Prezident Donald Trump v úterý dorazil do Kapitolu, aby přesvědčil republikánské zákonodárce ke sjednocení a prosazení nového daňového balíčku, který rozšiřuje jeho ekonomickou agendu.

Republikáni ve Sněmovně reprezentantů, která má křehkou většinu (220–213), se stále neshodnou na řadě klíčových bodů, včetně škrtů a daňových úlev. Trump ale prohlásil, že věří v jednotu strany a varoval odpůrce zákona, že by mohli čelit soupeřům v primárkách.

Návrh zahrnuje prodloužení daňových škrtů z roku 2017 a přidává nové daňové úlevy za dýška a přesčasy. Podle nezávislých odhadů by mohl zvýšit státní dluh o 3 až 5 bilionů dolarů.

Republikánští vůdci doufají v rychlé hlasování ještě před svátkem Memorial Day (26. května).

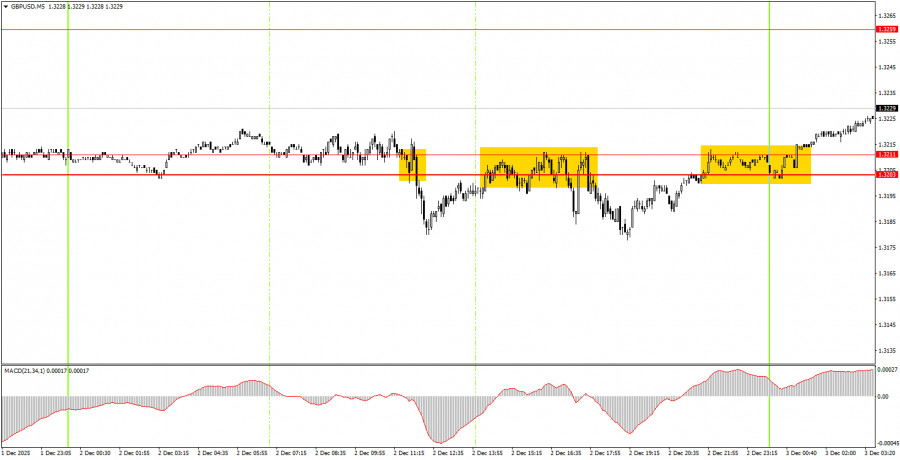

The GBP/USD pair traded "as if at a wake" on Tuesday. First, we witnessed another decline in the currency pair, with no clear reasons apparent. Secondly, the market effectively ignored the technical level of 1.3203, which had previously provided support twice. Thirdly, there is a possibility of forming a local range. Fourthly, the pair's volatility was 43 pips. Under these conditions, trading could not have been better. Nevertheless, with considerable effort, the British pound is still maintaining an upward trend. Thus, continued growth can be anticipated. However, this is unlikely to be rapid growth that enables easy, profitable trading. Instead, it will likely be a slow, "grinding" movement that ignores the macroeconomic backdrop entirely.

On the 5-minute timeframe, several trading signals were formed yesterday, but with an overall volatility of 43 pips, it was clear that making a profit from any signal was quite difficult. The price generated two sell signals in the 1.3203-1.3211 area, and a third buy signal emerged late last night. In both instances of sell signals, the price only dropped 15 pips, which was insufficient to set a stop-loss to breakeven. However, there shouldn't have been any losses on the short positions if beginner traders had closed their positions before the evening, as it was clear by then that no significant market movements would occur.

On the hourly timeframe, the GBP/USD pair continues to form a local upward trend but has become stuck in yet another range. As mentioned, no global factors are driving a sustained rise in the dollar, so in the medium term, we expect movements only to the upside. The correction/range on the daily timeframe may not yet be complete, but any local trend on the hourly timeframe potentially signifies the resumption of the global trend.

On Wednesday, beginner traders can expect new trading signals to form in the 1.3203-1.3211 area, which can now be considered the lower boundary of the range on the hourly timeframe. A bounce from this area will allow for long positions targeting 1.3259. A consolidation below this level will warrant short positions targeting 1.3096-1.3107.

On the 5-minute timeframe, trading can currently focus on the levels: 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. On Wednesday, there are no significant reports or fundamental events scheduled in the UK, while the U.S. will release several important reports, including the ISM Services Activity Index, the ADP report, and industrial production data.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.

RYCHLÉ ODKAZY