Everything is relative. The German economy did not grow in the third quarter. Is this bad news? It depends on what you're comparing it to. Compared to the impressive growth of U.S. GDP, then yes. Compared to 2023-2024, when Germany was in a recession, then no. Exports and weak consumer demand are pulling Berlin down, yet hopes remain. They allow EUR/USD to go on the offensive.

The ruling coalition led by Friedrich Merz expects Germany's GDP to accelerate from 0.2% in 2025 to 1.3% in 2026 and 1.4% in 2027. Authorities are counting on large fiscal stimuli, but as the Bundesbank rightly noted, this is not enough. Reforms are needed to create favorable conditions for business. Disappointing reports on the German business climate indicate that it's too early to discuss these changes.

Against this gloomy backdrop, the U.S. economy looks like a lively performer. The consensus forecast from Reuters experts anticipates GDP expansion of 2% by the end of 2025. This is more than the expected 1.8% in October and the 1.3% in July. According to specialists, the main drivers of GDP expansion will be personal expenditures and business investments.

Considering the growing reliance of the American economy on artificial intelligence, this seems logical. In fact, the largest companies are spending colossal amounts on AI. Without these investments, Deutsche Bank estimates that investment volumes would be comparable to 2019 levels. The rise in stock prices of technology companies enriches Americans and increases consumer spending.

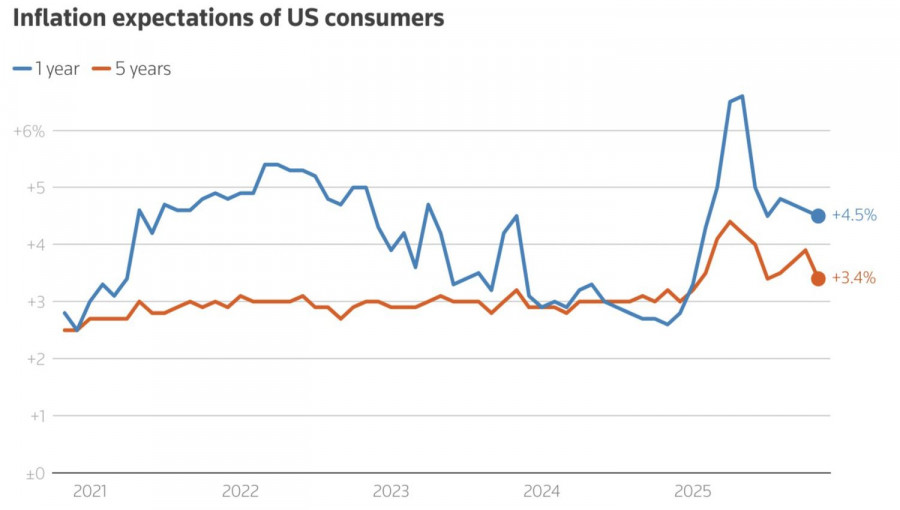

The U.S. economy appears resilient, and Morgan Stanley expects it to remain so in 2026. Together with slowing inflation, this will allow the Federal Reserve to continue its monetary expansion cycle. Indeed, experts surveyed by Reuters expect the PCE index's growth rate to decrease from 2.9% to 2.6% next year. Lower inflation expectations will allow the central bank to ease monetary policy with a clear conscience.

Thus, despite U.S. GDP growing faster than Germany's, the narrowing growth differential plays into the hands of bulls on EUR/USD. This is also true of expectations for continued Federal Reserve monetary expansion, which could occur quickly if Donald Trump manages to significantly change the FOMC's composition. Filling it with "doves."

The American president does not hide his desire to see the federal funds rate at 1%. While this currently seems unlikely, if the majority of committee members adhere to Stephen Miran's views, anything is possible.

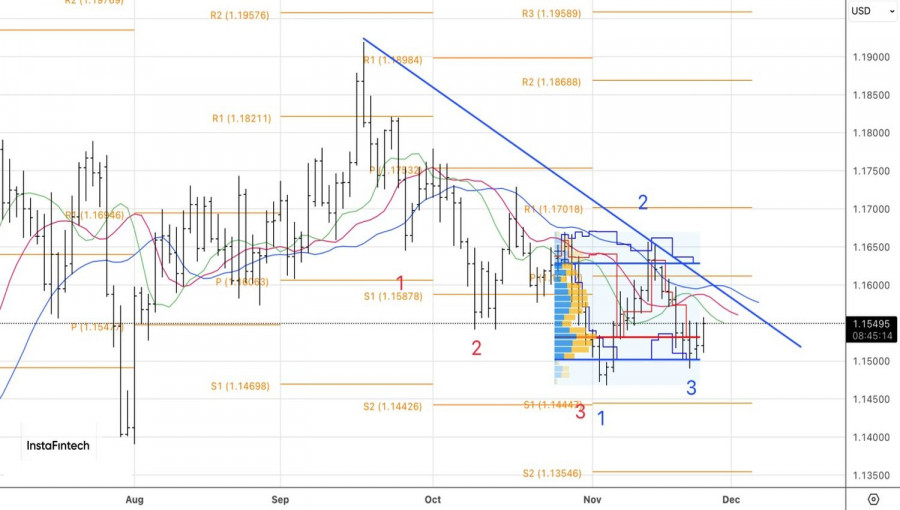

Technically, on the daily chart, EUR/USD shows an attempt by the bulls to take the initiative and activate a reversal pattern 1-2-3. When combined with the Three Indians pattern, this could create a strong opportunity for completing the correction of the upward trend. It makes sense to consider opening long positions starting at 1.1535.

QUICK LINKS