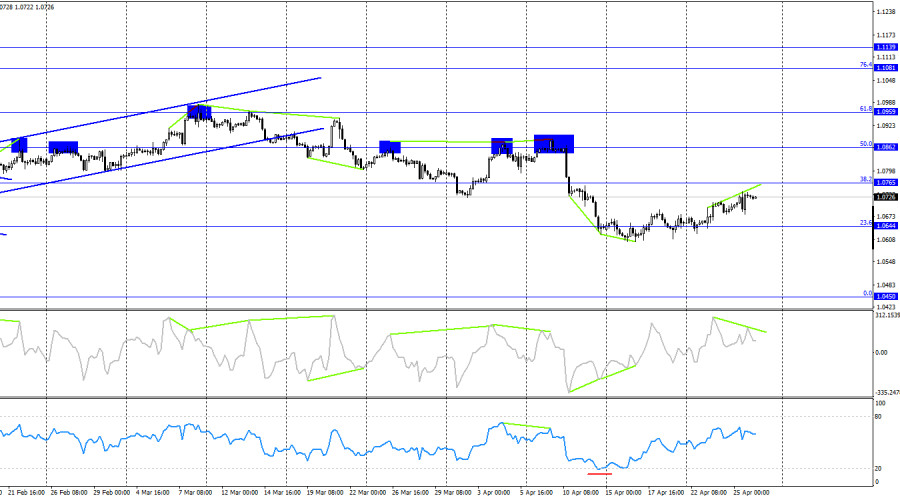

The EUR/USD pair on Thursday rebounded from the corrective level of 100.0%-1.0696 and resumed its upward movement towards the corrective level of 76.4%-1.0764. The ascending trend channel continues to characterize the current market sentiment as "bullish." Consolidation of quotes below the ascending corridor will change the market sentiment to "bearish" and may lead to a resumption of the pair's decline towards the level of 1.0619 and below.

The wave situation remains unchanged. The last completed downward wave broke the low of the previous wave (from April 2nd), and the new upward wave is still too weak to break the last peak from April 9th. Thus, we are dealing with a "bearish" trend, and at the moment, there is no sign of its completion. For such a sign to appear, the new upward wave needs to break the peak of the previous wave (from April 9th). If the next downward wave fails to break the last low from April 16th, this will also be a sign of a trend change to "bullish." Until then, the bears will maintain their advantage.

The information background on Thursday was important and strong. Traders learned about the economic growth of the United States in the first quarter. It amounted to 1.6% quarter-on-quarter and 3.1% year-on-year. It is noteworthy that the quarterly GDP of the United States turned out to be significantly below traders' expectations, while the annual one was higher. Bears failed to benefit from this report, as the quarterly value is still slightly more important. The American economy continues to slow down for the second quarter in a row, and the pace of the slowdown is quite high. At this rate, by the end of the year, the US economy may show growth close to zero, as is currently happening in the UK and the EU. A reduction in the Federal Reserve rate will not happen anytime soon, so the US economy may continue to slow down.

On the 4-hour chart, the pair fell to the corrective level of 23.6%-1.0644 and rebounded from it after forming two "bullish" divergences on the CCI indicator and the RSI indicator falling below 20. Thus, a reversal in favor of the euro occurred, and the upward movement began towards the corrective level of 38.2%-1.0765. A "bearish" divergence is looming on the CCI indicator, which could put an end to the euro's rise. Consolidation of the pair's exchange rate below the level of 1.0644 will allow expecting a resumption of the decline towards the next Fibonacci level of 0.0%-1.0450.

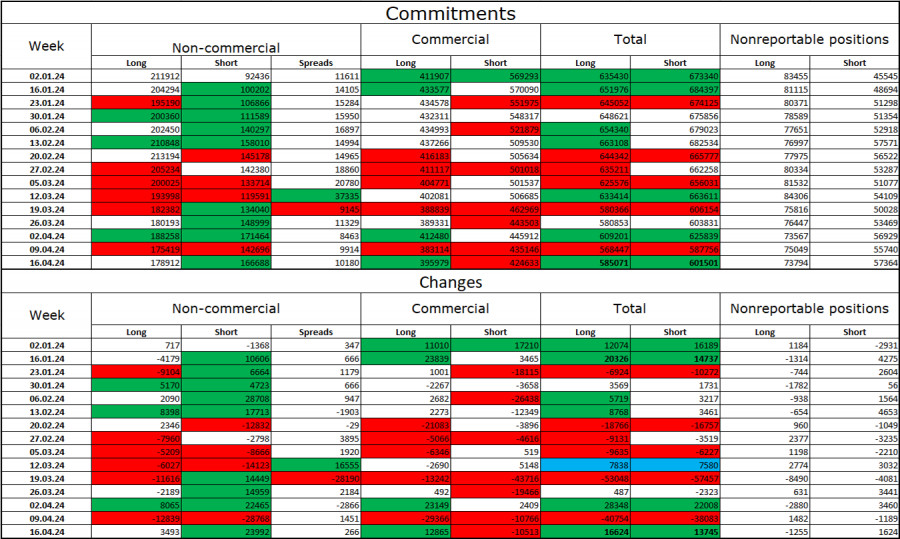

Commitments of Traders (COT) report:

In the last reporting week, speculators opened 3493 long contracts and 23992 short contracts. The sentiment of the "Non-commercial" group remains "bullish" but continues to weaken rapidly. The total number of Long contracts held by speculators now stands at 179 thousand, while Short contracts amount to 167 thousand. The situation will continue to change in favor of bears. In the second column, we see that the number of Short positions has increased from 92 thousand to 167 thousand over the past 3 months. During the same period, the number of Long positions decreased from 211 thousand to 179 thousand. Bulls have dominated the market for too long, and now they need a strong information background to resume the "bullish" trend. However, the information background has been supporting bears only recently. The European currency could have lost many more positions in recent weeks.

News Calendar for the US and EU:

US - Core Personal Consumption Expenditure Price Index (12:30 UTC).

US - Personal Income and Spending Change (12:30 UTC).

US - University of Michigan Consumer Sentiment Index (14:00 UTC).

On April 26th, the economic events calendar contains three entries of approximately equal importance. The impact of the news background on traders' sentiment today may be of moderate strength, but only in the second half of the day.

Forecast for EUR/USD and trader advice:

Sales of the pair are possible today on consolidation below the ascending corridor on the hourly chart with a target at 1.0619. Or on a rebound from the upper channel line with a target at the lower line. Purchases of the euro were possible on a close (or rebound) above the level of 1.0696 on the hourly chart with a target at 1.0764, but bulls are currently weak, so the rise may end soon. Caution should be exercised with purchases.