Analysis of Trades and Recommendations for Trading the European Currency

The test of the 1.1641 price level occurred when the MACD indicator had just begun moving down from the zero mark, which confirmed the correct entry point for selling the euro. However, a significant decline in the pair never materialized.

Demand for the euro returned after the release of PMI data. The market reacted to the positive data as a sign of economic recovery in the eurozone. Positive dynamics in the services sector—an important component of the regional economy—indicate rising consumer spending and growing optimism in the business environment. Nonetheless, despite the encouraging impression, analysts advise caution. The rise in the services PMI may be driven by temporary factors such as seasonal fluctuations or the release of pent-up demand. The sustainability of the trend will depend on a combination of economic factors, including inflation, interest rates, and geopolitical conditions.

In the second half of the day, market participants will be expecting a significant number of U.S. macroeconomic indicators. Particular attention will be given to the ADP data, often viewed as a leading indicator of the official Labor Department employment statistics. A notable increase in job creation may convince the Federal Reserve of the need for a pause in its interest-rate-cutting cycle at the end of the year. The ISM Services PMI is another important indicator of economic health. Given persistent inflation, stable growth in the services sector may support the U.S. dollar. Industrial production and manufacturing data will offer insights into the state of the production sector.

Given the close connection between these economic indicators and the Fed's monetary policy decisions, their publication may trigger significant volatility in the currency market. Market participants will carefully analyze the data to assess the likelihood of further interest rate cuts and the potential impact of these changes on the U.S. dollar.

As for the intraday strategy, I will rely primarily on scenarios No. 1 and No. 2.

Buy Signal

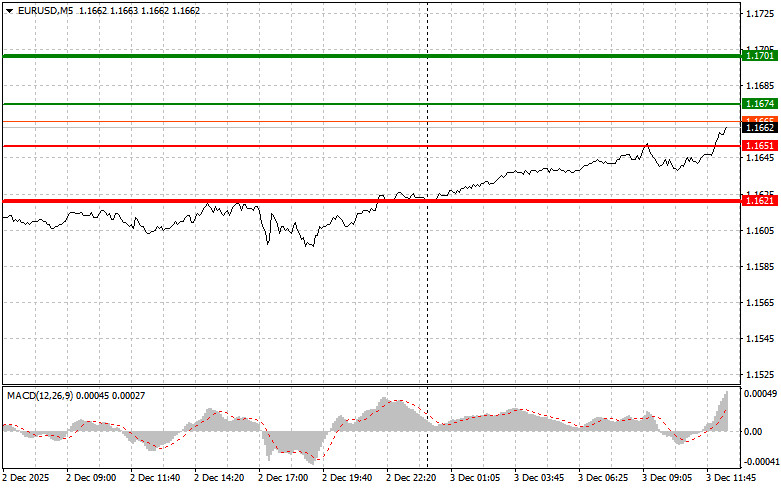

Scenario No. 1: Today, buying the euro is possible when the price reaches around 1.1674 (green line on the chart), with the target set at 1.1701. At 1.1701, I plan to exit the market, as well as open a sell position in the opposite direction with an expected move of 30–35 points from the entry point. A strong rise in the euro can be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning its upward movement from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1651 level at a moment when the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a reversal upward. A rise toward the opposite levels of 1.1674 and 1.1701 may be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches 1.1651 (red line on the chart). The target will be 1.1621, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25-point move upward from that level). Pressure on the pair will return today if U.S. statistics are strong. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning its downward movement from it.

Scenario No. 2: I also plan to sell the euro today if the 1.1674 level is tested twice consecutively at a moment when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1651 and 1.1621 may be expected.

What's on the Chart:

Important: Beginner Forex traders must make entry decisions with extreme caution. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses you can quickly lose your entire deposit, especially if you don't use proper money management and trade large volumes.

And remember: for successful trading, you must have a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.

HIZLI BAĞLANTILAR

show error

Unable to load the requested language file: language/turkish/cookies_lang.php

date: 2025-12-03 06:45:55 IP: 172.18.0.1