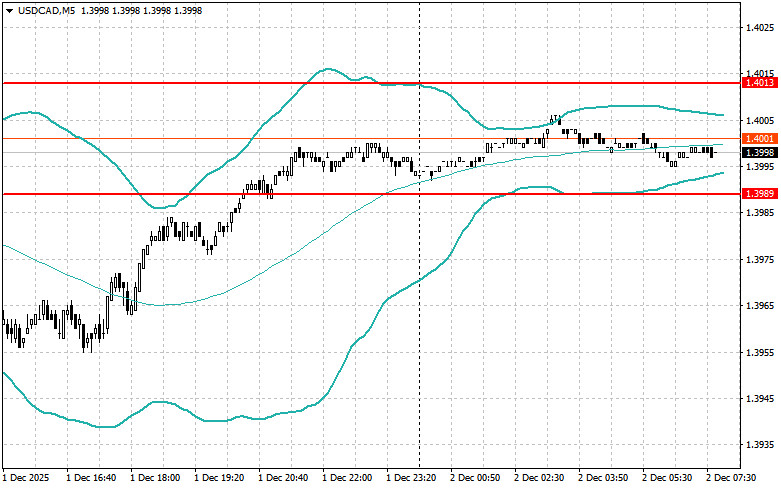

The dollar remained under pressure following the release of another series of weak fundamental data from the U.S.

Weak figures from the ISM manufacturing index intensified pressure on the U.S. dollar in the second half of the day. The index, which reflects business activity in the manufacturing sector, unexpectedly declined, signaling a slowdown in industry growth. This, in turn, sparked concerns regarding the overall prospects of the American economy. Investors, worried about potential growth slowdowns, began to offload dollar assets, which directly impacted the currency's exchange rate. Dollar sales also increased amid expectations that the Federal Reserve might continue its accommodative monetary policy.

Today, in the first half of the day, data on the Eurozone consumer price index, the core consumer price index, and the unemployment rate are due. These reports will be crucial for assessing the current state of the region's economy and, consequently, for determining the European Central Bank's next steps in monetary policy.

Particular attention will be given to the consumer price index, which is a key inflation indicator. Sustaining it around the European Central Bank's target level of 2.0% could prompt the central bank to maintain a wait-and-see stance regarding interest rates. Conversely, a significant slowdown in the CPI might signal the need for monetary easing to support economic growth.

The unemployment data will provide insight into the state of the labor market. A reduction in the unemployment rate may bolster consumer demand and increase inflationary pressure, while an increase could indicate a slowdown in economic growth.

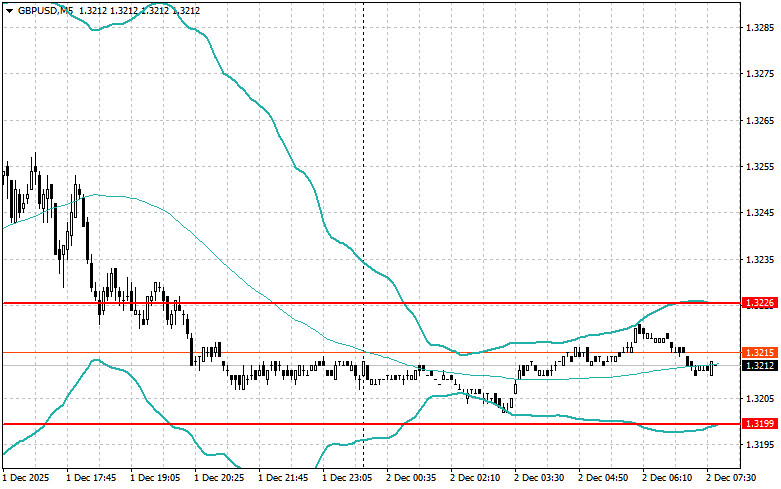

Regarding the pound, a summary and transcript of the Bank of England's Monetary Policy Committee meeting, as well as the UK housing price index from Nationwide, are expected to be published in the first half of the day. A thorough analysis of the report from the policymakers' meeting will allow market participants to gauge how conservative the Bank of England's stance on rates is. The Nationwide housing price index serves as one indicator of the state of the UK housing market. An increase in the index may indicate strengthening of the economy and rising consumer confidence, while a decrease could signal potential issues within the economy and a decline in housing demand.

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data significantly exceed or fall short of economists' expectations, the Momentum strategy would be most appropriate.

ລິ້ງດ່ວນ