The GBP/USD currency pair continued to trade very calmly on Tuesday, and the flat is now visible on the 4-hour timeframe as well. In articles for novice traders, we have been discussing for a week that the pair is in a sideways channel with all the consequences that entail. This flat is now visible on the 4-hour timeframe as well, with approximate boundaries at 1.3100 and 1.3190. It is clear that on Tuesday, in the complete absence of any fundamental or macroeconomic information, the technical picture did not change.

Today, the UK will release an important inflation report for October. This report is significant because the Bank of England continues to rely on this indicator in its decision-making regarding key interest rates. At the last meeting, the British central bank indicated that it expects rising unemployment and falling inflation. Unemployment has already jumped from 4.8% to 5%, and now it's the turn of consumer prices.

Experts predict that inflation will slow to 3.6-3.7% in October. This will mark the first slowdown in consumer price growth since May of this year if it happens. In our view, such a minimal decline in inflation could be merely a temporary dip. Over the past 12 months, during which inflation surged from 1.7% to 3.8%, the figure has shown several slowdowns, only to accelerate again. Thus, relying on just one decline does not warrant making bold conclusions.

However, the Bank of England may draw those conclusions. It is worth remembering that earlier this year, Andrew Bailey discussed plans for four stages of 0.25% rate cuts. Three reductions have already taken place, leaving one more. As mentioned, a reduction in inflation to 3.7% is unlikely to be termed a "super-positive moment indicating a downward trend." However, at the last meeting, four out of nine Monetary Policy Committee members voted for a rate cut. At that time, inflation in the UK had not decreased by even a fraction.

Therefore, it can be assumed that any decline in inflation within today's report will suggest a new easing of monetary policy by the BoE in December. If this is the case, the British pound may resume its decline, but it should be noted that in recent months, the market has ignored many fundamental factors. It's possible that we may see a fall in the British pound momentarily, followed by a continuation of erratic movement within a narrow price range or flat.

The technical picture on the daily timeframe remains clear—an upward trend and a correction against it. However, this correction shows no signs of ending. We have seen no particular prospects for the dollar, and at the same time, there are currently no signs of an end to the global correction on the daily timeframe. On the 4-hour timeframe, the CCI indicator has exhausted its ability to create "bullish" divergences and enter the oversold area, but the market is currently ignoring all bullish factors. The spring continues to compress.

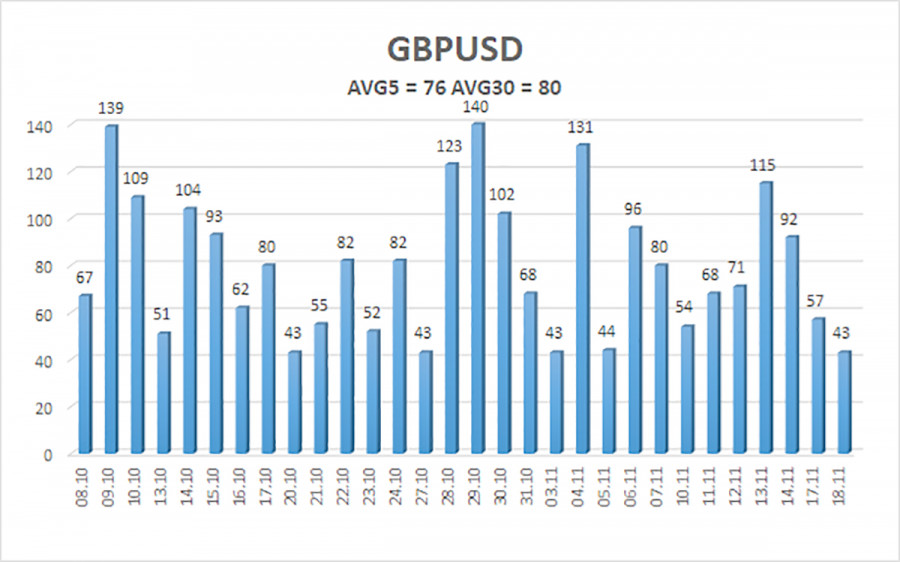

The average volatility of the GBP/USD pair over the past five trading days as of November 19 is 76 pips, which is considered "average." We expect the pair to move within the range of 1.3064 and 1.3216 on Wednesday. The higher channel of linear regression is directed downwards, but only due to technical corrections on higher timeframes. The CCI indicator has entered oversold territory four times, suggesting a potential resumption of the upward trend. Another bullish divergence has formed, from which the last growth spiral began.

The GBP/USD currency pair is attempting to resume its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the American currency to appreciate. Thus, long positions with targets of 1.3306 and 1.3428 remain relevant for the near future while the price is above the moving average. If the price is below the moving average line, small short positions with a target of 1.3062 may be considered on technical grounds. From time to time, the U.S. currency shows corrections (on a global basis), but for any trend to strengthen, it needs real signs of resolution to the trade war or other global positive factors.

RYCHLÉ ODKAZY