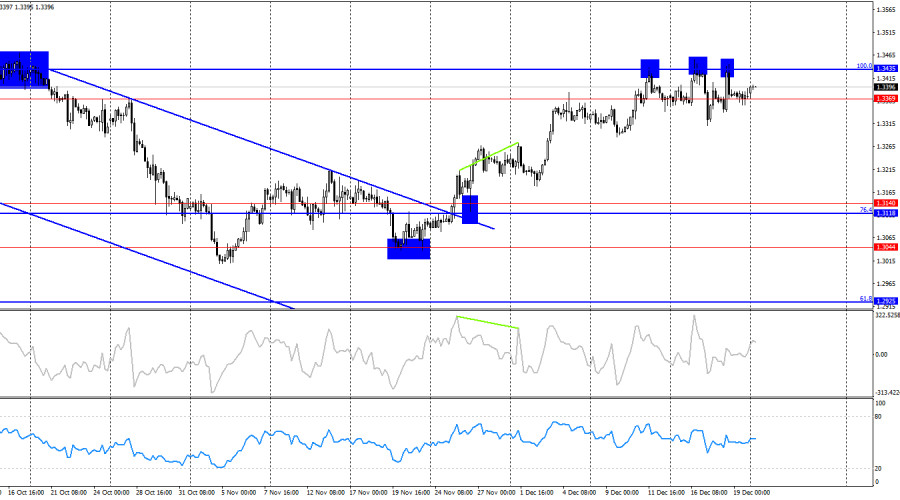

On the hourly chart, the GBP/USD pair on Friday rebounded from the support level at 1.3352–1.3362, reversed in favor of the pound, and began a move higher toward the 1.3425 level. However, overall the pair has been trading in a sideways range for more than a week. Thus, there is a high probability of another rebound from the 1.3425 level and a return to the 1.3352–1.3362 level. A consolidation of the pair below this level would make it possible to expect a continuation of the decline toward the next corrective level at 61.8% – 1.3294.

The wave structure turned "bearish" last week. The most recent completed downward wave broke the previous low, while the latest upward wave failed to break the previous high. The news background for the pound has been weak in recent weeks, but the U.S. news background also leaves much to be desired. A week before the New Year, a consensus and balance have formed between bulls and bears.

On Friday, the news background for GBP/USD was supplemented by the retail sales report. It turned out that sales fell by 0.1% m/m and rose by 0.6% y/y in November. These figures were worse than market expectations, yet the pound still managed to show slight growth during the day. I believe this growth was due solely to the technical rebound from the 1.3352–1.3362 level and nothing else. As I have already said, the pair is trading sideways, so the boundaries of this range are of key importance. Today, the UK will release its GDP report for the third quarter, but traders are unlikely to be able to leave the 1.3352–1.3425 range. The UK economy very rarely provides support for the bulls. The only notable events this week will be on Tuesday. The year is ending in a sideways range for the pound; traders are tired and are postponing the opening of long-term positions until next year. Therefore, I expect only weak market movements until the end of the current year.

On the 4-hour chart, the pair made its third rebound from the 100.0% Fibonacci corrective level at 1.3435, reversed in favor of the U.S. dollar, and began a new decline toward the 1.3140 level. A consolidation above the 1.3435 level would favor the British pound and allow expectations of further growth toward the Fibonacci level of 127.2% – 1.3795. No emerging divergences are observed on any indicators today.

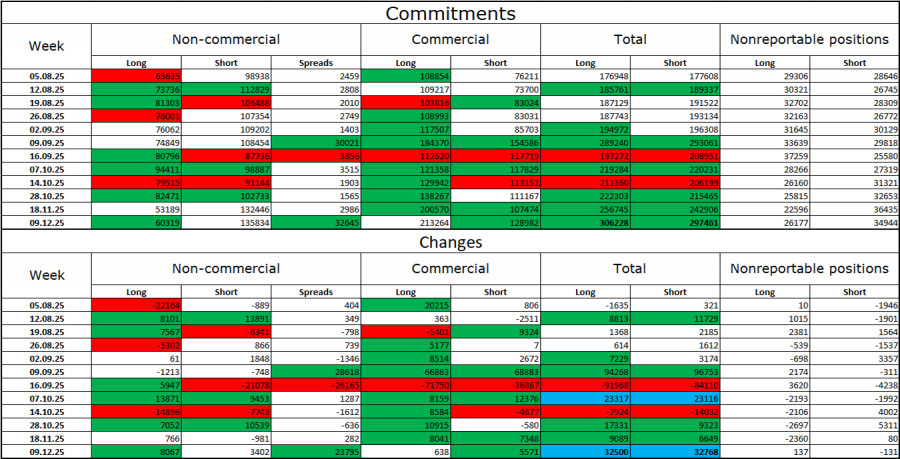

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" category of traders became more bullish over the last reporting week. The number of long positions held by speculators increased by 8,067, while the number of short positions rose by 3,402. The gap between the number of long and short positions is now effectively as follows: 60 thousand versus 135 thousand. As we can see, bears have dominated since early December, but the pound appears to have already exhausted its downward potential. At the same time, the situation with euro contracts is the exact opposite. I still do not believe in a sustained bearish trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency occasionally enjoys demand in the market, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Fed is forced to ease monetary policy in order to halt the rise in unemployment and stimulate job creation. For 2026, the FOMC does not plan aggressive monetary easing, but at the moment no one can be sure that the Fed's stance will not shift to a more dovish one during the year.

Economic Calendar for the U.S. and the UK:

On December 22, the economic calendar contains only one entry, which is not of particular interest. The impact of the news background on market sentiment on Monday may be extremely weak.

GBP/USD Forecast and Trading Advice:

Sell positions could be opened on a rebound from the 1.3425 level on the hourly chart with a target at 1.3352–1.3362. The target has been reached. New sell positions can be considered after a close below the 1.3352–1.3362 level with a target at 1.3294. I recommended buy positions on a rebound from the 1.3352–1.3362 level with targets at 1.3425 and 1.3470. Today, these trades can remain open.

Fibonacci grids are drawn from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

SZYBKIE LINKI