The British pound is showing gains against the U.S. dollar during the North American session and has moved into a consolidation phase, despite U.S. labor market data indicating stability, while expectations of a Federal Reserve rate cut remain high. As markets digest the positive U.S. employment figures and maintain expectations of a December Fed rate cut, the British pound is holding firm.

Recent U.S. economic data showed that the number of Americans filing for unemployment benefits came in below experts' forecasts for the week ending November 29. Initial jobless claims totaled 191,000, below the forecast of 220,000 and even below last week's upwardly revised figure of 218,000 (from 216,000). For the same week, continuing claims reached 1.939 million, slightly below the previous 1.943 million reading.

Meanwhile, according to the Challenger Job Cuts report, companies announced 71,321 job cuts in November — 24% higher than the same period last year, but 53% lower than in October. All this strengthens market participants' conviction that the Fed will likely cut rates at its December 9–10 meeting, with probability now assessed at more than 85%, following Wednesday's weak employment change data.

The currency pair stabilized after discussions on the Autumn Budget. Some analysts, quoted by Reuters, believe the proposed measures are unlikely to trigger a sharp rise in inflation, which in turn could allow the Bank of England to resume its monetary easing cycle. The market is also pricing in roughly a 90% probability of a rate cut by the Bank of England at its meeting later this month.

From a technical perspective, the GBP/USD pair has surpassed the 200-day Simple Moving Average (SMA) at 1.3320 but has so far failed to secure a position above the 100-day SMA to open the way toward testing the round 1.3400 level. If this level is breached, the pound may continue rising toward resistance at 1.3425 and 1.3450, on the way to the psychological 1.3500 level. But a drop below the 200-day SMA around 1.3320 will expose the round 1.3300 level. After a breakdown, the next support will be the 50-day SMA at 1.3266 and the 1.3250 level.

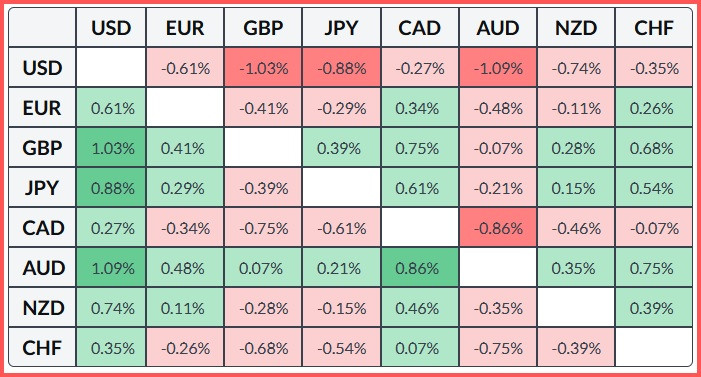

Below is a table showing the percentage change of the British pound against major currencies for the current week. The British pound showed the greatest strength against the U.S. dollar.