The test of 147.02 occurred at a time when the MACD indicator was beginning to move upward from the zero line, which confirmed the correct entry point for buying the dollar and resulted in the pair's growth by more than 30 points.

The published U.S. retail sales data turned out weaker than expected, putting pressure on the dollar and supporting the yen. This points to a slowdown in the pace of U.S. economic growth, which will likely push the Federal Reserve toward more cautious actions in the near future. The results fell significantly short of expectations, raising concerns about the stability of consumer spending. Under current circumstances—when inflation is rising, while the labor market and retail sales are weakening—the Fed is likely to take a wait-and-see approach, carefully analyzing incoming economic data and signals from financial markets. The final decision on further monetary policy will depend on the balance between inflation risks and the threat of economic slowdown. Presumably, the central bank will avoid abrupt changes, favoring gradual and deliberate actions aimed at stabilizing the economy and maintaining financial stability.

Today's increase in Japan's services activity index did not provide significant support for the yen. This is because investors had already priced in the expected improvement in this sector, and the current figures were not a surprise. Moreover, persistent concerns about the central bank's dovish stance continue to put pressure on the Japanese currency, which is traditionally considered a safe-haven asset.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

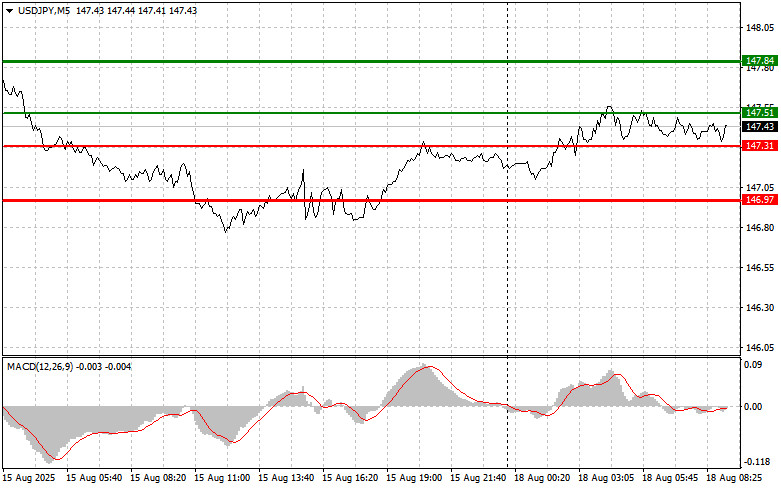

Scenario 1: I plan to buy USD/JPY today at the entry point around 147.51 (green line on the chart) with a target at 147.84 (thicker green line on the chart). Around 147.84, I plan to exit the buys and open sell positions in the opposite direction (expecting a move of 30–35 points in the opposite direction from that level). It is best to return to buying the pair during corrections and significant pullbacks of USD/JPY.

Important! Before buying, make sure the MACD indicator is above the zero line and only starting to rise from it.

Scenario 2: I also plan to buy USD/JPY today in the event of two consecutive tests of 147.31, specifically when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth toward the opposite levels of 147.51 and 147.84 can be expected.

Scenario 1: I plan to sell USD/JPY today only after the level of 147.31 (red line on the chart) is updated, which will lead to a quick decline in the pair. The key target for sellers will be 146.97, where I plan to exit sells and immediately open buys in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). It is better to sell as high as possible.

Important! Before selling, make sure the MACD indicator is below the zero line and only starting to decline from it.

Scenario 2: I also plan to sell USD/JPY today in the case of two consecutive tests of 147.51, at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the opposite levels of 147.31 and 146.97 can be expected.

TAUTAN CEPAT