The test of the price at 1.1613 occurred when the MACD indicator was starting to move upward from the zero line, confirming a good entry point to buy euros. As a result, the pair only rose by 10 pips before pressure returned.

Positive news about a steady increase in the Economic Optimism Index from RCM/TIPP in the United States initially led to a temporary strengthening of the dollar against the euro, undermining any bullish potential and preventing the entry point for buying euros from fully materializing. However, after a slight strengthening of the dollar, market participants quickly reassessed their forecasts, taking into account global risks and the likelihood of U.S. interest rate cuts.

Today, in the first half of the day, the euro's growth may continue. This will depend on the data regarding the Services PMI index, the composite PMI, and the Producer Price Index (PPI). Additionally, European Central Bank President Christine Lagarde will be delivering a speech today. If the indicators turn out to be better than expected, the euro will receive an additional boost for growth. Otherwise, pressure on the single currency may return, and we could see a downward correction. Market attention will also be focused on Lagarde's rhetoric; any hints at possible monetary policy easing could negatively affect the euro.

At the same time, it's important to consider that the overall fundamental backdrop for the euro remains quite favorable. Inflation in the Eurozone is slowing, which suggests the central bank will likely continue to adopt a wait-and-see monetary policy, supporting the euro in the medium term. From a technical perspective, the euro is currently in a phase of growth, and breaking through key resistance levels could open the way for further gains. However, the possibility of a downward correction remains, especially if the PMI and PPI data disappoint.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

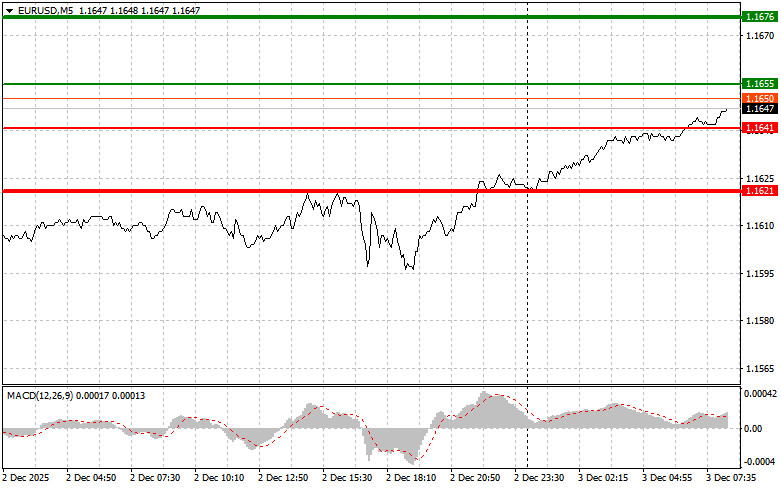

Scenario #1: Today, I plan to buy euros when the price reaches around 1.1655 (green line on the chart), targeting a move to 1.1676. I plan to exit the market at 1.1676 and also sell euros immediately on the bounce, aiming for a movement of 30-35 pips from the entry point. One can expect euro growth only after good data. Important! Before purchasing, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy euros today if there are two consecutive tests of 1.1641 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. We can expect growth toward the opposite levels of 1.1655 and 1.1676.

Scenario #1: I plan to sell euros once the price reaches 1.1641 (red line on the chart). The target will be the level of 1.1621, where I intend to exit the market and buy immediately in the opposite direction (targeting a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair will return with weak data. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell euros today if there are two consecutive tests of the price at 1.1655 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. We can expect a decline toward the opposite levels of 1.1641 and 1.1621.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-12-03 06:44:44 IP: 172.18.0.1