Společnost Bernstein snížila hodnocení akcií BHP Group Ltd ADR z Outperform na Market-Perform s odkazem na omezený potenciál růstu po snížení prognóz cen železné rudy počínaje rokem 2026.

Makléř rovněž snížil cílovou cenu BHP na 19 liber z 20 liber za akcii.

Akcie společnosti BHP kotované na burze v USA v úterý v předobchodní fázi klesly o více než 1 %.

Snížení ratingu přichází v rámci širší změny výhledu společnosti Bernstein na sektor železné rudy, neboť se očekává, že nové dodávky, zejména ze Simandou, budou v příštích letech tlačit trh do přebytku.

Analytici nyní vidí stabilizaci cen železné rudy v rozmezí 79-85 USD/t v reálných dolarech v roce 2025, což je výrazně pod předchozími předpoklady.

„Snižujeme hodnocení společnosti BHP z Outperform na Market-Perform, protože po snížení našich odhadů cen železné rudy od roku 2026 nevidíme smysluplný růst,“ uvedl ve své poznámce analytik Bob Brackett.

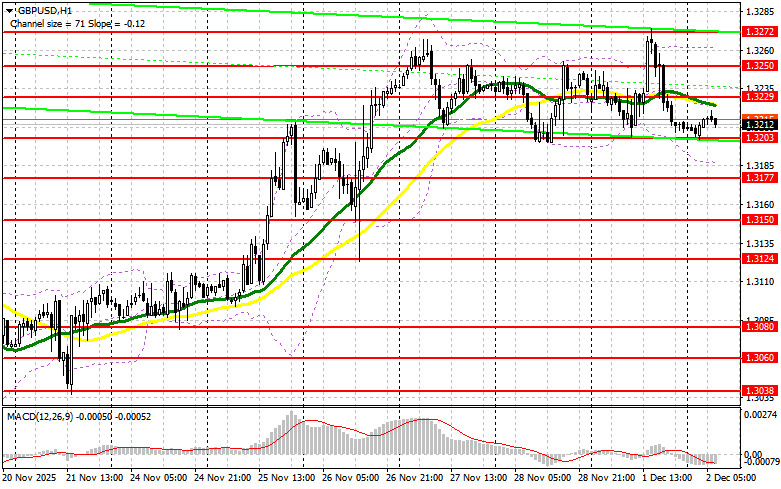

Yesterday, several entry points in the market were formed. Let's take a look at the 5-minute chart and analyze what happened there. In my morning forecast, I highlighted the level of 1.3211 and planned to make decisions based on it. The decline and formation of a false breakout around 1.3211 provided an entry point for buying the pound, resulting in the pair rising by more than 20 pips. In the afternoon, active selling around 1.3265 prompted the opening of short positions, sending the pound back to the support area at 1.3211.

A weak ISM report on the U.S. manufacturing index increased pressure on the U.S. dollar and strengthened the British pound. However, after last month's high was updated, pressure on the pair returned. In the first half of the day, summaries and minutes from the Bank of England's Financial Policy Committee meeting, as well as the UK housing price index from Nationwide, are expected. In the case of weak reports, pressure on the pound may increase, leading to a decline in the pair towards the nearest support at 1.3203. Only the formation of a false breakout there will provide an opportunity to open long positions with the aim of growing the pair to resistance at 1.3229, formed at the end of yesterday. A breakout and a reverse test from the top to the bottom of this range will increase the chances of strengthening GBP/USD, triggering stop orders from sellers and providing a suitable entry point for long positions, with the possibility of reaching 1.3250. The furthest target will be the area of 1.3272, where I plan to take profit. In the event of a decline in GBP/USD and a lack of buying activity at 1.3203, a level that has already been tested three times for strength, pressure on the pair will increase, leading to a move towards the next support at 1.3177. Only the formation of a false breakout there will be a suitable condition to open long positions. I plan to buy GBP/USD on a bounce from the 1.3150 low, targeting a 30-35-pip intraday correction.

Pound sellers returned the market to the framework of a sideways channel yesterday, and are now targeting its lower boundary. However, it is best to act in the current situation on growth, which will confirm the presence of large bears in the market. In the case of strong reports from the UK, I expect the first signs of bears around the resistance level of 1.3229. Only the formation of a false breakout there will provide a reason to sell the pound, aiming for a decline towards the support at 1.3203, which serves as the lower boundary of the channel. A breakout and a reverse test from below to above this range will deliver a larger blow to buyers' positions, triggering stop orders and opening the way to 1.3177. The furthest target will be the 1.3150 area, where I plan to take profit. In the event of a rise in GBP/USD and a lack of activity at 1.3229, where the moving averages favor the bears, buyers will continue the trend's development, potentially leading to a spike towards 1.3250. I plan to open short positions there only on a false breakout. If there is no downward movement there, I will sell GBP/USD on a bounce from 1.3272, targeting an intraday downward correction of 30-35 pips.

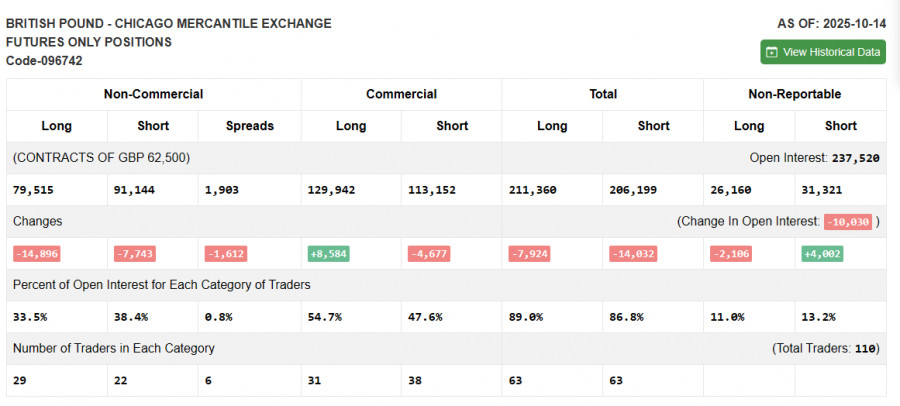

Due to the shutdown in the U.S., fresh data on the Commitment of Traders is not being published. As soon as the latest report is prepared, we will publish it immediately. The last relevant data is only from October 14.

In the COT report (Commitment of Traders), a reduction in both long and short positions was observed. Pressure on the dollar remains—especially after the latest data, which will likely force the U.S. Federal Reserve to continue cutting interest rates. At the same time, the Bank of England's policy remains cautious, indicating clear plans for further fighting inflation. The short-term future dynamics of the GBP/USD exchange rate will be determined by new fundamental reports. In the last COT report, non-commercial long positions decreased by 14,896 to 79,515, while non-commercial shorts decreased by 7,743 to 91,144. As a result, the spread between long and short positions narrowed by 1,612.

Moving Averages

Trading is occurring below the 30 and 50-day moving averages, indicating a possible decline in the pound.

Note: The period and prices of the moving averages are considered by the author on the hourly chart (H1) and differ from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In the case of a decline, the lower boundary of the indicator around 1.3185 will serve as support.