Bitcoin v úterý zaznamenal prudký růst a dosáhl nových maxim, protože investoři sázejí na přívětivější regulaci za prezidentství Donalda Trumpa. Největší světová kryptoměna je od Trumpova vítězství v prezidentských volbách v roce 2024 na vzestupu. Navzdory známkám ochlazení chuti k riziku v jiných třídách aktiv, včetně akcií, si Bitcoin udržel svou rally. Výrazné zisky zaznamenaly i další hlavní altcoiny, přičemž Dogecoin vzrostl o téměř 42 % a dosáhl nejvyšší úrovně od května 2021.

Navzdory tlaku silnějšího dolaru se Bitcoin otřepal ze síly dolaru a pokračoval ve své růstové trajektorii. Spekulace ohledně Trumpovy politiky, zejména jeho slibů přívětivější regulace kryptoměn, podpořily zelenou bankovku. Trump rovněž zmínil myšlenku národní bitcoinové rezervy. Očekává se, že potenciál příznivější regulace ve Spojených státech zvýší legitimitu Bitcoinu a přiláká více institucionálního kapitálu.

Zájem investorů o kryptoměnové burzovně obchodované fondy (ETF) po Trumpově vítězství prudce vzrostl. Fond iShares Bitcoin Trust společnosti BlackRock zaznamenal příliv více než 1 miliardy USD, zatímco ETF na ether (ETH) zaznamenaly rekordní příliv 295,5 milionu USD. Značný zájem zaznamenaly také bitcoinové ETF, do kterých přiteklo 1,1 miliardy dolarů. Vzhledem k tomu, že tržní kapitalizace bitcoinu překonala stříbro a stala se osmým největším aktivem na světě s historickou hodnotou 1,78 bilionu dolarů, rozšířila se rally i na další akcie související s kryptoměnami, jako jsou MicroStrategy a Coinbase.

Další zprávou je, že zaniklá krypto burza Mt Gox údajně v pondělí přesunula přibližně 2,4 miliardy dolarů v bitcoinech do dvou peněženek. Tato mobilizace tokenů obvykle znamená prodej nebo distribuci, ale Mt Gox má stále značné množství Bitcoinů, které musí vrátit věřitelům. Navzdory tomuto vývoji zůstala rally Bitcoinu nedotčena.

Altcoiny zaznamenaly smíšené výsledky, přičemž Dogecoin vedl se 40% nárůstem. Ethereum, druhá největší kryptoměna podle tržní kapitalizace, vzrostlo o 3 % na tříměsíční maximum. Ripple (XRP) zaznamenal více než 10% skok, zatímco SOL, MATIC a ADA klesly o 3,8 % až 4,5 %.

Celkově trh s kryptoměnami nadále zažívá vzestupnou dynamiku, která je poháněna spekulacemi kolem Trumpova prezidentství a potenciálními přívětivějšími regulacemi.

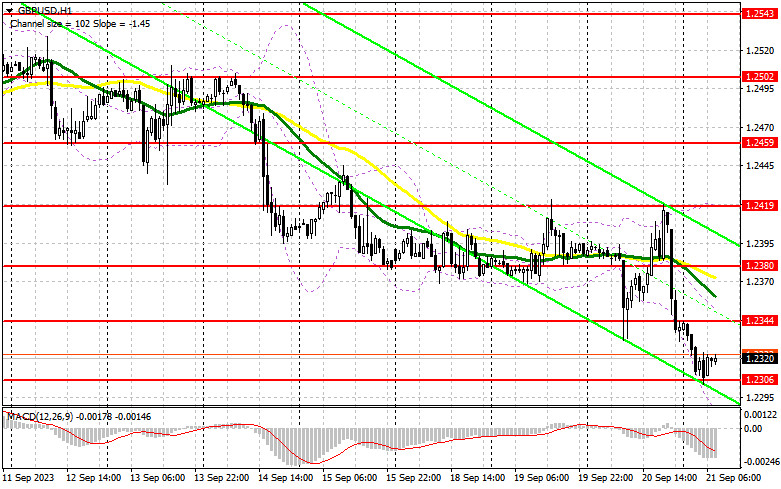

Yesterday, the pair formed several entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2340 as a possible entry point. A decline and a false breakout at 1.2340 generated a buy signal. As a result, the pair rose by almost 40 pips. In the afternoon, only one pip was missing before the false breakout at 1.2421, so whoever missed the entry point did the right thing. There was always time to jump into the market after a breakout and retest of 1.2380, which resulted in a sell-off of more than 50 pips.

