U.S. dollar fell by 100 pips even before the ADP report was published, which is now pivotal, as there have been no relevant data on Non-Farm Payrolls and the unemployment rate. The dollar began its decline possibly during the night due to insider information reaching market makers, but with any ADP report, we only anticipated a decline in the dollar. It's important to remember that practically any value in any U.S. labor market report below 150,000 can be considered weak. A value of -32,000 indicates a total failure. Therefore, regardless of what the report showed, it was quite reasonable to expect a decline in the dollar.

In our view, over the past few months, during which the dollar grew quite actively, the market has already accounted for nearly all potential factors that could have driven the British currency down. At this point, there are simply no remaining factors. Meanwhile, it has ignored all the factors leading to a decline in the American currency. Recall that the dollar performed well during the month-and-a-half-long "shutdown," amid new tariffs from Donald Trump at the beginning of October, and after two monetary policy easing measures by the Fed. We don't even consider the declining U.S. labor market, which opens up new "dovish" prospects for the Fed. We reiterate that we believe the dollar had much more reason to decline recently than to appreciate, despite all the budget issues in the UK.

However, globally, the downward correction has continued, seemingly without end. Currently, the pair has overcome the Kijun-sen line on the daily timeframe, marking the first step toward resuming an upward trend. Now it remains to breach the Senkou Span B line at 1.3364, and then the pound could return to 1.3786 by the end of the year. A drop of 500 pips in a month is quite realistic when the currency (the dollar) has no growth factors.

Regarding the Bank of England and its likely monetary policy easing in December, we believe this factor has already been priced in. If the dollar has grown and the pound has fallen over the last 2.5 months, which central bank's rate cut was the market responding to? A few more interesting and important reports will be published in the U.S. by the end of the week, but essentially, they are of no significant importance. The market is convinced that the Fed will lower rates again next week, so the dollar has no basis for growth. It previously had little, but if the global correction is now completed, the dollar may once again plummet.

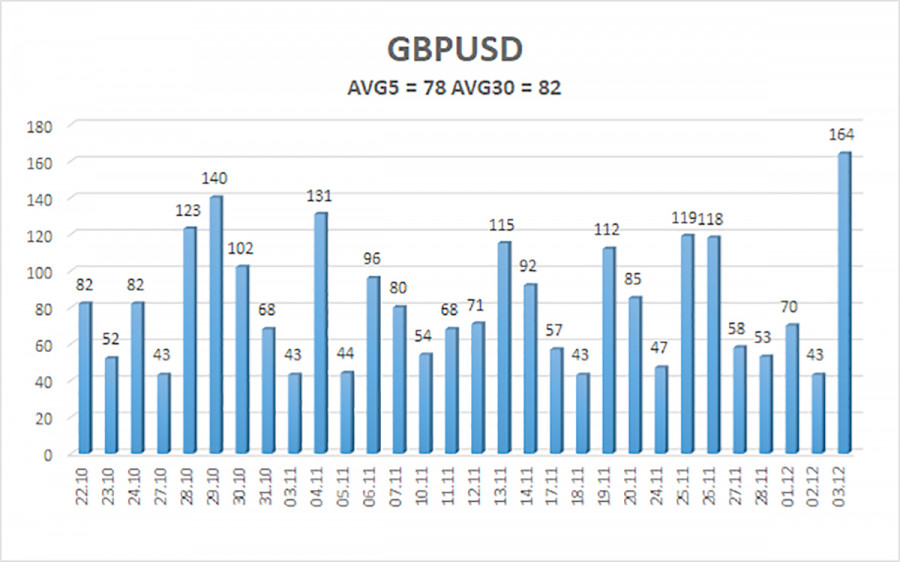

The average volatility of the GBP/USD pair over the last five trading days is 78 pips, which is considered "average" for this pair. On Thursday, December 4, we expect movement within a range bounded by the levels of 1.3265 and 1.3421. The upper channel of the linear regression is downward-sloping, but this is only due to a technical correction on higher timeframes. The CCI indicator has entered the oversold area 6 times in recent months and has formed another "bullish" divergence, which continues to warn of a resumption of an upward trend.

The GBP/USD currency pair is attempting to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the dollar, so we do not expect the American currency to grow. Therefore, long positions with targets at 1.3428 and 1.3489 remain relevant in the near term as long as the price remains above the moving average. If the price is located below the moving average line, small short positions can be considered with a target at 1.3123 on technical grounds. From time to time, the American currency shows corrections (in the global sense), but for a sustained strengthening trend, it needs signs of an end to the trade war or other positive global factors.

RYCHLÉ ODKAZY