The EUR/USD currency pair mainly traded sideways on Monday. During the European session, a downward movement was observed, raising many questions from both a fundamental and macroeconomic perspective. No important or even secondary reports were published on Monday. There was also nothing noteworthy among fundamental events.

On Friday, Donald Trump announced new tariffs on China—100%—which essentially marks a new escalation in the global trade war. Nevertheless, the dollar again barely declined in the foreign exchange market. For over two weeks in a row, the market has been ignoring all negative news for the U.S. currency. We believe the current downward movement of the pair is completely illogical — or perhaps a result of market-maker manipulation. The dollar has had no reason to strengthen. On the daily timeframe, a kind of flat trend is being maintained, and this is the only plausible explanation for the current decline in EUR/USD.

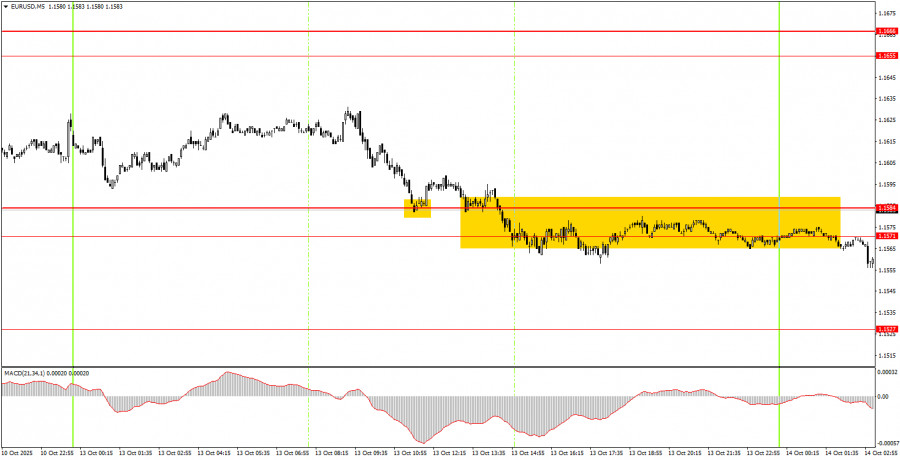

On the 5-minute timeframe, a single buy signal was formally generated. During the European session, the price reached the 1.1584 level and rebounded from it. However, the pair's upward movement lasted only about 5 minutes.

We had assumed that Monday would bring either a low-volatility flat or growth fueled by Trump's new tariffs. In fact, the European session already indicated that an upward move wasn't going to happen.

On the hourly timeframe, the EUR/USD pair broke through the trend line several times, but the downward movement resumed for very questionable reasons. We view the current price action as completely illogical. The overall fundamental and macroeconomic background remains disastrous for the U.S. dollar, so a strong rally in the USD is not expected.

In our opinion, just as before, the American currency can only count on technical corrections — one of which we are currently observing.

On Tuesday, the EUR/USD pair may move in any direction. There's little logic behind current movements, and much noise. A correction could begin after a fairly extended decline, especially given that Donald Trump stirred the markets with his new tariffs. However, guessing is pointless. It's better to act on the trading signals generated on the 5-minute timeframe.

On the 5-minute TF, consider the levels 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527, 1.1571-1.1584, 1.1655-1.1666, 1.1745-1.1754, 1.1808, 1.1851, 1.1908, 1.1970-1.1988. On Tuesday, the Eurozone will release German industrial production figures and ZEW economic sentiment indices. These are not considered top-tier data. In the U.S., Jerome Powell will deliver another speech, which could be interesting but likely won't be impactful due to the complete lack of macroeconomic data from the U.S.

Important speeches and reports (always listed in the economic calendar) can strongly affect the movement of a currency pair. Therefore, during such events, it is recommended to trade with maximum caution or exit the market altogether to avoid sharp price reversals.

Beginner traders should remember that not every trade will be profitable. Developing a strict trading strategy and proper money management are key to long-term success in forex trading.

RYCHLÉ ODKAZY