Yesterday, gold prices rose, preparing for the best week in the last month as traders grappled with uncertainty surrounding the resumption of the U.S. government after a six-week hiatus and the risk of a pause in the rate-cutting cycle.

The precious metal traded above $4,200 per ounce, reflecting a weekly increase of about 5% and recovering losses from the previous session. Expectations of another rate cut in the U.S., driven by weak economic outlooks, continue to provide tailwinds for the precious metal, which yields no interest. The five-day growth in silver exceeded 10%, approaching last month's record levels.

The rise in gold prices reflects the classic market response to instability. When the political and economic situation is murky, investors tend to turn to safe-haven assets like gold, viewing it as a way to preserve capital amid heightened risk. The six-week "shutdown" period of the U.S. government raised questions about the stability of the American economy, certainly boosting demand for the precious metal. Additionally, discussions within the Federal Reserve regarding future monetary policy create additional nervousness in the market. If the Fed pauses its rate-cutting cycle, it could negatively impact economic growth and further enhance gold's appeal as a defensive asset.

The increase in gold prices this week may also have been amplified by a technical model in which dealers selling cheap options are compelled to buy gold futures as a hedge. In a sluggish market, any sudden price increase can amplify buying interest and trigger a sharp rise, even without new demand from physical gold buyers.

Although last month the price of gold retreated from record levels above $4,380, it has still increased nearly 60% this year and is on track to achieve the best annual performance since 1979. Central banks have ramped up purchases, seeking to preserve value and diversify assets, while investors have poured money into the metal as a hedge against increasing fiscal instability in some of the world's largest economies.

Precious metals continue to receive support due to the Fed's prospect of injecting additional liquidity into the financial system.

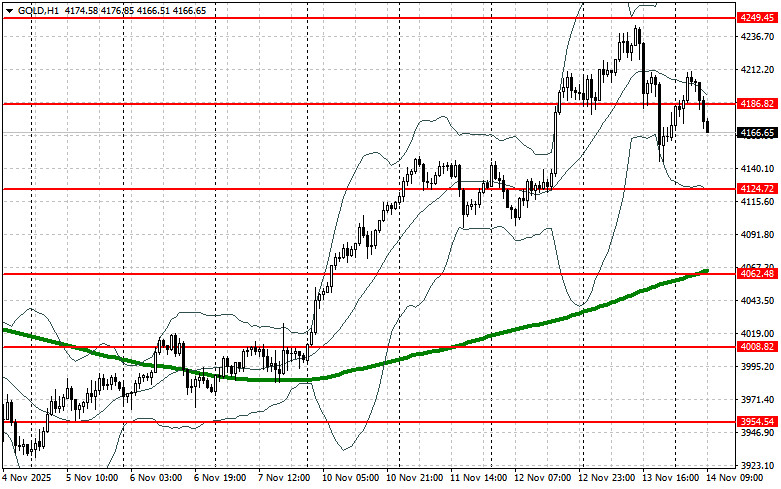

Regarding the current technical picture for gold, buyers need to clear the nearest resistance at $4,186. This will allow targeting $4,249, above which it will be quite challenging to break through. The furthest target will be the area around $4,304. If gold declines, bears will attempt to take control of $4,124. If they succeed, a breakout of this range will deal a severe blow to the bulls' positions, potentially driving gold down to a minimum of $4,062 with a prospect of reaching $4,008.