Yesterday, stock indices closed higher. The S&P 500 rose by 0.30%, while the Nasdaq 100 added 0.17%. The Dow Jones Industrial Average strengthened by 0.86%.

On Thursday, Japanese assets were in focus in the Asian markets. The country's indices led after data from the United States increased the likelihood of a interest rate cut by the Federal Reserve next week, and the sale of 30-year government bonds saw the highest demand since 2019. Meanwhile, many expect that the Bank of Japan will, on the contrary, raise rates next week.

Unlike many other markets in Asia, Japan is more sensitive to events surrounding the expectations of a Fed rate cut, partly because the Fed can set the pace for the Bank of Japan through the currency channel. Strengthening confidence in the necessity of a Fed rate reduction, easing pressure on the yen, may provide the Bank of Japan with more opportunities for a more cautious policy in the future.

The Topix and Nikkei 225 indices rose by more than 1.7% each, while the broader Asian stock index MSCI Inc. added 0.5%. South Korean and Taiwanese indices also continued their two-day rally. Futures on American stocks remained stable.

Data released on Wednesday showed that US companies reduced the number of jobs in November by the maximum amount since the beginning of 2023, raising concerns about a more pronounced weakening of the labor market. However, relief from the ADP employment data for the US in November and growing hopes for a Fed rate cut next week seem to be contributing to improved sentiment in the stock markets.

In the currency markets, the dollar remained stable after falling by 0.4% during the previous session, when US Treasury yields rose, lowering the yield on two-year bonds to about 3.48%. The Indian rupee fell to a record low against the dollar as sentiment remained weak amid delays in finalizing a trade agreement with Washington.

China set its daily reference rate for the yuan at a level that was significantly below forecasts, indicating that the central bank is aiming to limit the currency's rally, which is approaching the closely monitored level of 7 per dollar.

In the commodities market, silver decreased in value but continued to trade near its historical high against the backdrop of increased bets on a Fed rate cut. Gold slightly declined. Oil prices rose as investors assessed the prospects of a peaceful agreement between Russia and Ukraine and the implications of tensions between the US and Venezuela.

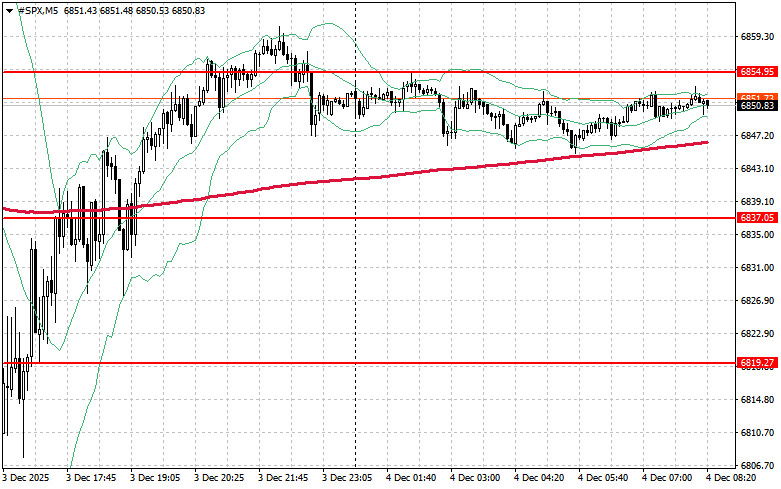

Regarding the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance leve of $6,854. This will help the index gain ground and pave the way for a potential rise to a new level of $6,874. Another priority for bulls will be to maintain control over $6,896, which will strengthen buyers' positions. In the event of a downward movement amid reduced risk appetite, buyers must assert themselves around $6,837. A break below this level would quickly drive the trading instrument back to $6,819 and open the way to $6,801.

LINKS RÁPIDOS