According to recent data, gold reached a record high today. This comes amid renewed geopolitical tensions and the prospect of further US interest rate cuts. Silver has also reached a historical high.

Investors, seeking safety amid global uncertainty, are flocking to precious metals, which are traditionally considered a "safe haven." Additionally, expectations of a more accommodative monetary policy from the Federal Reserve are putting further pressure on the dollar, making gold and silver more attractive to holders of other currencies. The price increase in precious metals is fueled not only by short-term factors but also by long-term trends, including the rising national debt of many countries, ongoing inflation risks, and diversification of assets by central banks.

The spot price of gold rose by 1.2% and dipped just below $4,500 per ounce, continuing its ascent following the largest single-day jump in over a month. Traders anticipate that after three consecutive interest rate cuts, the Fed will again lower borrowing costs next year, doing so at least twice.

Gold's appeal as a safe-haven asset has also strengthened amid rising geopolitical tensions, particularly in Venezuela, where the US is blocking oil tankers, increasing pressure on President Nicolas Maduro's government.

It's worth noting that gold prices have increased by 70% this year and are set to deliver their best annual performance since 1979. This rapid growth has been supported by increased purchases from central banks and inflows into gold-backed exchange-traded funds (ETFs). According to the World Gold Council, the total assets in such funds have increased every month this year, except for May.

Aggressive measures by US President Donald Trump to reshape global trade, along with his threats to the Federal Reserve's independence, have fueled the bullish market.

As mentioned earlier, silver has also risen by 1.4%, approaching the $70 per ounce mark. The price of this white metal has increased by approximately 140% this year.

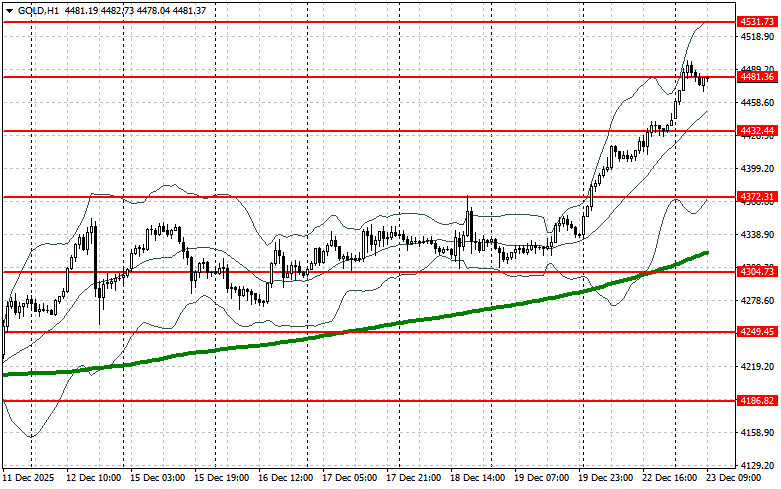

As for the current technical picture of gold, buyers need to reclaim the nearest resistance at $4,481. This will allow targeting $4,531, above which it will be quite challenging to break through. The furthest target will be the area of $4,591. If gold falls, bears will attempt to take control of $4,432. If successful, a breakout of this range will deliver a serious blow to the bulls' positions, pushing gold down to a low of $4,372 with the potential to reach $4,304.

ລິ້ງດ່ວນ