Hedgeový fond D.E. Shaw uzavřel krátkou sázku na Bayer v hodnotě 1,02 miliardy eur (1,08 miliardy dolarů), jak vyplývá z nedávného oznámení německých regulačních orgánů. Tento krok přichází poté, co se akcie společnosti Bayer po prezentaci výsledků dostaly na 20leté minimum. Společnost D.E. Shaw, významný hráč v oboru spravující více než 60 miliard dolarů, neučinila žádné oficiální prohlášení. Společnost Bayer na tento vývoj zatím nereagovala.

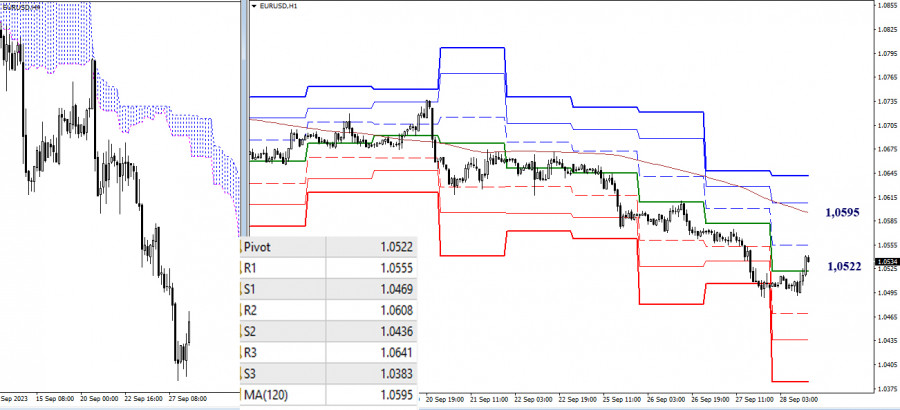

EUR/USD

Higher Timeframes

Bears continued the decline and fully achieved the daily target by breaking through the Ichimoku cloud (1.0500). This level also serves as a significant psychological threshold, so there may be a slowdown or a rebound formation. A corrective rise can be considered complete when testing the daily short-term trend (1.0613). Breaking through this level and further decline will allow bearish players to target the final support of the current zone—the final level of the Golden Cross on the monthly Ichimoku cloud (1.0447).

H4 – H1

At present, on lower timeframes, the emergence of an upward correction is observed, the main reference point of which is the weekly long-term trend (1.0595), with intermediate resistance on this path possibly being R1 (1.0555). The completion of the correction and the exit from its zone (1.0489) will bring bearish sentiment back to the market, with the classic pivot points (1.0469 – 1.0436 – 1.0383) becoming the relevant reference points.

***

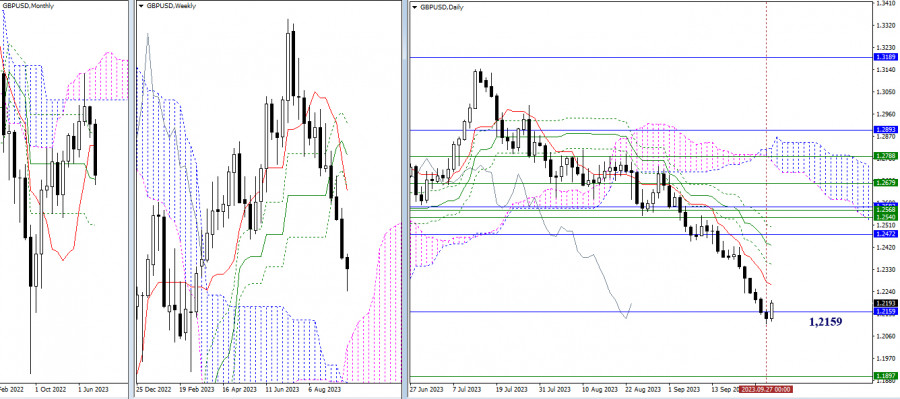

GBP/USD

Higher Timeframes

The monthly medium-term trend (1.2159) is a fairly strong support level with a wide range of influence, so the formation of the interaction result may take time. The fact that today the pair, without updating the previous day's low, has already updated its high, confirms the market's attention to this support (1.2159). In the case of a correction, the nearest reference points will be the resistance levels of the death cross of the daily Ichimoku cloud, with the first two levels today located at 1.2266 and 1.2352.

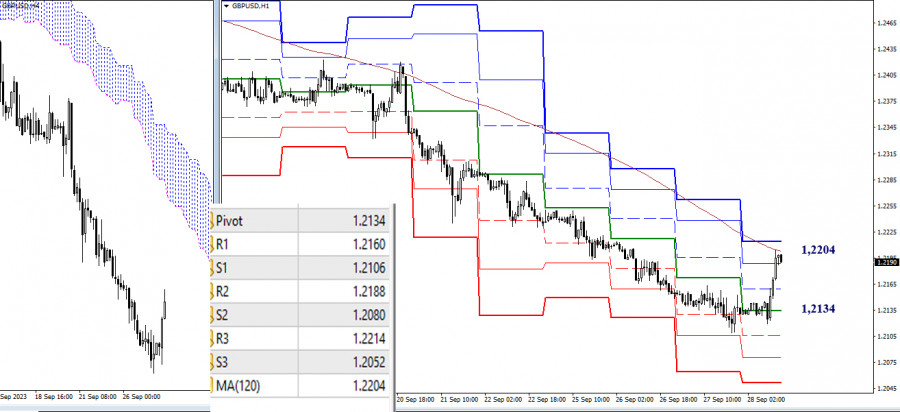

H4 – H1

On lower timeframes, bears have begun testing the key level—the weekly long-term trend (1.2204), responsible for the current balance of power. The pair's activity below the weekly trend favors the bears. Consolidation above and a reversal of the moving average will be a signal that the current balance of power is ready to support the strengthening of bullish sentiment. The reference points for intraday work are the classic pivot points.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

QUICK LINKS