The euro and British pound rose sharply against the U.S. dollar; however, dollar buyers took advantage of attractive prices and quickly restored market equilibrium.

Yesterday, the European Central Bank kept interest rates unchanged, clearly indicating that the current cycle of monetary policy easing has concluded. This step, as expected by most analysts, marked the end of a period in which the ECB actively stimulated the economy by lowering interest rates. Now that inflation is stabilizing and economic growth is showing signs of resilience, the ECB is shifting to a more conservative strategy.

The Bank of England lowered interest rates to 3.75%, warning that further steps in this direction will be much more challenging, which supported the British pound.

Today, several data releases are expected in the first half of the day, including the GfK consumer climate index for Germany, the German producer price index, the ECB's current account balance, and the eurozone consumer confidence indicator. The GfK consumer climate index reflects the moods of German consumers, their willingness to spend, and confidence in the future. Positive values of the index signal optimism and potential growth in consumer spending. The German producer price index is an important indicator of inflationary pressure in the manufacturing sector. A significant increase in producer prices is unlikely, but it may eventually be reflected in consumer prices, making close monitoring of this indicator crucial for understanding the overall inflation picture.

The ECB's current account balance shows the difference between eurozone receipts and payments from current operations. Finally, the eurozone consumer confidence indicator reflects the overall mood of consumers in the euro area. Like the German GfK index, it serves as a valuable gauge of economic growth prospects and the potential impact of consumer spending on the eurozone economy. Together, this data provides a comprehensive view of the current state of the German and European economies, allowing analysts and traders to make informed decisions.

Regarding the pound, data on UK retail sales and the UK government's net borrowing requirement are expected in the first half of the day. The change in retail sales, a key indicator of consumer spending, reflects the dynamics of consumer purchases of goods and services. An increase in retail sales indicates consumer optimism, which could strengthen the British pound. Data on the UK government's net borrowing requirement illustrate the difference between government revenues and expenditures. A rise in borrowing may signal the need to finance a budget deficit, which is currently a problem in the UK and may, in turn, put pressure on the British pound.

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data is significantly above or below economists' expectations, it is best to use the Momentum strategy.

Buying on a breakout at 1.1730 may lead to a rise in the euro to around 1.1755 and 1.1776;

Selling on a breakout at 1.1710 may lead to a drop in the euro to around 1.1690 and 1.1660;

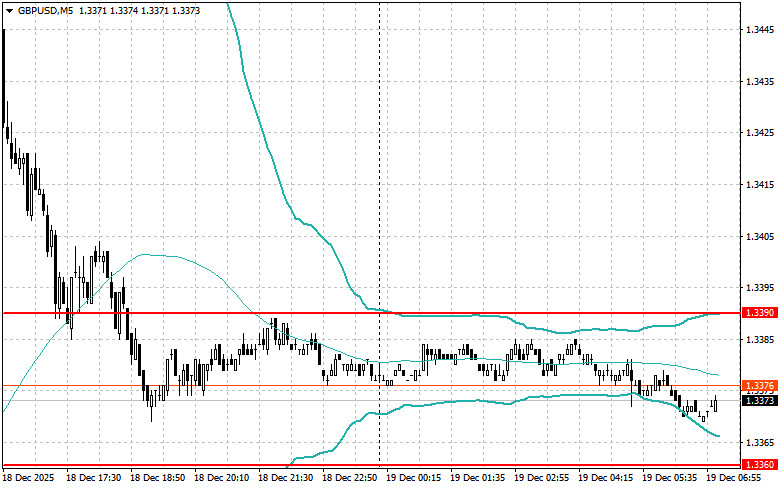

Buying on a breakout at 1.3385 may lead to a rise in the pound to around 1.3421 and 1.3452;

Selling on a breakout at 1.3365 may lead to a drop in the pound to around 1.3340 and 1.3322;

Buying on a breakout at 156.12 may lead to a rise in the dollar to around 156.45 and 156.89;

Selling on a breakout at 155.67 may lead to a drop in the dollar to around 155.32 and 155.01;

Look for short positions after a failed breakout above 1.1736 on a pullback below this level;

Look for long positions after a failed breakout below 1.1707 on a pullback to this level;

Look for short positions after a failed breakout above 1.3390 on a pullback below this level;

Look for long positions after a failed breakout below 1.3360 on a pullback to this level;

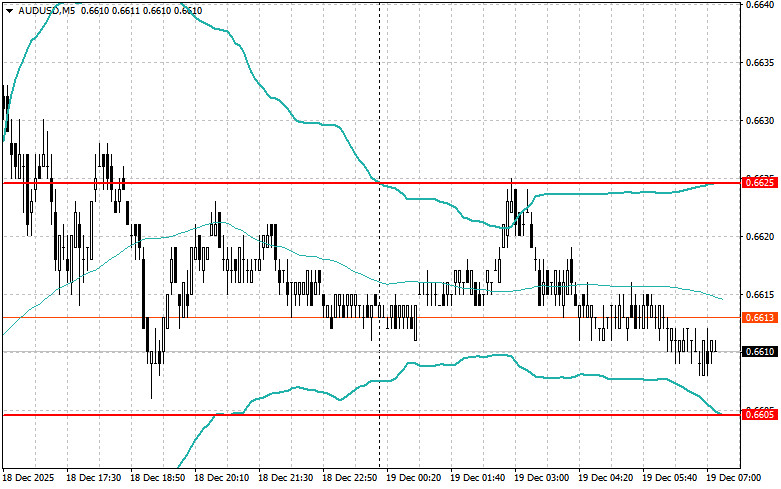

Look for short positions after a failed breakout above 0.6625 on a pullback below this level;

Look for long positions after a failed breakout below 0.6605 on a pullback to this level;

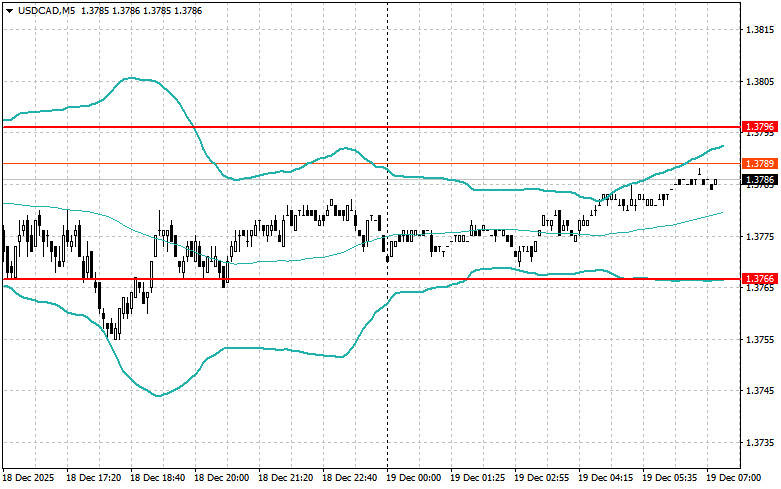

Look for short positions after a failed breakout above 1.3796 on a pullback below this level;

Look for long positions after a failed breakout below 1.3766 on a pullback to this level;

SZYBKIE LINKI