Společnost Sony Corp ve středu oznámila solidní výsledky za celý rok, ale snížila prognózu pro letošní rok, aby zohlednila dopad tlaku amerických cel.

Japonský konglomerát předpovídá pro fiskální rok 2025 provozní zisk z pokračujících činností ve výši 1,38 bilionu jenů (9,4 miliardy USD), což představuje meziroční nárůst o 8 %, ale varoval, že nové cla by mohly tuto částku snížit o 100 miliard jenů, čímž by zisky zůstaly v podstatě beze změny.

Provozní zisk společnosti Sony (NYSE:SONY) bez finančních služeb vzrostl za rok končící 31. březnem o 23 % na 1,28 bilionu jenů (8,7 miliardy USD) díky silným výsledkům v oblasti her, obrazových senzorů a streamování hudby.

Vedení však zdůraznilo rizika plynoucí z nedávného zvýšení cel ze strany USA, zejména pro své podnikání v oblasti elektroniky a zábavy.

„Rychle reagujeme na dodatečná cla USA, která již byla zavedena, a zvažujeme reakce na několik možných scénářů do budoucna,“ uvedla společnost v prohlášení.

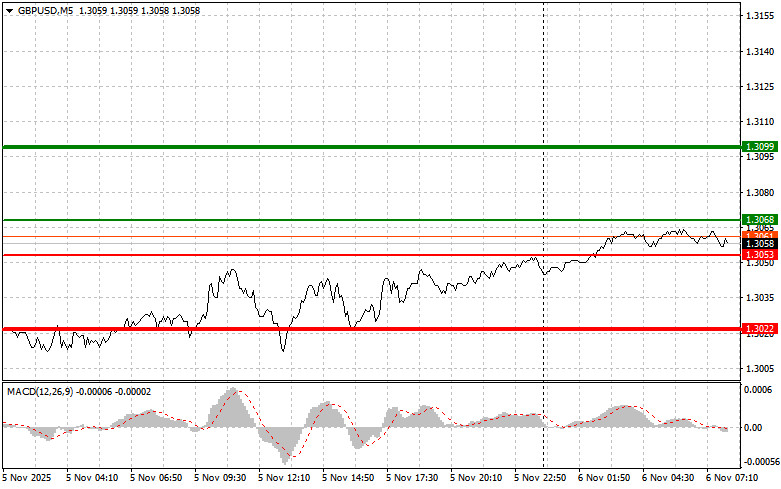

The test of the price level at 1.3025 occurred when the MACD indicator was beginning its downward movement from the zero mark, confirming the correct entry point for selling the pound. However, the pair did not fall, which resulted in a loss.

According to the ADP report, the number of jobs exceeded economists' forecasts. This unexpected jump strengthened the U.S. dollar, but there was no significant sell-off in GBP/USD.

Today promises to be another interesting day. A decision on the main interest rate and the Bank of England's monetary policy report are ahead, along with a speech from Governor Andrew Bailey. While the rate decision is not expected to surprise (it is anticipated to remain unchanged), hints at a future decrease could weaken the pound's position. A more cautious tone in addressing inflation may negatively impact economic growth and is unlikely to provide strong support for the pound.

The monetary policy report will serve as an important supplement to the rate decision, as the Bank of England will present its view on the current economic situation and future forecasts. Investors and analysts will meticulously examine this document for signals regarding the central bank's future actions. Governor Andrew Bailey's speech will be the highlight of the day. He will not only comment on the decision made and the monetary policy report but also respond to journalists' questions, providing an additional opportunity to assess the BoE's stance. Bailey's remarks could significantly affect the British pound and the overall sentiment in financial markets.

For the intraday strategy, I will mostly rely on the implementation of Scenarios #1 and #2.

Scenario #1: I plan to buy pounds today upon reaching an entry point around 1.3068 (green line on the chart), targeting a move to 1.3099 (thicker green line on the chart). At 1.3099, I will exit my long positions and open a short in the opposite direction (anticipating a 30-35-pip move in the opposite direction from this level). Growth in the pound today can only be expected within the framework of a correction. Important: Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move.

Scenario #2: I also plan to buy pounds today in the event of two consecutive tests of the price 1.3053 when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. An increase can be expected toward the opposite levels of 1.3068 and 1.3099.

Scenario #1: I plan to sell pounds today after a breach of the level 1.3053 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3022 level, where I plan to exit my shorts and immediately buy in the opposite direction (anticipating a 20-25-pip move from this level). Sellers of the pound could return to the market at any moment. Important: Before selling, ensure that the MACD indicator is below the zero mark and just starting its downward movement from there.

Scenario #2: I also plan to sell pounds today if the price 1.3068 is tested twice consecutively, when the MACD indicator is in the overbought zone. This will limit the upward potential of the pair and lead to a market reversal downward. A decrease can be expected toward the opposite levels of 1.3053 and 1.3022.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

RYCHLÉ ODKAZY