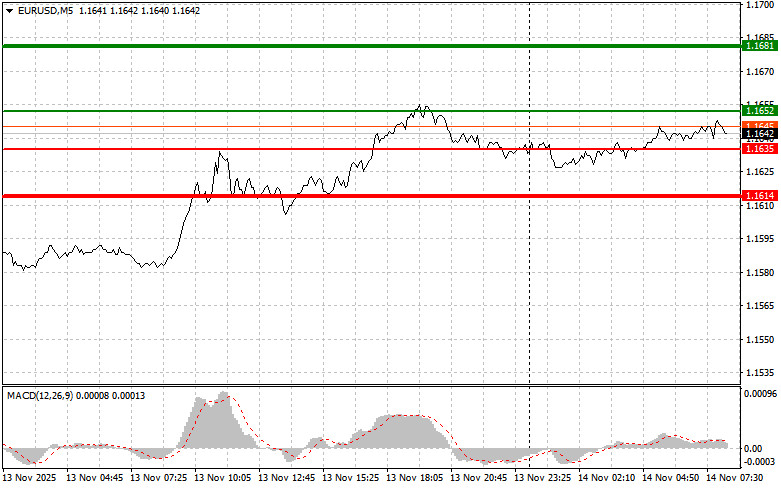

The test of the price at 1.1633 coincided with the MACD indicator rising significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro.

The lack of fundamental data from the U.S. and disagreements within the Federal Reserve regarding further actions on the key interest rate negatively impact the dollar's position. Growing uncertainty regarding the monetary policy direction, exacerbated by conflicting statements from the Federal Open Market Committee members, is a key factor that leads traders to avoid long positions in the dollar. The ambiguity surrounding the central bank's future policy makes the American currency more volatile and less attractive to investors seeking stability and predictability.

Today, in the first half of the current session, the euro could strengthen against the dollar; however, this scenario requires encouraging reports on third-quarter Eurozone GDP growth, labor market trends, and the external trade surplus. Impressive GDP figures, indicating resilient economic growth in the region, will serve as a stimulus for further upward movement of the European currency. Market participants interpret this as a sign of the European economy's successful adaptation to existing trade issues with the U.S., reducing the need for aggressive stimulus measures from the European Central Bank. Positive trends in employment will also contribute to this. A decrease in unemployment and an increase in the number of employed individuals will create favorable conditions for boosting consumer spending and business activity, supporting the euro. The state of the labor market is an important indicator of economic health. However, there are likely to be issues with the external trade surplus, which will serve as a restraining factor for the euro's growth.

Regarding the intraday strategy, I will rely more on scenarios No. 1 and No. 2.

Scenario No. 1: Today, I can buy euros when the price reaches around 1.1652 (green line on the chart), targeting a rise to 1.1681. At point 1.1681, I plan to exit the market and also sell the euro back, expecting a movement of 30-35 pips from the entry point. A rise in the euro can be anticipated after good data. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy euros today if the price tests 1.1635 twice in a row while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to a market reversal upwards. A rise to the opposite levels of 1.1652 and 1.1681 can be expected.

Scenario No. 1: I plan to sell euros once the price reaches 1.1635 (red line on the chart). The target will be 1.1614, where I intend to exit the market and buy back immediately (expecting a 20-25-pip move in the opposite direction from that level). Pressure on the pair will return with weak statistics. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also intend to sell euros today if the price tests 1.1652 twice in a row, when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline towards the opposite levels of 1.1635 and 1.1614 can be expected.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

RÁPIDOS ENLACES