The test of the price at 1.3144 occurred when the MACD indicator was beginning to move downward from the zero mark, confirming the correct entry point for selling the pound. However, the pair did not drop as expected, resulting in a loss.

In the absence of UK data, the pound declined after news of a rise in manufacturing orders that beat analysts' forecasts. At the same time, Federal Reserve representatives, in cautious statements about the outlook for inflation and economic activity, indicated that the central bank would not rush into changes in monetary policy, which also strengthened the dollar.

This morning, data on the UK Consumer Price Index and its core value will be published. Experts suggest that inflationary pressure may increase, which, in turn, should have a positive effect on the value of the British currency. An increase in the Consumer Price Index will mean consumers are paying more for goods and services, which may lead the Bank of England to maintain interest rates at their previous high level. Higher interest rates typically attract foreign investors seeking higher returns, increasing demand for the British pound. However, if the CPI rise is perceived as temporary or the UK economic outlook worsens, the positive effect on the pound may be limited. The BoE may act cautiously, not wanting to stifle economic growth with overly aggressive rate hikes. It is also important to consider the core Consumer Price Index, which excludes volatile components such as food and energy prices, as it provides a clearer picture of sustained inflationary pressure.

As for the intraday strategy, I will mainly rely on the implementation of scenarios #1 and #2.

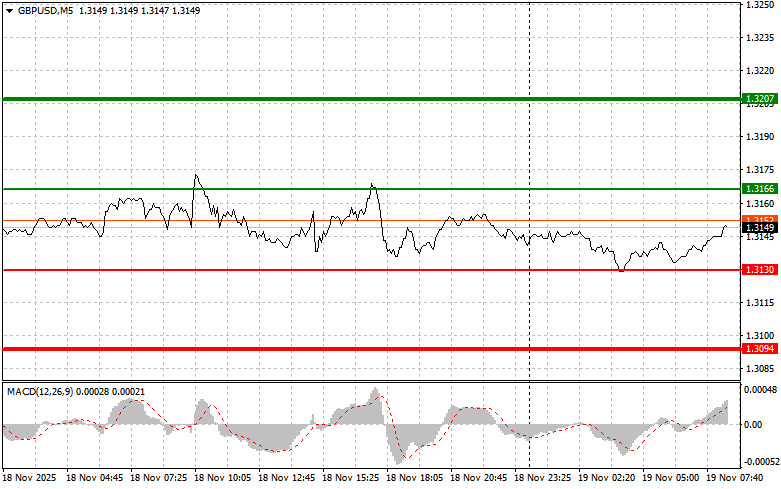

Scenario #1: I plan to buy the pound today upon reaching an entry point around 1.3166 (green line on the chart), with a target for growth to 1.3207 (thicker green line on the chart). Around 1.3207, I plan to exit the long positions and open shorts immediately in the opposite direction (targeting a movement of 30-35 pips in the opposite direction from the level). Growth in the pound today can be expected with strong inflation. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.3130 twice in a row while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. An increase can be expected toward the opposite levels of 1.3166 and 1.3207.

Scenario #1: I plan to sell the pound today after breaking the level of 1.3130 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3094 level, where I plan to exit shorts and immediately open longs in the opposite direction (targeting a move of 20-25 pips in the opposite direction from the level). Pound sellers will emerge with soft inflation. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its downward movement from it.

Scenario #2: I also plan to sell the pound today if the price tests 1.3166 twice in a row, when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downward. A decrease can be expected toward the opposite levels of 1.3130 and 1.3094.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

RYCHLÉ ODKAZY