Švédská fintech společnost Klarna v pátek oznámila 24% nárůst příjmů v roce 2024, když tento průkopník v oblasti buy now, pay later zveřejnil své dokumenty pro dlouho očekávaný debut na burze v USA.

V roce 2021 prudce vzrostl počet kótovaných akcií v oblasti fintech, ale v důsledku rostoucích úrokových sazeb a vysokého ocenění ztratil dynamiku. S pozvolným zvyšováním chuti k riziku na akciových trzích však několik společností, které svůj plán vstupu na burzu odložily, vyhlíží návrat.

Společnost Klarna, která změnila podobu online nakupování tím, že se stala průkopníkem modelu krátkodobého financování, nezveřejnila velikost své navrhované nabídky.

Podle zpráv z médií by mohla usilovat o získání více než 1 miliardy USD při ocenění přesahujícím 15 miliard USD.

Předpokládá se, že trh BNPL do roku 2032 překročí 160 miliard dolarů, přičemž maloobchodníci jako Walmart (NYSE:WMT), Target a Amazon (NASDAQ:AMZN) se připojí k fintech firmám, jako jsou Klarna, Affirm a Block, aby přilákali mladší zákazníky, kteří neradi nakupují na úvěr.

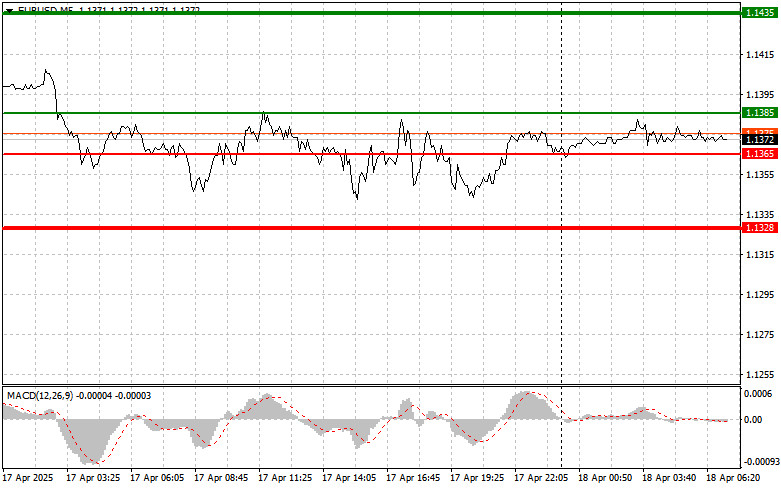

The test of the 1.1357 price level occurred when the MACD indicator had already dropped significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the euro. The second test of 1.1357, with the MACD in the oversold zone, triggered Buy Scenario #2, resulting in a 30-pip upward move.

The euro reacted little to yesterday's European Central Bank meeting, again resulting in a rate cut. ECB President Christine Lagarde noted in her speech that economic expectations for the Eurozone are clouded by serious instability from the United States, creating risks of a downturn. That's why the decision to cut rates was made unanimously. It was also mentioned that most indicators suggest inflation is approaching the ECB's 2% target, although the effects of new tariffs remain unclear.

The market reaction was muted as if it had grown accustomed to such measures or no longer seen them as effective in stimulating growth. Investors are likely more focused on global concerns—notably the trade standoff between the U.S. and the rest of the world—which genuinely clouds the global economic outlook. U.S. policy is increasingly affecting the European economy as well. The threat of new tariffs, unpredictability in trade policy, and general geopolitical uncertainty are all holding back investment and weakening business confidence in the Eurozone. The ECB appears to use all available tools to combat these external challenges, but their effectiveness is limited.

Today's economic calendar includes only Italy's trade balance data, which is unlikely to attract much market attention. Given that the market largely ignored yesterday's ECB rate decision, it's improbable that Italian data will have a significant impact.

We'll likely see market consolidation today, with minor fluctuations within yesterday's range. Investors will likely take a wait-and-see approach, awaiting more significant drivers that could move the market.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the euro today upon reaching the entry point around 1.1385 (green line on the chart), targeting a rise to 1.1433 (thicker green line). At 1.1433, I intend to close long positions and open short ones, aiming for a 30–35 pip pullback from the entry point. This buy scenario assumes continued upward momentum in the first half of the day.

Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro today if the price tests the 1.1365 level twice in a row while the MACD is in oversold territory. This will limit the pair's downside potential and lead to an upward market reversal. A move toward 1.1385 and 1.1433 can be expected.

Scenario #1: I plan to sell the euro after reaching 1.1365 (red line on the chart), targeting 1.1328, where I will exit shorts and immediately open long positions, aiming for a 20–25 pip bounce in the opposite direction. Selling pressure will likely return if the pair fails to break above the weekly high.

Important! Before selling, make sure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.1385 twice a row while the MACD is overbought territory. This will limit the pair's upside potential and lead to a downward market reversal. A decline toward 1.1365 and 1.1328 is expected.

RYCHLÉ ODKAZY