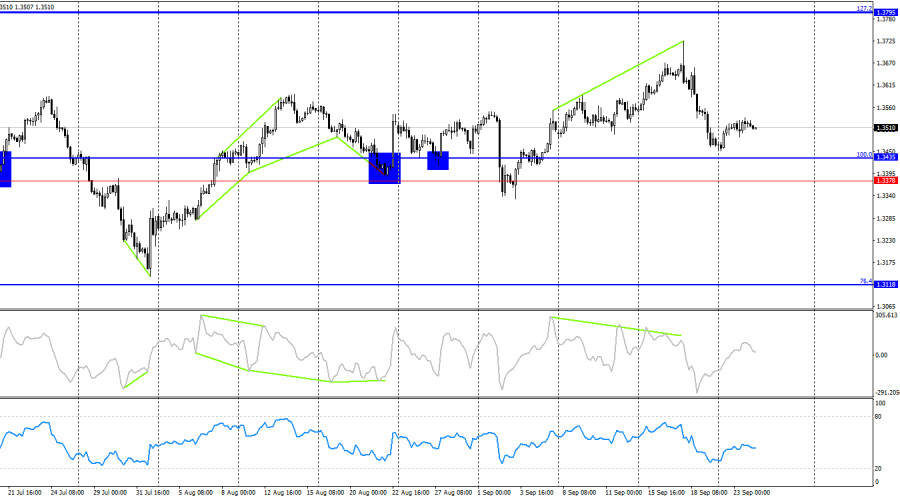

On the hourly chart, the GBP/USD pair traded sideways on Tuesday slightly above the 76.4% retracement level at 1.3482. Thus, the growth process may continue toward the next 100.0% retracement level at 1.3587. A consolidation of the pair's rate below 1.3482 would work in favor of the U.S. currency and a resumption of decline toward the support zone of 1.3416–1.3425.

The wave situation has shifted to a "bearish" one. This happened suddenly and unexpectedly. The last completed upward wave broke the previous peak, but the last downward wave also easily broke the previous low. The news background last week was mostly neutral for the pound, but Thursday and Friday spoiled the picture. However, this news flow has already been absorbed by traders, and the question remains: on what grounds do the bears intend to continue their attacks?

On Tuesday, the news background for the pound was negative. The manufacturing PMI fell from 47.0 to 46.2 points, and the services PMI declined from 54.2 to 51.9 points. Thus, the bears could have launched another attack but chose not to. Despite the trend turning "bearish," it remains very difficult for the dollar to count on growth. No one denies the problems in the UK economy, but conditions in America are also far from cloudless. The U.S. business activity indices also fell but still showed higher values than the British ones. Jerome Powell's speech did not change anything for the dollar, as the Fed Chair maintained the rhetoric expressed last week. Today, there will be no significant news. Therefore, we are unlikely to see serious attacks from bulls or bears. Nevertheless, if new trading signals appear, attention should be paid to them.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar after a "bearish" divergence on the CCI indicator and the Bank of England and Fed meetings. The decline continues at this time toward the support zone of 1.3378–1.3435. A rebound from this zone would work in favor of the pound and a slight rise in the pair. A consolidation below the zone would favor continued decline toward the 76.4% retracement level at 1.3118.

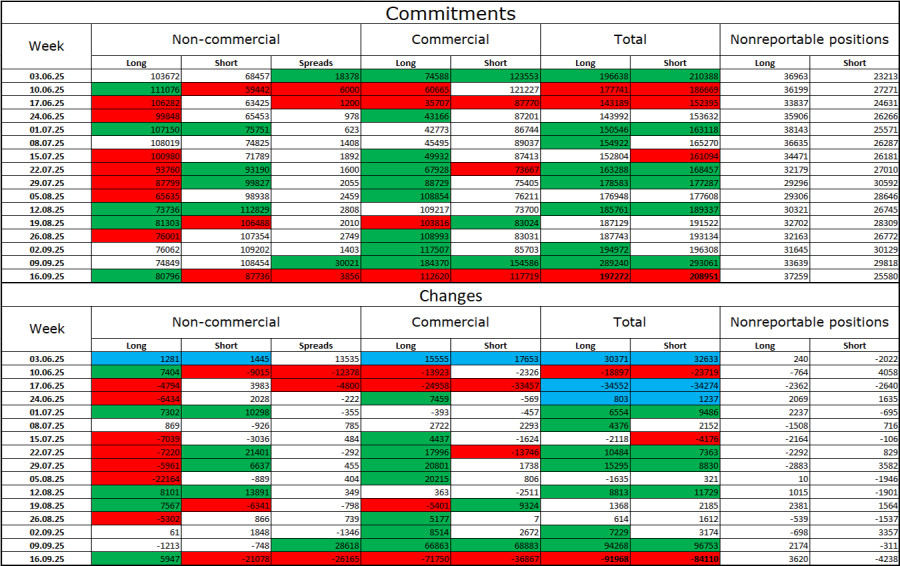

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category became sharply more "bullish" over the last reporting week. The number of long positions held by speculators increased by 5,947, while the number of short positions decreased by 21,078. The gap between longs and shorts now stands at roughly 80,000 versus 87,000. The bulls are once again tipping the scales in their favor.

In my opinion, the pound still faces prospects of decline. The news background for the U.S. dollar in the first six months of the year was disastrous but is gradually beginning to improve. Trade tensions are easing, major deals are being signed, and the U.S. economy is expected to recover in the second quarter thanks to tariffs and various types of investments. At the same time, the prospects of Fed monetary easing in the second half of the year have started to create strong pressure on the dollar, with the U.S. labor market weakening and unemployment rising. Thus, for now, I do not see grounds for a "bearish" trend.

Economic calendar for the U.S. and UK:

On September 24, the economic calendar contains only one minor entry. The impact of the news background on market sentiment on Wednesday will be absent or extremely weak.

GBP/USD forecast and trader tips: Sales of the pair are possible today if it closes below 1.3482 on the hourly chart, targeting the 1.3416–1.3425 zone. Purchases could be considered if it closes above 1.3482 on the hourly chart, with a target at 1.3587. These trades can currently be kept open.

The Fibonacci grids are built at 1.3586–1.3139 on the hourly chart and 1.3431–1.2104 on the 4-hour chart.

QUICK LINKS