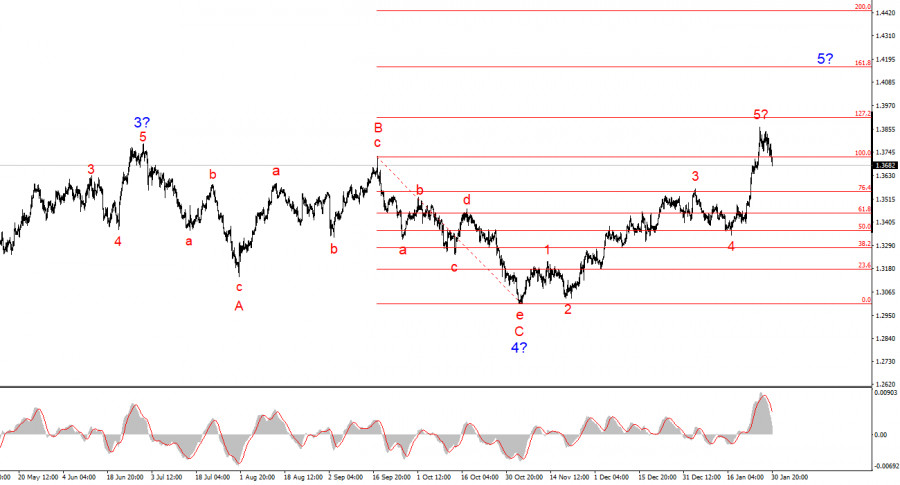

The British pound is following a path similar to that of the euro. The latest wave structure is an upward five-wave sequence; thus, according to the principles of wave analysis, we should expect the formation of one, or preferably three, corrective waves now. I want to remind you that, in my opinion, the global wave 5 is not finished. I anticipate further increases in both the euro and the pound. In this case, the wave layout may transform into a more complex structure, but we will still witness at least one corrective wave. Consequently, a corrective scenario will prevail next week. What could support this?

First, the Bank of England's meeting should be noted. The BoE, like the European Central Bank, does not plan to initiate a round of monetary easing at the beginning of February, but that does not mean the market will overlook this event. The accompanying statement from the BoE will include forecasts for key economic indicators, and the outcomes of the MPC's vote on interest rates may surprise both positively and negatively. Currently, the consensus forecast implies two votes in favor of a rate cut and seven against. If there are more votes "for," the market may exert additional pressure on the pound.

However, I do not expect significant pressure on the pound. A correction is just a correction, and inflation in the UK accelerated to 3.4% in December. Compared to the last local peak, the consumer price index in Britain has not slowed down significantly over the last six months. In my view, for a rate cut to happen, inflation would need to fall below 3%.

No other significant events are scheduled in the UK for the coming week, but it is worth remembering that Donald Trump has been astonishing markets almost every couple of days this year. I do not rule out that it may happen again this time. Therefore, news from Trump could overshadow the BoE meeting.

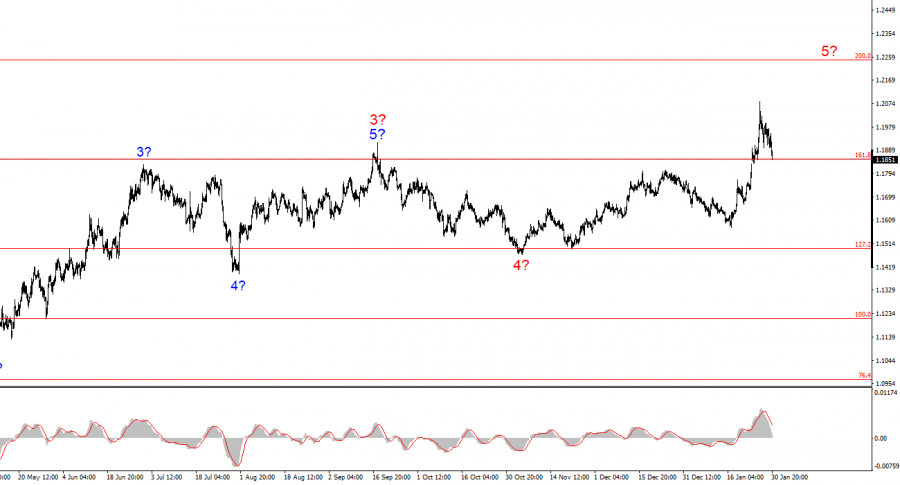

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward segment of the trend. Trump's policies and the Fed's monetary policy remain significant factors in the long-term decline of the US currency. The targets for the current segment of the trend may reach the 25 figure. At this moment, I believe that the global wave 4 has completed its formation, so I expect further increases in quotes. However, I also expect a downward wave in the near future, as the series of waves a-b-c-d-e also appears to be complete. Soon, my readers may want to look for benchmarks for new purchases.

The wave structure for the GBP/USD instrument has become quite clear. The five-wave upward structure has completed its formation, but the global wave 5 may take on a much more extended form. I believe that a corrective wave or wave set may begin to form soon, after which the upward trend will likely resume. Consequently, in the coming weeks, I recommend looking for opportunities for new purchases. In my opinion, under Trump, the British pound has a good chance of reaching $1.45-$1.50. Trump himself welcomes the decline of the dollar. All of his actions have a dual positive effect: a weaker dollar and the resolution of internal, external, trade, and geopolitical issues.

TAUTAN CEPAT