Hope sustains young people and offers comfort to the old. Bitcoin fans believe that a breakout above the $95,000 resistance level would allow the cryptocurrency to soar to $200,000. Opponents of digital currencies, on the contrary, warn that a drop below $85,000 would force crypto treasuries to sell their tokens. The entire system, including BTC/USD, would collapse like a house of cards.

Under such conditions, Bitcoin's consolidation comes as no surprise. Rumors that MSCI would exclude crypto companies from its indices pushed prices lower. However, as soon as the information was not confirmed, BTC/USD rocketed higher. To the disappointment of the bulls, the rally looked more like a relief than a revival. Although Bitcoin ETFs recorded their largest daily inflows in several months, investors preferred to remain cautious—and they were right.

Dynamics of capital flows into Bitcoin ETFs

One reason for traders' optimism toward cryptocurrencies was the passage of US stablecoin legislation by Congress. In reality, however, the greatest benefits were reaped entirely by stablecoins. Transaction volumes using them surged by 72% in 2025, reaching $33 trillion. USDC took the lead with a turnover of $18.3 trillion, followed by USDT with $13.3 trillion.

Bitcoin is also under pressure from a report by industry pioneer Strategy, a crypto-treasury company. Michael Saylor's firm reported unrealized losses of $17.44 billion in the fourth quarter. Its shares have fallen 70% from their record highs. At the same time, investors fear that a further decline in BTC/USD could trigger token sales by Strategy and similar companies. As a result, the cryptocurrency could collapse like a house of cards.

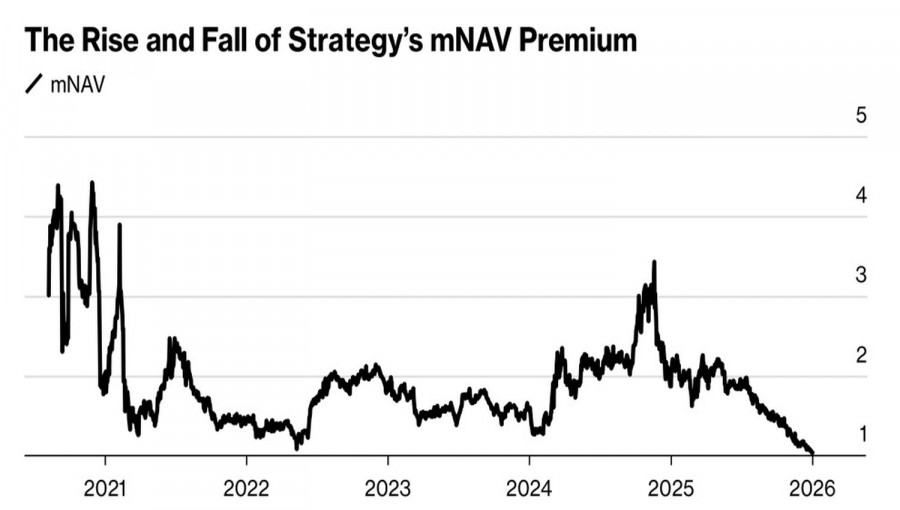

Dynamics of the ratio between Strategy's assets and its reserves

Bitcoin is not helped by new record highs in the S&P 500 and gold. For a long time, the digital asset was seen as something between a risky and a safe-haven instrument. It often rose during rallies in the US stock market. BTC/USD also received support from various shocks that simultaneously drove precious metals higher.

At the turn of 2025–2026, everything changed. The gold rally is now hindering rather than helping BTC/USD. Bitcoin is under pressure, among other things, due to capital flows into precious metals and US stocks. It has stopped rising, and investors have begun to redirect their money.

The same rotation is taking place in the US stock market. Shares of technology giants are being replaced by small-cap companies. Bitcoin has had a high correlation with the Nasdaq 100, so consolidation in this index contributes to the formation of a trading range in the cryptocurrency.

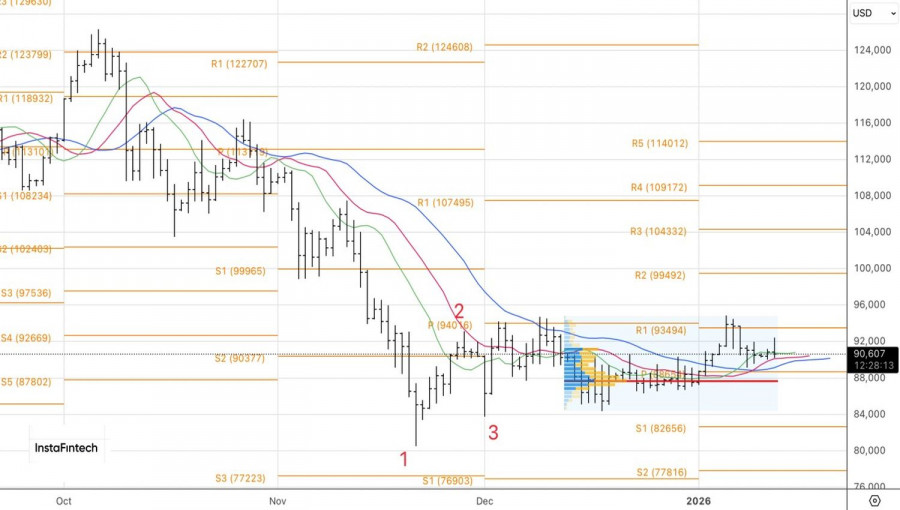

From a technical perspective, the daily BTC/USD chart shows consolidation in the $84,000–$94,000 range after an unsuccessful test of its upper border. The formation of a pin bar with a long upper shadow signals weakness among the bulls. A break below the fair value level at $87,750 becomes a trigger for selling.

QUICK LINKS