If the crowd were always right, the sun would still revolve around the Earth. Most major banks believe that after the 13% rally in EUR/USD in 2025, the main currency pair will continue to rise in 2026. The main reasons cited are the divergence in monetary policy and the White House's pressure on the Federal Reserve. However, at the end of 2024, there were many supporters of the US dollar. In fact, the USD index fell by 10% in the first half of the year. How will it be this time?

Consensus forecasts from Bloomberg experts suggest a 3% decline in the USD index in the next year. The biggest "bulls" on the euro are Goldman Sachs and Deutsche Bank. They expect EUR/USD to rise by 6% because the Federal Reserve has room to ease monetary policy, while the European Central Bank has completed its cycle.

Indeed, Donald Trump reiterated that US interest rates should fall to 1% or lower. They should be the lowest in the world. To achieve this, the Federal Reserve chair will consult with the White House. Such presidential interference in the central bank's affairs undermines the US dollar's credibility and will contribute to the continued rally of EUR/USD.

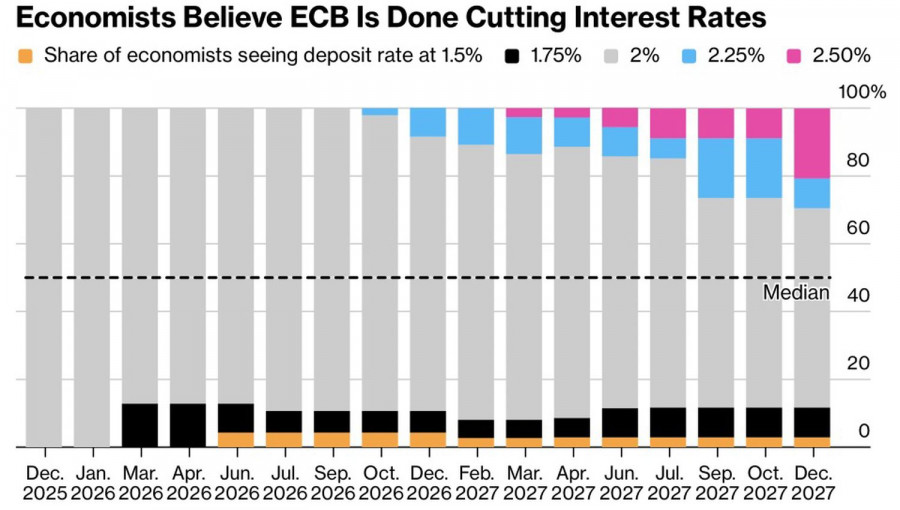

Moreover, Bloomberg experts forecast that the ECB's deposit rate will remain at 2% at least until 2027. At the same time, most respondents, about 60%, believe that the next step by the ECB will be to tighten, rather than loosen, monetary policy.

The ideas of divergence in monetary policy and White House interference in Fed affairs are understandable. However, supporters of the US dollar believe that these factors are already largely priced into EUR/USD quotes. For example, Citigroup forecasts a decline in the major currency pair due to the acceleration of US economic growth and capital inflows into the US stock market. According to the firm, these processes will be underpinned by both a large and beautiful tax cut and artificial intelligence technologies.

Bloomberg Economics warns that central banks are overestimating the resilience of national economies to Donald Trump's tariffs. Over time, cracks will start to appear. The ECB will be forced to throw a lifebuoy to the eurozone by lowering the deposit rate. If this happens, there will be serious doubts about the strength of the upward trend in EUR/USD.

Thus, in Forex, there are many assumptions about the future of the major currency pair. Most expect its growth; however, the arguments from the "bears" are convincing.

Technically, an inside bar was formed on the daily chart of EUR/USD. If the "bulls" manage to hold above 1.175, the risks of restoring the upward trend will increase, providing an opportunity to build long positions. Otherwise, it's advisable to stay out of the market, at least until the release of the US labor market data.

QUICK LINKS