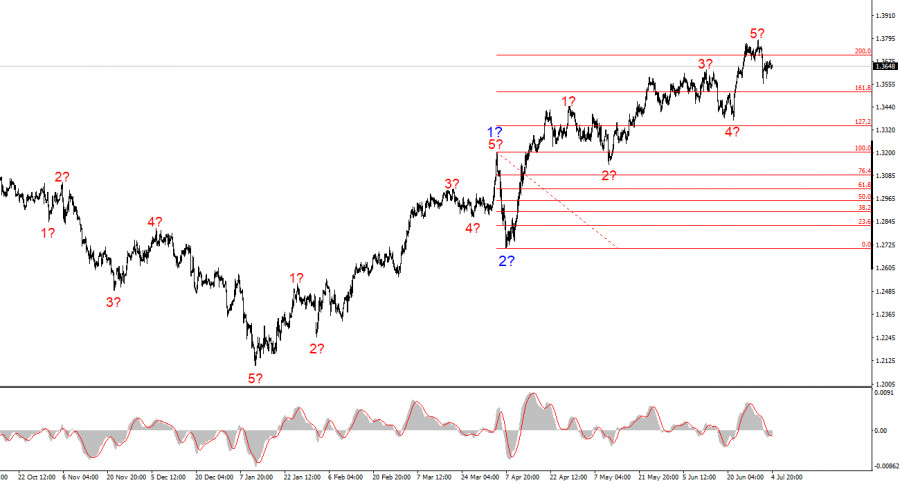

The wave pattern for GBP/USD continues to indicate the formation of a bullish impulse structure. The wave pattern is nearly identical to that of EUR/USD, as the U.S. dollar remains the primary driver. Demand for the dollar is declining across the market, which is why many instruments are showing similar dynamics. Wave 2 of the upward trend has taken a single-wave form. Within the assumed wave 3, waves 1, 2, 3, 4, and presumably 5 have been formed. Therefore, this wave sequence is considered complete, and the market is now transitioning to a corrective structure.

It is important to remember that much in the currency market currently depends on the policies of Donald Trump—not only trade policy. Occasionally, the U.S. releases positive economic news, but the market remains focused on the broader uncertainty in the economy, the contradictory actions and statements from Trump, and the protectionist tone coming from the White House. As a result, the dollar has to overcome these headwinds in order to benefit from even favorable data.

The GBP/USD exchange rate posted another slight decline today. Demand for the U.S. dollar has been increasing over the past week, resulting in a gain of 200 basis points. This movement is moderate in scale. Most charts continue to show a long-term upward trend that has persisted for nearly six months, with recent declines forming part of a corrective structure within that trend. These corrections are frequently limited in strength and duration. In cases where a three-wave correction might typically occur, only a single wave is often observed. Even strong economic data from the U.S., such as that released last week, does not consistently lead to a stronger dollar.

Therefore, in my view, the current market situation is clear. As noted in my recent reviews, the wave structure is currently the main factor supporting the dollar. We observed a clear five-wave upward pattern, which should be followed by a three-wave decline. It is possible that instead of three waves, we will see only one again, but only the wave structure provides a rationale for expecting a pullback.

On Monday and Tuesday, the dollar had no fundamental reasons to strengthen. Over the weekend, it became known that Donald Trump began sending out tariff notices, and on Monday, the U.S. President raised tariffs on 15 countries. This is likely not the last tariff increase, as only 3 out of 75 countries have managed to reach agreements with Washington. It is unlikely that Trump will simply ignore the rest. Thus, there were no grounds for dollar appreciation at the beginning of the week. What we are observing is a technical correction in line with the wave count.

The wave pattern for GBP/USD remains unchanged. It continues to reflect a bullish impulse segment. Under Donald Trump, the markets may still face many shocks and reversals that could significantly impact the wave pattern, but for now, the main scenario remains intact. The targets for the current upward trend are located near 1.4017, which corresponds to the 261.8% Fibonacci extension from the assumed global wave 2. A corrective wave sequence has likely begun, so it is advisable to wait for its completion before opening new long positions. Classically, this structure should consist of three waves.

Core principles of my analysis:

QUICK LINKS