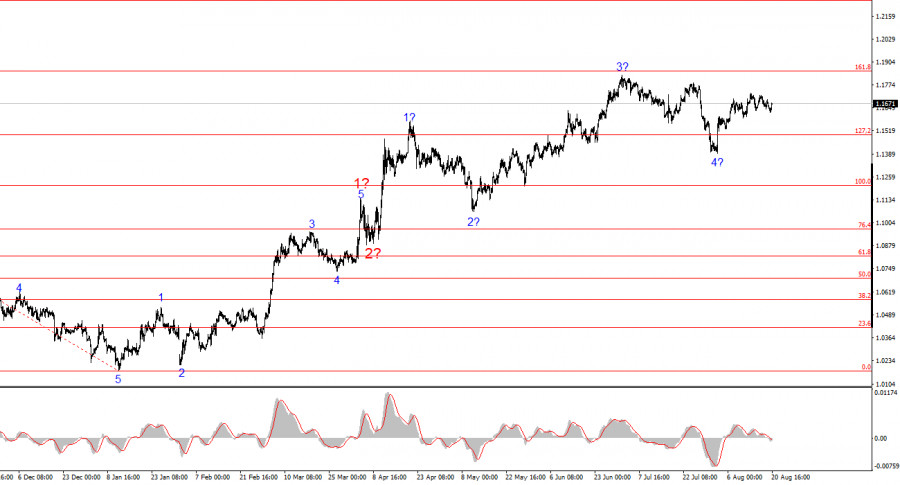

The wave pattern on the 4-hour chart of EUR/USD has remained unchanged for several months now, which is very encouraging. Even when corrective waves form, the integrity of the structure is preserved. This allows for accurate forecasts. It should be noted that wave counts do not always look like textbook examples. Currently, however, the picture looks very good.

The upward segment of the trend continues to develop, while the news background for the most part does not support the dollar. The trade war initiated by Donald Trump goes on. The confrontation with the Fed continues. "Dovish" expectations are growing. Trump's "one big law" will increase U.S. government debt by 3 trillion dollars, while the U.S. president constantly raises tariffs and introduces new ones. The market gives a very low assessment of Trump's first six months in office, even though economic growth in the second quarter reached 3%.

At this point, it can be assumed that wave 4 has been completed. If so, the formation of impulse wave 5 has begun, with targets potentially extending as far as the 1.25 level. Of course, wave 4 could take a longer, five-wave form, but I proceed from the more likely scenario.

The EUR/USD rate showed virtually no change on Wednesday. The amplitude of movements in recent days has been minimal due to a complete lack of news—or rather, a lack of important news. For instance, today the first relatively significant report of the week was released: July inflation in the Eurozone. However, it was significant only on paper. In practice, Eurozone inflation reports are released in two estimates, and market participants usually pay attention only to the preliminary one. The final estimate published today matched the preliminary figure—2%. Recall that 2% inflation is exactly the level the ECB aimed to achieve in the medium term. Naturally, inflation will not be 2% every month, but small fluctuations around this mark are quite acceptable for the European regulator.

Based on this report, it can be concluded that the ECB will not conduct a new round of monetary policy easing in the near future. There is simply no need for it. If rates are lowered further, inflation could start to accelerate, which is hardly the ECB's goal amid the global trade war. It should be noted that the Eurozone economy is coping quite well with Trump's tariffs—unlike, for example, the British economy. Therefore, interest rates can be fixed in neutral territory for a long time. Current rate levels may not be sufficient to boost economic growth, but the EU has already learned to live with a slow pace of growth.

Based on the EUR/USD analysis, I conclude that the instrument continues to build an upward trend segment. The wave count still entirely depends on the news background related to Trump's decisions and U.S. foreign policy. Trend targets can extend up to the 1.25 level. Therefore, I continue to consider buying opportunities with targets around 1.1875, corresponding to the 161.8% Fibonacci level, and higher. I assume wave 4 has been completed. Accordingly, now remains a good time to buy.

Basic principles of my analysis:

QUICK LINKS