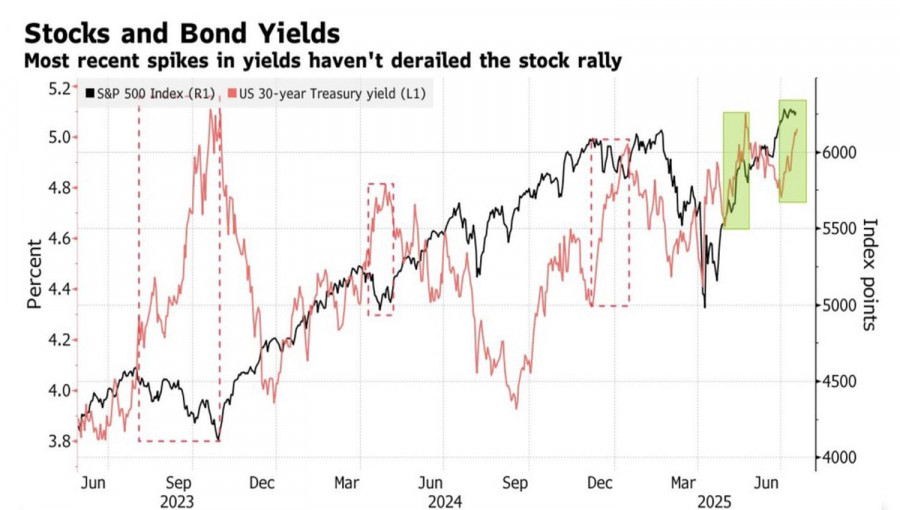

What could be better for the S&P 500 than a Federal Reserve rate cut amid a still-strong economy? A series of positive labor market and retail sales data, combined with pleasant surprises in corporate earnings, has convinced investors that all is well. Against this backdrop, Christopher Waller's calls for monetary policy easing as early as July became a catalyst for the broad stock index's surge to new record highs.

A decline in jobless claims and a 0.6% month-over-month increase in retail sales suggest that consumers remain resilient and continue to spend. Coupled with a more than 10% depreciation of the U.S. dollar in the first half of the year, this paves the way for strong Q2 corporate earnings. There's a high probability that actual profits will exceed forecasts, fueling the S&P 500's drive to new highs. An impressive 26% rally from the April lows and an $11.5 trillion increase in market capitalization—just the beginning?

One of Wall Street's top "bears," Morgan Stanley, disagrees. The bank forecasts a 5–10% decline in the broad stock index due to the negative impact of Donald Trump's trade policy on corporate earnings. Only after that, according to the bank, will a new bull market begin. Therefore, any dips in the S&P 500 should be bought.

In reality, it will take a significant amount of time before tariffs affect company operations. The weakening of the U.S. dollar will offset their impact. According to research by Macro Hive, every 10% drop in the USD index delivers a 2% windfall profit to U.S. corporations. Given that 41% of S&P 500 issuers generate revenue abroad, strong earnings reports should be expected.

Christopher Waller's dovish comments are further fueling the stock market rally. The FOMC official stated that the Fed doesn't need to wait until cracks appear in the U.S. economy. The risk of runaway inflation is low, and any price increases resulting from tariffs are expected to be temporary. Under such conditions, the federal funds rate should be cut as early as July.

Waller was appointed by Donald Trump, who supports easing monetary policy. He is one of four contenders to become the next Fed chair. His dovish rhetoric may reflect a desire to appeal to the U.S. president, which undermines trust in the Fed.

Nevertheless, according to JP Morgan, central bank independence is a myth. It has always danced to the White House's tune. For this reason, the bank recommends continuing to buy U.S. stocks for the long term.

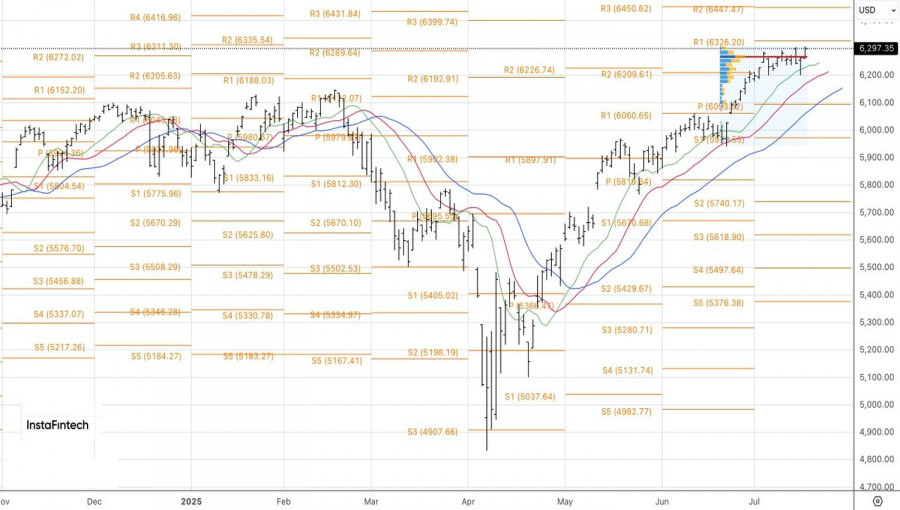

Technically, the daily S&P 500 chart showed a pin bar, which allowed for a long entry from the 6270 level. The previously stated targets of 6325 and 6450 remain valid. It makes sense to stick with a buying strategy.

SZYBKIE LINKI