For long positions on GBP/USD:

Today brings the Bank of England rate decision. There's a possibility that the central bank may hike interest rates for the last time this year - especially after yesterday's UK inflation data, which showed that the CPI fell in August. The UK's annual inflation rate slowed, but monthly price pressures have increased. Given how sharply energy prices have increased and the fact that wage growth in the UK continues at a fairly strong pace, we should be cautious about BoE Governor Andrew Bailey's statements today. In any case, the central bank's future policy, even against the backdrop of today's rate hike, will exert downward pressure on the pound, leading to another sell-off further along the bearish trend. For now, buyers need to defend the 1.2306 level, where a false breakout will provide an initial entry point for long positions against the bear market, aiming for a correction to the nearest resistance at 1.2344. A breakout and stabilization above 1.2344 will bolster buyer confidence, signaling long positions aiming for 1.2380. This level is marked by moving averages that favor the sellers. The more distant target is the 1.2419 area, where I will be taking profits. However, reaching this level will only be feasible if the Bank of England shows an aggressive stance. If there is another dip to 1.2306 without buyer activity, pressure on the pound will increase, aiming for new monthly lows. In that case, only the defense of 1.2275 and a false breakout there will signal long positions. I plan to buy GBP/USD immediately on a rebound only from the 1.2237 low, aiming for a daily correction of 30-35 pips.

For short positions on GBP/USD:

Bears need to defend the nearest resistance at 1.2344 and take control of the new low at 1.2306. Ideally, Bailey will signal the end of the interest rate hike cycle, and selling on a correction from 1.2344 would be the best scenario. But I will act there only after a failed consolidation. It will serve as a sell signal with the prospect of another drop to 1.2306. A breakout and an upward retest of this range will strike a significant blow to the bulls, opening a downward path to support at 1.2275. The more distant target remains the 1.2237 area, where I will be taking profits. If GBP/USD rises and there is no activity at 1.2344 – which I personally doubt – buyers will get a chance for a correction. In that case, I will postpone selling the pair until a false breakout at 1.2380. If there is no downward movement there, I will sell the pound immediately on a rebound from 1.2419, but only aiming for a 30-35 pip correction within the day.

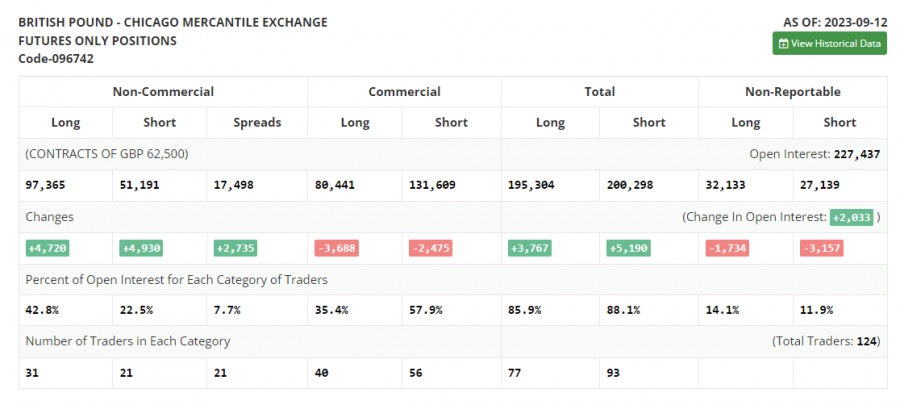

COT report:

The COT report (Commitments of Traders) for September 12 indicated an increase in both long and short positions. The released data on average earnings in the UK, which clearly has a negative impact on inflation, combined with the decrease in the UK's GDP led to another sell-off in the British pound, which may intensify in the near future. Apart from the Bank of England's meeting, where further actions regarding interest rates are not clear, a consumer price index report is planned. Almost all economists expect an increase in inflationary pressure in the UK in August. Given the backdrop of a weakening economy, we may expect another significant sell-off of the pound against the US dollar. The latest COT report indicates that non-commercial long positions increased by 4,720 to 97,365, while non-commercial short positions also jumped by 4,930 to 51,191. As a result, the spread between long and short positions increased by 2,735. The weekly closing price dropped to 1.2486 from 1.2567.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair grows, the upper band of the indicator near 1.2419 will act as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

QUICK LINKS