The test of 1.0477 in the first half of the day coincided with the MACD indicator beginning to rise from the zero level, confirming a valid entry point. However, the pair only declined by 15 points, and that was the extent of the movement.

Upcoming U.S. economic data will play a key role in shaping market sentiment. Reports on the Manufacturing PMI, Services PMI, and Composite PMI for February are in focus, as they provide insights into the current state of the U.S. economy and its potential trajectory in the coming months.

The Manufacturing PMI is particularly important as it is considered a leading indicator of economic growth, reflecting changes in new orders, production volumes, employment, and inventories. A decline in this index could signal an economic slowdown, which would weigh on the U.S. dollar.

The Services PMI will help gauge conditions in the service sector, which constitutes a significant portion of the U.S. economy. The Composite PMI, which combines data from both sectors, will provide a more comprehensive picture of the country's economic health.

For today's trading session, I will focus primarily on executing Scenario #1 and Scenario #2.

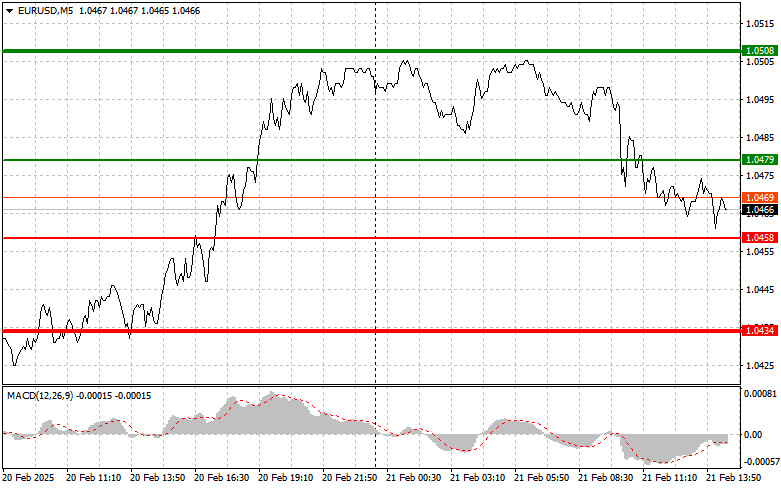

Scenario #1: Buy EUR/USD at 1.0479 (green line on the chart) with a target of 1.0508. At 1.0508, I plan to exit long positions and sell the euro in the opposite direction, anticipating a 30-35 point correction. The euro's rise is expected only if the U.S. economic data is weaker than forecasted.Important! Before buying, ensure that the MACD indicator is above the zero level and just beginning to rise.

Scenario #2: Another buying opportunity will arise if the price tests 1.0458 twice, with MACD in the oversold zone. This will limit the downward potential and trigger a market reversal upward, targeting 1.0479 and 1.0508.

Scenario #1: Sell EUR/USD upon reaching 1.0458 (red line on the chart), targeting 1.0434, where I will exit short positions and immediately buy in the opposite direction, aiming for a 20-25 point rebound.Important! Before selling, ensure the MACD indicator is below the zero level and just beginning to decline.

Scenario #2: Another selling opportunity arises if EUR/USD tests 1.0479 twice, with MACD in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal toward 1.0458 and 1.0434.

Chart Explanation

TAUTAN CEPAT