Analysis of Macroeconomic Reports:

There are a few macroeconomic reports scheduled for Friday, all from Germany. It is important to remember that Germany is considered the "locomotive" of the European economy—a "locomotive" that has been struggling in recent years. Therefore, reports from Germany on key indicators can be considered conditionally important. Today, data on unemployment, inflation, and retail sales will be published. These will not be released all at once, so throughout the first half of the day, the market may react to the incoming information.

Analysis of Fundamental Events:

No fundamental events are scheduled for Friday. However, recent speeches by representatives of the European Central Bank, the Federal Reserve, and the Bank of England have not provided traders with anything to ponder. It is worth noting that the ECB has effectively achieved its goal of stabilizing inflation around 2%, so there is no need to change monetary policy. The BoE is close to lowering the key rate for the fourth time this year, but inflation remains high, so we should not expect rapid further policy easing. As for the Fed, everything depends on the labor market, unemployment, and inflation data for October and November, which have not yet been released.

General Conclusions:

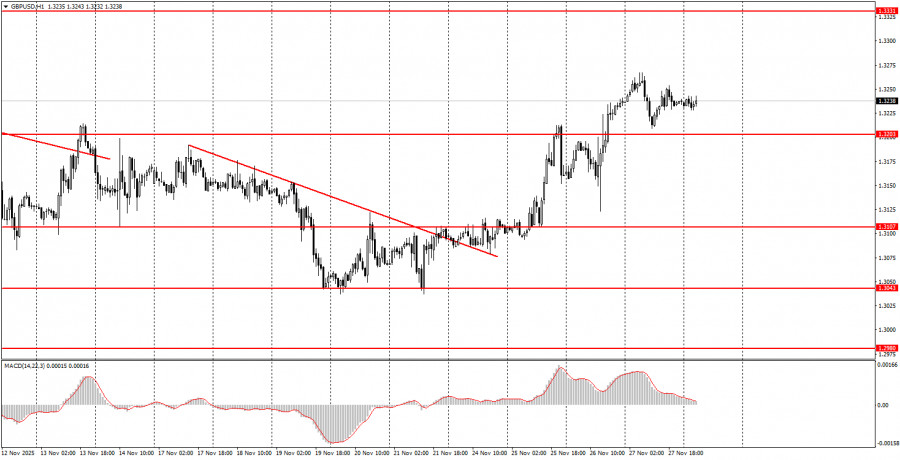

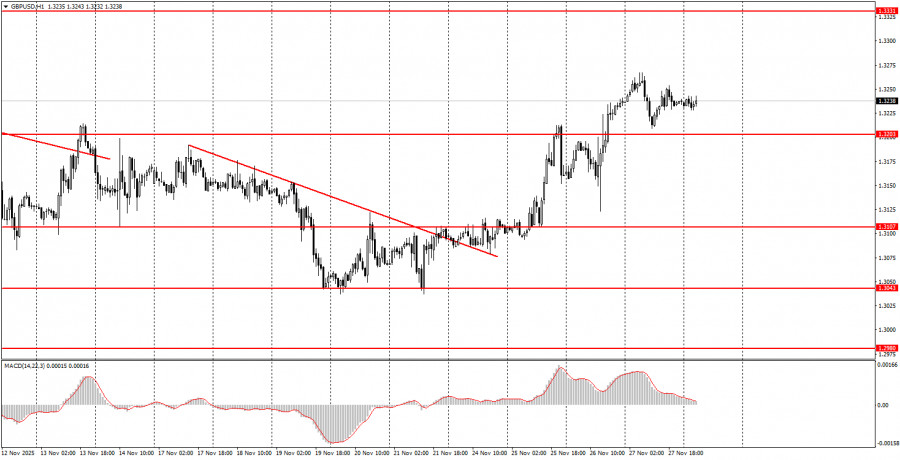

During the last trading day of the week, both currency pairs are likely to trend upward, as an ascending trend has begun in both cases. The euro has a great trading area at 1.1571-1.1584, around which several buy signals were formed over the past two days. The British pound has a level at 1.3259 and an area at 1.3203-1.3211. Volatility on Friday may once again be low.

Key Principles of My Trading System:

- The strength of the signal is considered based on the time taken to form the signal (bounce or breach of a level). The less time taken, the stronger the signal.

- If two or more trades have been opened around a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can create numerous false signals or may not form them at all. In any case, it's best to stop trading at the first signs of a flat.

- Trading deals are opened during the period between the start of the European session and the middle of the American session, after which all deals should be closed manually.

- On the hourly timeframe, it is preferable to trade based on signals from the MACD indicator only when there is good volatility and a trend that is confirmed by a trend line or trend channel.

- If two levels are too close to each other (between 5 and 20 pips), they should be treated as an area of support or resistance.

- After a 15-20-pip move in the right direction, a Stop Loss should be set to breakeven.

What the Charts Show:

- Support and resistance price levels are targets for opening buy or sell positions. Take Profit levels can be placed around them.

- Red lines indicate trend channels or trend lines, reflecting the current trend and indicating the preferred trading direction.

- The MACD indicator (14,22,3) — histogram and signal line — is a supplementary indicator that can also be used as a source of signals.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.