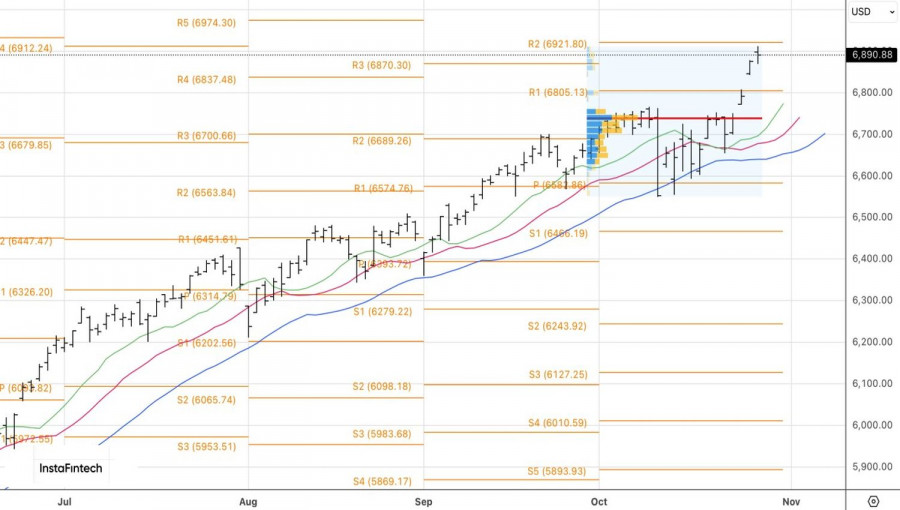

Good news is abundant, while bad news is virtually nonexistent. Against this backdrop, how can the S&P 500 not rise? The broad stock index reached another record high amid new optimism over trade, rising NVIDIA stock prices, and strong macroeconomic data. However, toward the end of the trading session, investors preferred to play it safe and close some long positions ahead of important reports from the Magnificent Seven companies and the announcements following the FOMC meeting. As a result, the stock market pulled back.

The Wall Street Journal insider reports that the White House intends to reduce tariffs on imports related to fentanyl products from 20% to 10%. As a result, the average tariff against China will drop from 55% to 45%. This will be another step toward de-escalating the trade conflict and improving global risk appetite. This is complemented by positive private-sector employment data from ADP. Over four weeks leading up to October 11, the indicator rose on average by 14,250, compared to -32,000 in August. The labor market is clearly improving, as is the U.S. economy. Why not buy the S&P 500?

Investors do not consider the FOMC meeting a significant market event. The verdict from the central bank is clear even before its conclusion. The federal funds rate will fall to 4%, and Jerome Powell will likely refrain from signaling its future direction amid a divided FOMC. In such conditions, good news from the U.S. economy is beneficial for the S&P 500.

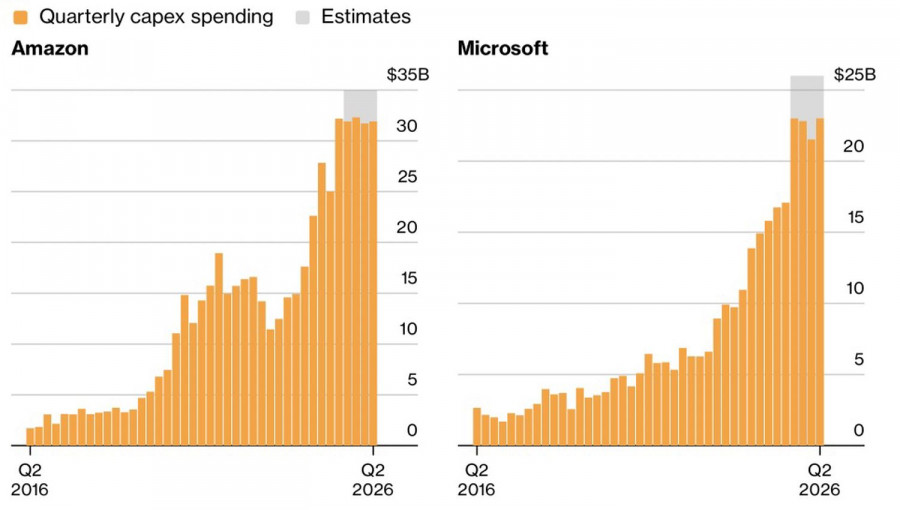

Investors are preparing for the third-quarter corporate earnings reports of tech giants. It is expected that expenses for Microsoft, Alphabet, Amazon, and Meta will increase to $360 billion in the current financial year and to $420 billion in the next. The majority of these expenses will be related to artificial intelligence technology. It is the Magnificent Seven that has pushed—and continues to push—the broad stock index to record highs. Notably, the S&P 500 has surged 92% from its October 2022 low. Judging by the performance of previous bullish markets, this is not an excessive rise.

Moreover, NVIDIA is skeptical about the idea of a bubble in technology companies. The industry leader signed a contract with pharmaceutical corporation Eli Lilly to create a supercomputer for drug development using artificial intelligence. This boosted the company's stock by 5% and accelerated the S&P 500's growth.

It is no surprise that in these conditions, banks and investment firms are lining up to increase forecasts for the broad stock index. If the 7,100 mark was considered astronomical at the beginning of the year, it is now seen as a baseline scenario.

Technically, on the daily chart, the rally of the S&P 500 targeted the previously indicated goal of 6,920 continues to gain momentum. As long as the broad stock index trades above the 6,800 pivot level, the emphasis should remain on buying. Moreover, breaching resistance at 6,920 will open the way toward 7,045 and 7,140.