However, if you look at the issue in more detail, you find that the collapse of NATO would also be disadvantageous to America. Through its military bases in Europe, the United States projects power in the Middle East, against China and Russia. If NATO ceases to exist, this would mean for the US the loss of military footholds that are actively used for operations in places like Iran. Moreover, if NATO ceases to exist, the European Union will realize that the rescue of a drowning person is the task of the drowning person himself. Europe would become more independent and self-reliant, which is precisely what Trump does not want. Washington wants to keep pulling the strings of the European Union, each time putting forward ever-new lists of demands, conditions, and ultimatums to preserve "American control" over the region. If NATO ends, European countries will no longer feel protected by "Big Brother," and it will become much harder for the White House to manipulate them through trade tariffs.

Put simply, with Greenland's annexation, Europe and the US would become enemies rather than allies. In that case, Washington would no longer be able to sell large batches of weapons and equipment to the EU for use in critical sectors. European consumers began boycotting American goods last year, after Trump imposed tariffs on friendly European countries. The boycott could intensify if the Danish island were annexed. All this would translate into financial losses for America and the termination of multibillion-dollar contracts. Therefore, the situation is dangerous for both sides.

But Trump would not be Trump if he did not constantly up the stakes. Trump knows better than anyone what it means to play on the edge of the bluff. He understands that without raising the stakes, you will not bring down the bank, and that is exactly what he has been doing for the past 12 months. Any increase in stakes by Washington can at any moment turn out to be a bluff. By bluffing, Trump "feels out" his opponent, like any poker player — he learns how far the other side is willing to go and how far he can push his own bet. Therefore, the Greenland situation could end in the most unexpected way. If Europe does not fear responding decisively and harshly, Trump will most likely back down. EU retaliatory tariffs would hit the US economy, and whether the White House will be able to seize control of the Fed in 2026 is still unknown. Trump needs control of the Fed so that the economy becomes impervious to external shocks. Low interest rates will ensure its growth regardless of any tariffs on American goods.

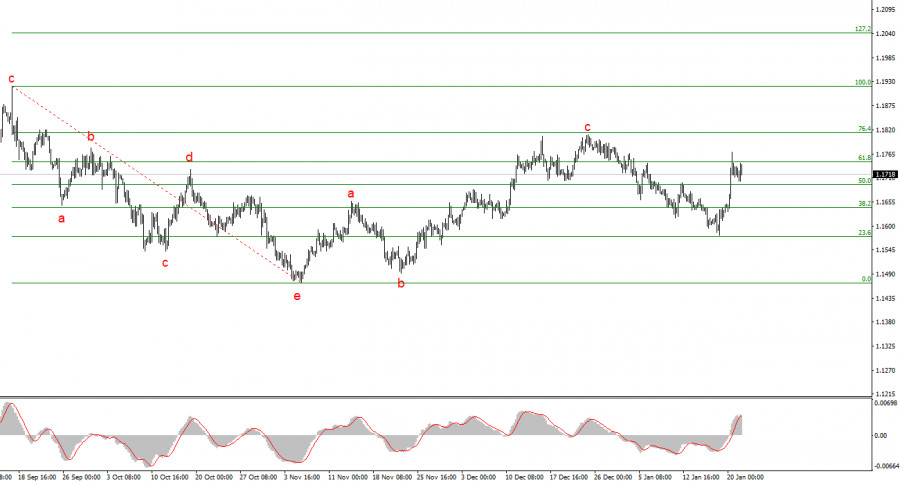

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the US currency. The targets of the current trend segment could extend as far as the 1.25 figure. However, to reach those targets, the market must complete the construction of the extended wave 4. Right now, we only see the market's desire to keep this wave going. Therefore, in the near term, a decline to the 1.15 figure can be expected.

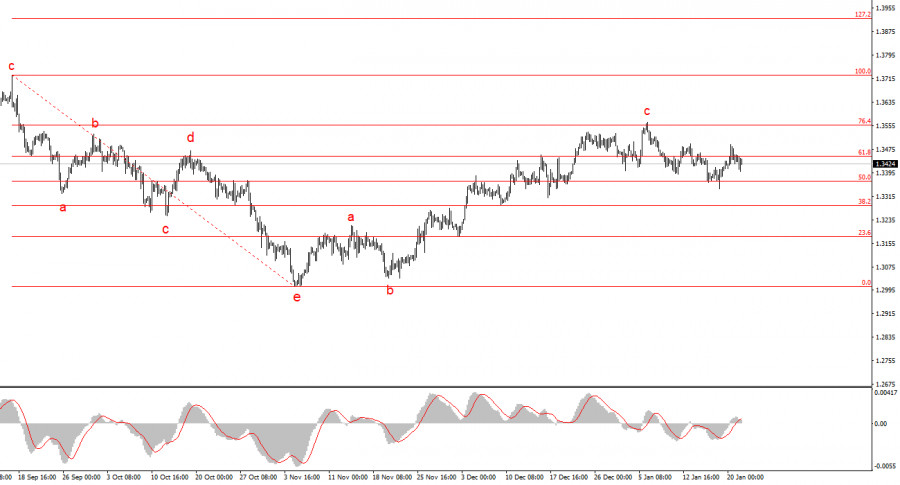

The wave picture of GBP/USD has changed. The downward corrective structure a-b-c-d-e in C of 4 appears complete, as does the entire wave 4. If this is indeed the case, I expect the main trend segment to resume its development, with initial targets around 1.38 and 1.40.

In the short term, I expected wave 3 or C to form, with targets around 1.3280 and 1.3360, which correspond to 76.4% and 61.8% of Fibonacci. These targets have been reached. Wave 3 or C has presumably completed its construction, so in the near term, a downward wave or a series of waves may form.

TAUTAN CEPAT