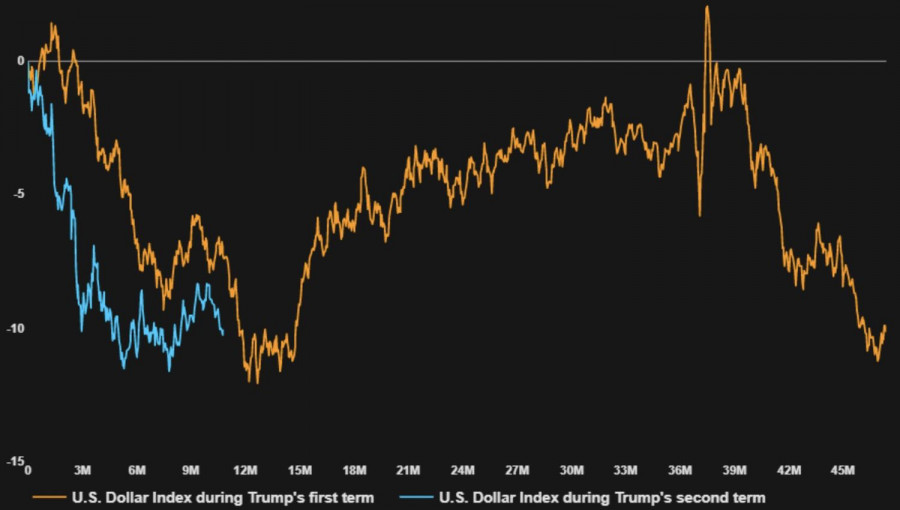

History is repeating itself. Just like in 2017, during the first year of Trump's presidency, the US dollar weakened against major world currencies. Investors operated under the principle of "what the president wants, God wants," and sold the "greenback." In 2018, it entered as a clear outsider; however, the "bulls" on the USD index managed to recover a significant portion of the losses. The greenback closed that year in positive territory. Can it replicate the feat of eight years ago?

Forex is confident that the US dollar's structural weaknesses remain and continue to work against it. These include a decline in institutional authority, a widening budget deficit, and purchases of gold by global asset managers rather than US currency and related assets.

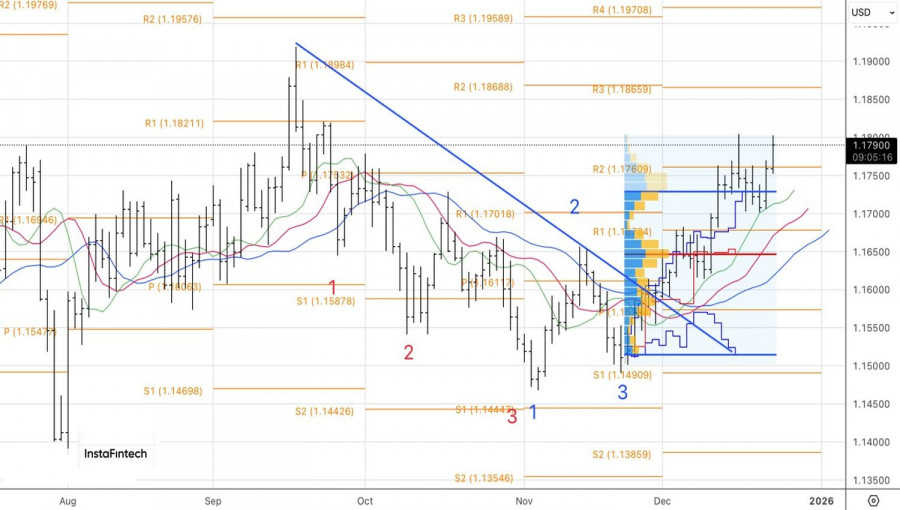

However, the first half of 2025 was much worse for the greenback than the second. For a long time, the "bulls" on the USD index resisted, even amid a declining federal funds rate. It was only at the end of December that they threw in the towel. The EUR/USD breached the 1.18 level, then took a step back.

What will happen in 2026? The Federal Reserve's prolonged pause in its easing cycle suggests the greenback may strengthen. In fact, the interest rate differential between the US and German debt markets tends to support the "bears" rather than the "bulls" in the main currency pair. As long as the markets do not begin to price in expectations for a cut in the federal funds rate, EUR/USD sellers may continue to hold their ground. This will not happen until at least February.

Consequently, the story of the US dollar's strengthening in the second year of Donald Trump's presidency, following a disappointing first year, is not as unrealistic as it seems.

Factors that could play in favor of the greenback include accelerated US economic growth from large, favorable tax-cut legislation, as well as the delayed impact of tariffs on the eurozone economy. Currently, it is assumed that the eurozone has shown greater resilience to import tariffs. The European Central Bank, along with central banks in France and Italy, is raising GDP forecasts. However, who knows how it will all turn out? The currency bloc relies on exports, and tariffs and a strengthening euro choke its economic vitality.

Thus, a scenario where the EUR/USD falls is possible, though it is not the base case. Investors are counting on a divergence in monetary policies between the ECB and the Fed, a narrowing of the economic growth differential between the US and the eurozone, and are actively buying euros. Moreover, the Christmas rally is approaching—a period when the main currency pair traditionally rises.

Technically, on the daily chart, the bulls are attempting to restore the upward trend in EUR/USD. If successful, the risks of continuation towards 1.1870 and 1.1960 will increase. In this case, existing long positions from 1.1760 should be increased upon a breakout of the local peak at 1.1805. A failed attempt will form a Double Top and serve as the basis for a reversal.

SZYBKIE LINKI