The euro and pound managed to hold their positions against the U.S. dollar, although pressure on them was quite strong at the end of last week.

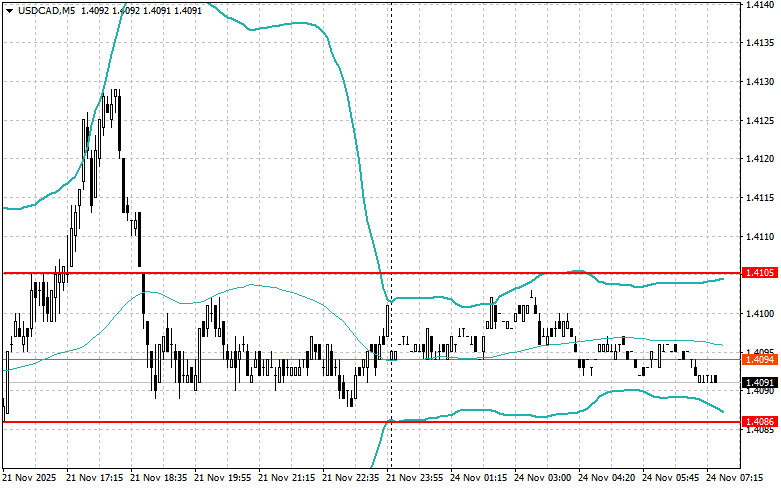

The decline in the U.S. manufacturing PMI index was offset by increasing activity in the services sector. This alleviated some concerns regarding the looming issues that have put pressure on the U.S. currency in recent weeks. Investors are closely monitoring indicators of economic resilience in the U.S. as the Federal Reserve prepares for its December meeting, where a decision on the future direction of monetary policy is expected. However, despite favorable data from the services sector, the overall picture remains uncertain. While inflation shows signs of slowing, it still significantly exceeds the Fed's target level of 2%. This creates a dilemma for the central bank, which must balance the need to control inflation against the risk of suppressing economic growth.

Today, we expect data on the German IFO business climate index, the current situation index, and the economic expectations index in the first half of the day. Shortly afterward, speeches are scheduled from European Central Bank President Christine Lagarde and Bundesbank President Joachim Nagel. The markets will pay particular attention to the German IFO figures, as they serve as a barometer of confidence in the Eurozone's largest economy. Stronger-than-expected data could signal potential resilience in German industry in the face of current global challenges, including the energy crisis and U.S. tariff policies. This, in turn, could give a boost to the euro, as Germany remains a key driver of the European economy.

At the same time, the speeches by Lagarde and Nagel will be carefully analyzed for hints about the ECB's future policy. Investors will be looking for signals about the ECB's willingness to further lower interest rates and to assess risks to the Eurozone economy.

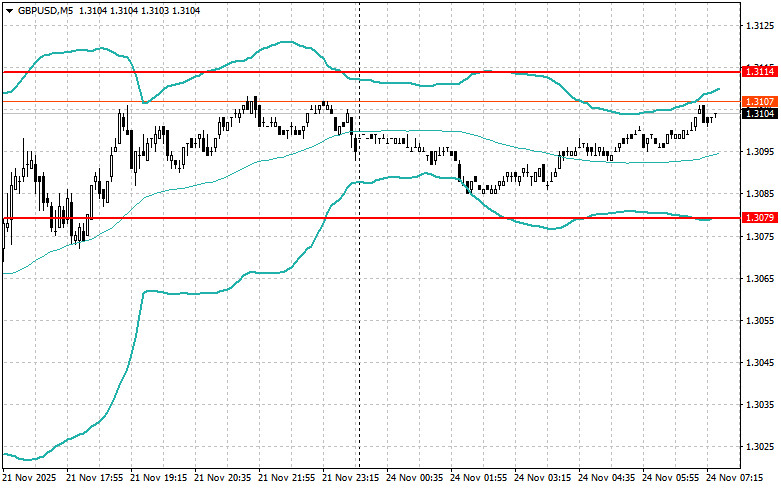

As for the pound, there is no significant report scheduled for the UK today, so we expect GBP/USD trading to remain within a range. The market will likely continue to consolidate, awaiting more substantial catalysts for directional movement. One such catalyst could be the UK's budget, which will be presented to the public on November 26 and has recently posed serious challenges for the pound's growth.

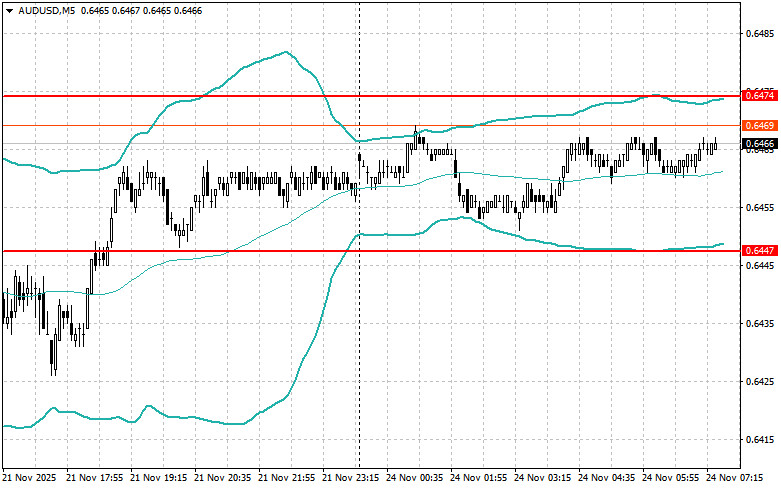

If the data aligns with economists' expectations, it is advisable to act based on the Mean Reversion strategy. If the data turns out to be significantly above or below economists' expectations, the Momentum strategy will be more appropriate.

QUICK LINKS